by Chris Guinther, Senior Investment Strategist

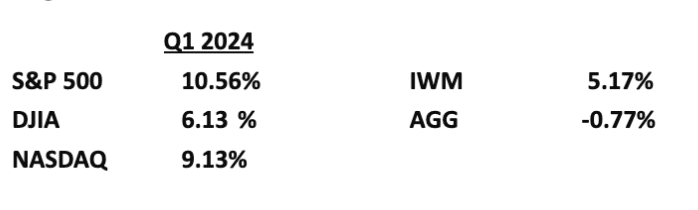

Through 3/31/24, returns for the various indices are as follows:

Good news, inflation slowed through the first quarter of 2024, and with that, the Federal Reserve shouldn’t need to keep raising interest rates. In fact, the consensus view for 2024 is that the Fed will probably lower interest rates several times so they aren’t restricting growth anymore. We tend to agree with that consensus and expect that if inflation stays flat or drops through the year, it’s not just good news, it’s great news!

Stable or lower interest rates typically keep the economy chugging along as consumers and managers better understand what the future looks like in terms of growth. The U.S. economy has been extremely resilient in terms of steady growth since the Covid scare. As has been the case for many decades, owning big, public, U.S.-based companies has generated tremendous growth. Over the past 10 years, returns for the S&P 500 index (the largest 500 companies in the U.S.) have averaged nearly 13% annualized. Compounded, that means investors have made over 3x their investments in a relatively short period that saw COVID-19, Inflation, 2 major wars, and, of course, much political turmoil.

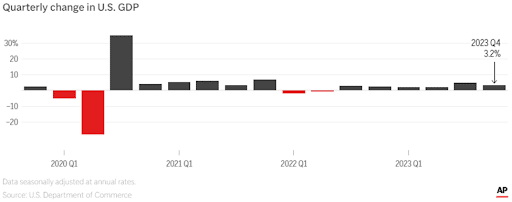

Since the collapse in the 10-year bond interest rates last November of over 100 basis points (1%), when the CPI came in lower than expected, equity markets have made material moves higher. When stocks move higher, that’s a good indicator of what’s to come in terms of economic growth, often measured by GDP. 2023 GDP growth ended up a whopping 6.3%. For 2024, GDP growth is currently expected to rise again by over 3%. We usually modify those growth figures by reducing them by the rate of inflation which has run hot the last few years, but still, nominal growth has been high and we’re expecting it to continue through 2024 absent any big shocks. Reasons for this include strong labor demand, on-shoring as the world shuns China, and very high fiscal spending (a growing problem that will be dealt with later).

One developing theme that’s both intriguing and confusing is AI (Artificial Intelligence) … and it appears to have legs to run. We are in the early days of AI, and it’s unclear what it will bring to each industry or how it will evolve. However, it feels similar to the beginning of the internet period to me (ala 1995). When I started in the business in the early 90s, and the first internet company (Netscape) became public, our team was asking all the basics: what runs this thing called the internet, why do we need email, and generally, what are obviously dumb questions today like, why do computers need to be connected?

Little did we know that August 9, 1995 was the beginning of a revolution that would span 3 decades. Netscape, NSCP (the first internet browser) was priced at $14, then upped to $28 the day before the actual IPO. It reached $75 intraday when it started trading, to finally close at $58. Up nearly 4-fold in 24 hours. Wow, that had never happened before. The team was shocked by the volatility. Here was a company that had little to no revenue, let alone earnings, yet had plenty of future plans and hype, being valued at nearly $3 billion dollars. It later rose to over $10 billion only to be bought out by AOL and cede most of its 80% market share to Microsoft, and more of its share later went to Google, before becoming nearly non-existent….all within 6 years. That was followed by 100’s of internet-related IPOs over the next 5 years. (i.e. eToys.com, AOL, Yahoo, 3Com) New billionaires were being created every quarter in Silicon Valley, and much of the world at the time “didn’t get it.”

What a ride that was, but it wasn’t really over in 2000. The ‘internet theme’ was just on pause, only to gather steam with real revenue and earnings again by 2002. To keep the history lesson short, let’s just say that the beginning of the internet period is rhyming with “AI” and it’s happening again, right now, today as I write.

What is AI going to do? Who’s going to use it? What is the ROI for companies adopting it early? Where are the revenues? Who loses, and who wins? This sounds to us like 1995 all over again…all with about the same level of confusion. It took about 10 years before we began to see the real durable use cases of the internet and how it was going to change the world and every industry on the planet. This AI theme feels about the same. And for investors, it will probably be just as volatile. There will be early adopters, and we will see winners emerge, only to see them potentially lose within 5 years. Early AI leaders like MSFT, NVDA, AMD, SMCI, TSM, MU, and AMAT have been making big moves in the past 6 months, and technology now constitutes over 45% of the S&P 500 (a new sector high!) All this to say, expect to hear a lot more about AI in the coming quarters and years. At MONTAG, we continue to research, follow, and invest in these themes, so based on investment objectives, it is possible that you will be seeing some of these stocks showing up in your accounts as well.

The information provided is for illustration purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action to be taken. These analyses have been produced using data provided by third parties and/or public sources. While the information is believed to be reliable, its accuracy cannot be guaranteed. MONTAG employees do not provide legal or tax advice. For specific legal or tax matters, you should consult with your own legal and/or tax advisors. There are risks associated with investing in securities. Investing in stocks, bonds, exchange traded funds, mutual funds, and money market funds involve risk of loss. Loss of principal is possible.