by Chris Guinther, Senior Investment Strategist

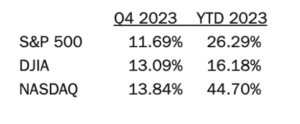

Let’s begin by noting the 2023 market numbers for Q4, as of the quarter’s close of December 31st:

The equity markets finished the year off on a positive note and we think for good reason. After roughly 2 years of falling corporate earnings due to the FED raising interest rates to kill inflation, it seems likely that they are nearing the end of the rate-hiking campaign. As inflation is falling, our view is that it will continue to lower as the lag effects of the interest rate hikes play out. In November, interest rates on the 10-year Treasury Bonds dropped over 1% (from 5% to 4%) to account for the likely end of the FED’s tightening, and the belief that inflation will fall back to the target of 2% sometime within 2024. That significant 1% drop in interest rates on longer-term bonds was nearly unprecedented and that move coincided with new highs on the S&P 500, the Nasdaq, and the Dow. Generally, investors are turning bullish and we tend to agree, as the notable turndown in inflation has changed the outlook and mood.

As the equity markets zig and zag every year, investors are often trying to anticipate ‘major inflection points’, although many times the ‘major inflection point’ doesn’t occur. For now, we think there is a better and improving case to be made for earnings to rise broadly in 2024 and into 2025.

While overall GDP growth may only be 2%, a similar growth rate that we experienced in the decade before COVID-19, investors have had concern for a steep fall off in earnings. This outlook has been waning as the FED appears to have taken its foot off the brakes since inflation is cooling. At the moment, we’re viewing all this as a ‘mission accomplished’ by the Fed, as they managed to slow demand in the economy just enough to allow supplies to rise and meet demand without causing panic or a recession. From here, it appears we will be able to resume slow growth in the U.S. While there is “some” upside for stocks driven by their earnings growth, the market is still pretty rich, trading at over 18x earnings, hindering the upside from valuations.

The continuing U.S. Government deficit spending and now excessive U.S. debt, while extremely helpful in averting a recession, has managed to kick the can down the road for now. Interestingly, as the levers are pulled, on the one hand, the Federal Reserve was slowing the economy by raising interest rates to slow inflation, and on the other hand, the U.S. Government spent $6 trillion dollars to stimulate the economy. This combination, although not good in the long term, did help to soften the landing for now.

We will continue to monitor the indicators and the economy to make sure client portfolios are in line with our expectations and within your investment profile.

The information provided is for illustration purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action to be taken. These analyses have been produced using data provided by third parties and/or public sources. While the information is believed to be reliable, its accuracy cannot be guaranteed. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed were or will be profitable. MONTAG employees do not provide legal or tax advice. For specific legal or tax matters, you should consult with your own legal and/or tax advisors. There are risks associated with investing in securities. Investing in stocks, bonds, exchange-traded funds, mutual funds, and money market funds involves risk of loss. Loss of principal is possible.