BY BRENDAN WAGNER, Portfolio Manager

I was recently at Six Flags® with my six-year-old daughter. She was over the moon excited to go on her first big rollercoaster. We entered the park and headed for the Twisted Cyclone. The ride reaches speeds of 50 miles per hour, takes one weightless upside down, and has a huge 10-story drop at 75 degrees. Guess what? My daughter’s face, as we pulled back into the entry/exit platform, indicated she had overestimated her level of excitement for the rollercoaster “thrill level.” So, we focused on more tame rides for the remainder of the day. This reminded me of how I guide clients through long-term investment strategies.

Investor Temperament: A Key to Long-Term Investment Success

Investors need to go into the investment process knowing what they own and what they’re getting into and have a sound strategy for dealing with the ups and downs inherent in owning publicly traded securities. They need to know whether they’re stepping onto the teacup ride at Disneyland® or a brain-jarring rollercoaster at Six Flags.

We know the benefits of publicly traded equities – fractional ownership of (hopefully) high-quality companies without having to pay a control premium, daily liquidity, and a long-term track record of appreciation. There can be less discussion and focus on the downsides or challenges of owning publicly traded equities. In short, you have the ever-present risk that your equities could fall in value substantially, testing your nerve and commitment to your individual holdings as well as longer-term allocations and risk profile.

To quote Martin Zweig, “In order to capture the potentially higher return that stocks offer, you have to reconcile yourself to the certainty of horrifying short-term losses. If you can’t do that, you shouldn’t be in stocks – and you shouldn’t feel bad about it, either.”

That quote by Zweig is important – people think about what you GET from an investment or investment strategy, but they also need to accept in advance what you GIVE UP in order to participate in those returns. A deep value investor or very conservative slow growth investor GETS the benefit of lower volatility and likely lower downside during market downturns. But, they GIVE UP the higher returns enjoyed by others with more aggressive portfolios in the good times. On the other end, a high-growth or momentum investor GETS the accompanying higher long-term returns these strategies can offer, while they GIVE UP the comfort or ability to know where the bottom or downside is for their strategy when things are ugly.

As investment professionals, we often spend time discussing portfolio positions and “new ideas” with clients We also spend plenty of time discussing risk profiles, habits, and game plans for stock market curveballs – arguably a bigger factor in investment success than individuals’ positions.

One of the tougher parts of the investment business is the unfortunate fact that human nature (Run from risk! End the pain!) is at odds with behaviors that benefit long-term investment success. Properly assessing one’s own risk tolerance is very difficult, but it’s key to committing to an investment strategy that will not “knock you off the horse” in times of turbulence, harming longer-term returns.

A person can be a high-growth investor, they can be a deep-value investor, or anything in between. But the key is to understand what you own, where the potential downside is, and your tolerance for pain, so you do not succumb to the pressure to switch strategies or “give up” in the face of unpleasant, but completely normal, market downturns.

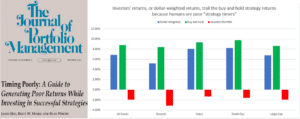

In the chart below, you will see how investors as a group who panic or make the decision to time the markets undermine the overall success of the strategy they have in place.

Professional equity investors should focus research efforts on outcomes that are realistically achievable

People need to accept that there are areas in which we might be better able to add more value than in others. Here are just a few things that professional equity investors spend their limited time trying to figure out:

- When is the next recession? When will it start? When will it end?

- What will be the magnitude of the next bear market? What will the length of the bear market be?

- Where are interest rates headed?

- Where are currencies and emerging economies headed?

- What will this company earn this quarter? Next year? Will they “beat” the consensus?

- What stocks will “lead” the indexes over the next week/month/quarter/year?

- Is this a high-quality company in a stable industry?

While many of the questions above can only be educated guesses, spending our time on that last question allows us to stack the deck in our favor. Focus efforts on things that are achievable, and the outcomes should take care of themselves. We can get many things wrong, but if we have put together a portfolio of high-quality companies that we know reasonably well, we are likely to make money in the medium term even if our other predictions are wrong.

A few last ideas on how investors can improve long-term investment success:

- Let go of the desire to be right in the short-term, and instead focus on the medium term

- If you had the right investment strategy and asset allocation before a downturn, it’s ok to “do nothing.”

- Sometimes the best “new buy” is the stock you own that’s fallen substantially.

- Understand that while the average returns from stocks have been in the upper single digits, the timing or allocations of those returns is out of your hands. Some years give you nothing.

As with riding the rollercoaster, you must pick the right size and thrill that you seek. There will be many bumps, turns, and bruises along the way. Just remember that as long as you stay mindful, and stay in your seat, you will likely be rewarded with a safe return that meets your long-term expectations.

At MONTAG, we do things differently. We‘ve been a family-run business for nearly 40 years, and we still believe that our clients are best served by treating them as part of that family. We take the time to get to know you – what you’ve done to build your net worth, your investment philosophy, your financial questions and fears, and above all, your financial hopes.

Every single client has their own unique story – a story that deserves more than a conversation with an anonymous voice. Contact our Client Services team today by calling 404.522.5774 or emailing [email protected] to get in touch.

The information provided is for illustration purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action to be taken. These analyses have been produced using data provided by third parties and/or public sources. While the information is believed to be reliable, its accuracy cannot be guaranteed.