Tailored Portfolios That Reflect Your Investment Needs

MONTAG has a 40-year history that includes managing investment portfolios for families and individuals, as well as small institutions with tens of millions of dollars in assets. Small institutions, like families and individuals, have very specific needs and very specific ways of approaching their agendas. Every organization is unique, and each one has its own balance sheet, its own income stream, its own expenses, and its own obligations. Where the investment assignment differs considerably from families and individuals is that small organizations typically have mission-based existences and rotating decision-makers, board leadership, and staff circulating into different roles over different periods of time—often simultaneously.

For any organization, portfolio growth sustains purchasing power. Fundraising is fundamental to most, but many count on their long-term savings for both future “mission-based investments” and as a “rainy day” fund. We manage institutional portfolios by looking beyond short-term market swings, maintaining strong communication with clients, and focusing on preservation of purchasing power through long-term portfolio growth. Our goal is to preserve both the present stability and financial anchor of an organization, and the future goals, plans, and dreams of an organization.

Organizations rely on their investment portfolios to finance current and future operations. When working with any organization, we start with a clear understanding of their balance sheet obligations and income statement. This information plays a key role in our work. It is part of the research and analysis necessary to develop customized investment objectives, which include risk tolerance and other investment criteria. From there, we structure institutional portfolios, like endowments, accordingly, taking into account risk and return dynamics. And we understand and honor the fiduciary obligations of board and staff members, so when we are called on to manage an institutional portfolio, we bring the utmost care and attention to the assignment.

Ready to connect with one of our investment professionals?

An Individualized Approach to Institutional Management

Dedicated Portfolio Management

You are paired with a Portfolio Manager who is the main point-of-contact for your organization.

Tailor-Made Investment Plans

We balance the needs of the organization with goals for preservation and growth.

Experienced Support Team

Your organization’s support team includes your Portfolio Manager, Portfolio Administrator & additional Client Support staff.

Commitment to Long-Term Growth

Your MONTAG team will meet regularly to discuss investments and assets, combining sound advice with consistent communication and revised goal setting.

Institutional Management Services

If you are a director or trustee of an institutional board, you hold fiduciary responsibility to maintain the organization’s current goals and plan for the future, which is often an uphill path. At MONTAG, we know the institutions where you give your valuable time and assets should be prepared for today and have the vision to prosper in the future.

Our advisors will guide institutional clients through:

- Understanding the history, mission, and goals of leadership for the organization.

- Working with leadership, committees, and staff members to forge trust and plan carefully. Considerable effort is made to accommodate important priorities already in place and craft an appropriate investment policy reflective of the risk/return ambitions of the organization. The goal is to match investment execution with the investment policy crafted by leaders, committees, and staff members.

- Long-term planning that aims to set aside appropriate levels of assets for short-term needs and obligations of the organization and grow the remainder to expand the capacity of the organization to meet its mission.

- Basic financial goal setting that reflects the current fiscal health of the institution.

- Acting as a portfolio and financial historian and educator for new leaders, committees, and staff members as time passes.

MONTAG’s Organizational Investment Practices routinely include:

- Customized Solutions: We pride ourselves on creating customized investment solutions that meet all types of objectives. These solutions evolve, generally including individual securities and/or ETFs (Exchange Traded Funds) and change as necessary to accommodate the investment objectives of a given client. We have no internal products or “model portfolio” solutions. Instead, we customize portfolios for each client using our broad experience in the investment arena.

- Team: We use a team-based approach, taking advantage of our entire portfolio management team with an average industry tenure of over 20 years.

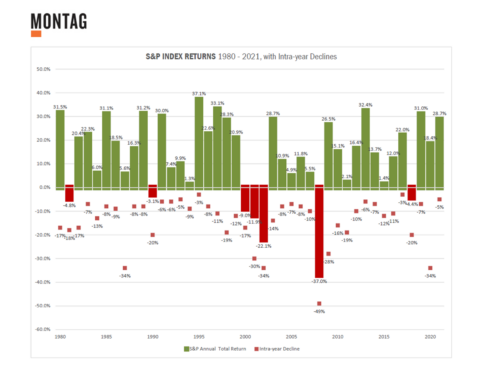

- Experience: Our investment team has deep experience managing portfolios through various market cycles. In partnership with third party research firms, this allows us to position our clients to benefit from shifts in performance between styles of investment, market capitalizations, or sector leadership. This approach permeates our firm’s thinking and strategy at all levels of analysis, starting with the macro, and running through the asset classes, sectors, and industries, fixed income markets and individual securities.

- Invest Direct: We invest directly in individual securities and have only limited use of third-party managers, typically in the form of passive ETFs, which complement our mostly “active management” shop.

- Fixed Income: Conservative approach managed by investment professionals with decades of experience.

- Public and Liquid Securities: We use liquid public securities and do not offer Illiquid Private Equity or Alternatives. We take confidence instead from decades of data that supports the risk return performance of the large cap domestic equity style.

- Fees: Our fees are competitive because we invest directly in individual securities and limit use of outside managers primarily to ETFs. Therefore, our clients incur very few other fees.

- No Outsourcing: We make all investment decisions internally, including all asset allocation, ETF selection, individual bonds, and stocks, and therefore have a tight grip on risk management.

- Active Managers: We are considered “Active Managers” that use some “passive securities” when they are appropriate and fit our “active approach.” Routine use of individual securities and ETFs is very familiar. We use a “both/and” style; not an “either/or” approach.

- Targeted Asset Allocation, not Total Asset Allocation: We use a “Targeted Asset Allocation” approach whereby we review/monitor and are prepared to invest in any-and-all asset classes available in the public markets. We advise against “over-diversification,” a very common practice in our industry.

- Asset Allocation Range: We use “Asset Allocation Ranges” in the management of client portfolios. The range allows for high agility and flexible movements either to expand or reduce exposure in a given asset class depending on fresh research and updated forecast of risk to asset value.

- Long Term: We focus on the long term and believe a strategy that is anchored to a long-term thesis and investment approach is critical to delivering successful performance over an economic cycle.

- Large Cap U.S. Stocks: We firmly believe in the leadership of Large Cap U.S. stocks. These companies have obvious size and scale advantages and naturally offer diversification by sector and geography. They should be a “core” and significant asset class for most long-term investors.

- Diversification/Risk Management: We use a comprehensive diversification approach that combines traditional diversification (by asset class, sector/industry, market cap, and style) with advanced diversification (by quality, valuation, and growth). This approach gives us the flexibility to employ multiple investment strategies in a single equity portfolio.

- Qualitative/Quantitative Approach: We use a qualitative approach layered with quantitative data by partnering with boutique research firms to help us quickly assess an ever-growing flow of data available only to investment managers with the resources and know-how to take advantage of it.

- Custodians: Fidelity or Schwab.

Our Investment Team

“The endowments of most of our institutional clients are absolutely mission critical. We manage each endowment with this at top-of-mind.”

– John Montag | President, CIO & Portfolio Manager

Related Blogs

Tips for Running a Family Business in 2024

Ned Montag: MONTAG has been a family business for a long time. Since the founding, my dad has worked for his father since 1960. Then, he hired John and I in the mid-90s and founded this business in 1982. … Read More

Qualities to Look for in a Portfolio Manager in 2024

Ned Montag: Over the years we have come to recognize there are several things that people are looking for when they look for a portfolio manager or investment manager. There are probably three, four, or five qualities in that … Read More

Long-Term Perspective

By OLGA LEE, CFA In light of the recent market volatility, we thought it would be worthwhile to remind investors that it is important to focus on the long-term when investing in the equity markets. No one likes to see … Read More

Recognition