By Brendan Wagner, Portfolio Manager

By Brendan Wagner, Portfolio Manager

The last four years may have felt like a roller coaster, but they also remind us that while average market returns may be in the high single digits, any 12-month period can look dramatically different than the long-term averages. It can be helpful to look at this past 3- or 4-year period in its entirety. That way one can see that many stocks got ahead of themselves in 2021, so in 2022 they gave back those heady gains, and then 2023 was a pretty rational market in terms of winners and losers.

When viewed over 36 months rather than 12, we get a better feel for where stocks have been and whether they might be above or below “trend.”

(Source – Intrinsic research)

We’ve received a few questions regarding the markets, and here’s an attempt at some answers.

Why didn’t rate hikes hurt the stock market in 2023?

Certain industries where the cost of capital is a huge driver of returns, such as real estate and (of course) regional banks, did suffer in 2022/2023. But many of the market’s largest companies are not directly harmed by higher rates. Because they are largely financed by their own enormous cash flows, unlike main street or small businesses, they are not facing new borrowing rates in the 8-9% range at their community bank. Debt levels are manageable, and maturities are well-spaced so that a current spike in rates does not coincide with a repricing of the majority of their borrowings.

Why didn’t Fed rate hikes cause a recession?

A “recession” is defined by two consecutive quarters of negative GDP growth. With government spending and massive healthcare and insurance inflation accounting for ever larger parts of our GDP, it is simply harder to have “down numbers” in this figure. And keep in mind that inflation in auto insurance, home and auto repairs, as well as goods everywhere boosts the GDP figures and more insurance inflation is on the horizon. Inflation is a way of life for companies, it is baked into growth plans – in fact it is a critical component of sales growth, and for many companies it is the entirety of their growth. That very inflation is the biggest driver of growth for “the economy.”

Will the Fed cut rates in 2024? And how much if so?

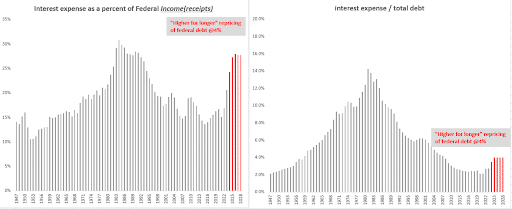

It is likely that the Fed will cut rates in 2024. There’s a growing consensus that the short-term rates that the Fed controls will head down in 2024 to end near 4% compared to 5.3% currently. But there’s a chance they could go significantly lower. And not because inflation is conquered. The more likely reason is that the Fed could get a “tap on the shoulder” by the rest of DC, pointing out the situation with Federal interest expense and the Federal government’s limited ability to collect enough revenue (taxes) to pay said interest. Below we highlight the growing interest expense eating up more of the government’s revenues and the possibility that we could exceed the interest burden of the 1980’s even with interest rates at a fraction of 1980’s levels.

(Source – US Treasury, Montag estimates)

There are a number of recent headlines recently titled something like “what everyone got wrong” regarding the markets in 2023. The assumption among many was that the Fed’s drastic interest rate hikes would cause a recession and a falling stock market. If anything, these headlines are a great reminder that we can achieve our investment goals (upper single-digit returns in stocks over multi-year periods) without predicting the near-term future. In a world where information is near-instantaneously available, it is hard for anyone to have much of an “edge” – so one of the best ways to separate from the “investment herd” is to sit back and let go of the timing aspect of investment returns. Continue to look for high-quality businesses, try not to overpay, and as Bill Walsh said, “the score takes care of itself.”

So – as for predictions, I cannot give them. But we can look at where we stand now. The top 30 stocks in the S&P500, on a valuation basis, are about as expensive as they were a year ago. If a broad economic downturn comes, then the valuations will in hindsight be higher, as earnings will end up lower. But generally, the market is cheaper than it was at the end of 2021, and expectations are fairly modest in many sectors.

For many stocks, 2023 was a great year because 2022 was a bad year. The modest valuations at year-end 2022 set up a great 2023. We do not have that tailwind currently, so returns could be more muted in coming years. On a positive note, many companies have already seen moderating operating results and had weak stock performance in 2023, meaning they’re at least partway through their recession already.

Tailwinds

- Many companies and industries have taken their lumps, meaning they’re closer to the end of their downturns.

- Fed signals they will cut rates soon, lowering the all-important bank prime rates, mortgage rates, and the “cost of everything” for our economy.

- Valuations and expectations outside the frothiest parts of the market are reasonable.

Headwinds

- Cost of capital for main street and non “mega-cap” companies remains cripplingly high, needs to come down more than the Fed intends.

- It may be unpleasant for the market to realize that the inflation the Fed wages war on is the entirety of revenue growth and the entirety of GDP growth. So, if inflation falls, so does “the economy” and company revenues.

- The US will be running a $2 trillion deficit in a non-recessionary environment. Interest expense may soon trend towards $1.6 trillion. If 2024 is the year that spending cuts enter the conversation, it may be a headwind for companies reliant on government spending.

The information provided is for illustration purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action to be taken. These analyses have been produced using data provided by third parties and/or public sources. While the information is believed to be reliable, its accuracy cannot be guaranteed. MONTAG employees do not provide legal or tax advice. For specific legal or tax matters, you should consult with your own legal and/or tax advisors. There are risks associated with investing in securities. Investing in stocks, bonds, exchange traded funds, mutual funds, and money market funds involve risk of loss. Loss of principal is possible.