By Helen Donahue, CFA, Portfolio Manager

In the investment world, a diversified portfolio is one of the central tenets for success, with asset allocation being one of the most important determinants of portfolio returns.

While equities typically provide superior returns over the long-term, an allocation to bonds or defensive stocks is important if your portfolio will be relied upon for providing living expenses.

How Does a Diversified Portfolio Benefit Me?

Since the Federal Reserve raised interest rates at a rapid pace beginning in 2022, bonds now offer a decent return. However, even when rates were lower as they had been the prior nearly 20 years, it is important to have an allocation to bonds or defensive stocks because this will limit the downside and reduce the volatility of the overall portfolio. Reducing large swings in the value of your portfolio reduces the emotional stress that comes along with investing.

When it comes to diversification, many professional investors recommend allocating to multiple asset classes, such as international stocks or bonds. In our opinion for US residents, over-diversifying into too many asset classes can diminish results and introduce risks such as currency fluctuations. While there may be occasional opportunities to add exposure to select markets outside of the US, at MONTAG, we believe having a diversified portfolio of US stocks and bonds provides sufficient diversification while offering the opportunity for superior returns over most time periods.

Non-U.S. Markets

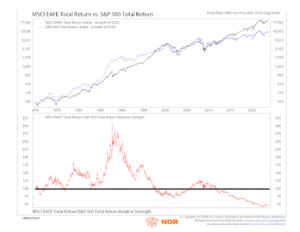

Diversifying into non-US markets has proved beneficial only over limited time periods as shown below in the chart from Ned Davis Research.

When the red line is above 100 on the bottom chart, the MSCI EAFE (Europe, Australia & New Zealand, Far East) is performing better than the S&P 500 and when it is below 100, the S&P 500 is performing better. The top chart shows the cumulative growth of $100 for both indices back to 1970. Notably, some of the higher returns earned in international stocks over the last several decades have been due to countries opening up following the fall of the Iron Curtain or admittance into the World Trade Organization. These were powerful tailwinds that are not likely to be repeated. In recent years, several countries have taken regulatory actions within their markets that discourage capitalism, which is likely to negatively impact their economies. Many developed countries outside the US are facing higher inflation and lower economic growth than the US, making it unlikely their markets will outperform. Innovation in the US has led to the technology sector becoming a large weighting in the S&P 500, which is another distinguishing factor of investing in the US relative to other parts of the world.

U.S. Equity Portfolios

Diversification within a US equity portfolio is also important. While it is tempting to chase the stocks or sectors that are leading the US equity markets higher, investors should take caution to not place all their savings into a narrow group of stocks. Having a properly diversified portfolio across different sectors can help smooth out returns over market cycles, which can help investors stay invested in the equity markets, one of the most important aspects of building wealth over long periods of time.

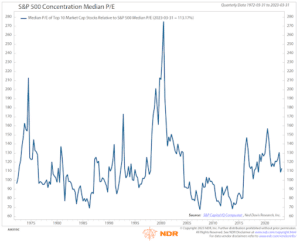

There have been several boom-and-bust cycles among sectors of the US equity market. The Nifty 50 experienced outsized returns in the early 1970s. The late 1990s saw internet companies, many of them with no or low profitability, lead the market higher. More recently, investors have flocked to many of the large technology companies. All of these periods lead to the favored stocks becoming expensive from a valuation perspective, which inevitably leads to a correction in their stock prices.

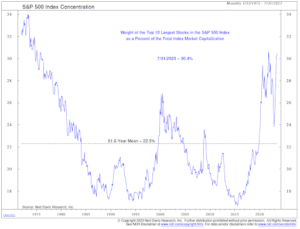

Because the S&P 500 is a market-cap-weighted index, its weightings can become concentrated in individual stocks or certain sectors and result in high valuations for these stocks, as shown in the charts below from Ned Davis Research. Once these valuation corrections occur, it can take many years for the impacted stocks to recover their losses.

In conclusion, while index funds can be a low-cost way to achieve good diversification, investors should be aware that these concentrations can develop. The portfolio managers at MONTAG are continuously evaluating our clients’ portfolios and assessing risk versus the broad equity and bond markets. Allocations can be shifted to reduce the downside risk that arises when concentrated positions develop in the equity market either by emphasizing stocks in other sectors or utilizing equal-weighted or sector-specific ETFs.

All of MONTAG’s wealth management portfolios are customized, allowing portfolio managers to manage both the asset allocation between stocks and bonds and to diversify the bond and equity components within our clients’ portfolios to help achieve their financial goals.

A Message From MONTAG Wealth Management

The information provided is for illustration purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action to be taken. These analyses have been produced using data provided by third parties and/or public sources. While the information is believed to be reliable, its accuracy cannot be guaranteed.

Author

-

Helen is a Portfolio Manager whose professional affiliations include the CFA Institute and the CFA Society Atlanta. Before joining MONTAG in 2020, Ms. Donahue was a Principal at Montag & Caldwell for over 20 years where she was a member of the Large Cap and Mid Cap Growth investment teams and served as a client portfolio manager for institutional and individual clients.

View all posts