By CHRIS GUINTHER, SENIOR INVESTMENT STRATEGIST & PORTFOLIO MANAGER

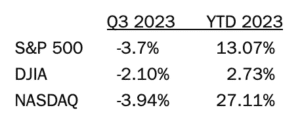

Through September 30th, the returns for the various indices are as follows:

As the market returns did weaken for the quarter, the major indices are still on the positive side for the year. In general, stock investors weren’t happy with interest rates continuing to rise and the increasing likelihood that the FED-engineered slowdown, meant to tamp out inflation, could end up inducing a recession. Looking at history, a recessionary outcome has occurred in nearly every case when the FED has increased rates substantially. Interest rates are now up to 5.25%, putting a damper on housing sales, auto sales, bank lending and every other part of the economy that relies on debt. Consumers are surely feeling the pinch, as credit card balances rise to over $1 trillion and signs of stress are showing up in consumers ability to repay their balances. Commercial real estate is also still on the decline, both from rising rates and the increasing popularity of flexible work schedules.

One oddly and notable positive influence on the economy, but likely to turn negative eventually,

is the government’s excessive spending and ongoing deficits. This is despite some of the lowest unemployment levels on record, now near 3.8%. It’s not clear to many people, who regularly run their households with a balanced budget or surplus, why politicians continue to approve more spending. Historically, that may be why the phrase ‘kick the can down the road’ was created.

Since the 2008 housing and banking crisis, government spending has continued unabated, with debt now reaching 120% of GDP and to a level we’ve never seen before in the U.S. Many think we are near a tipping point, especially as rates continue to rise and interest payments eat up as much of the federal budget as defense spending, which is already one of the largest categories of our budget at 12%. Government (federal, state and local) spending is thought to make up nearly a third of the economy (and growing!) and right now those institutions are spending every penny they get in and then some. Note that without this government spending propping up the short-term, we would most likely be seeing a noticeably slowing economy. We suspect the excessive spending has allowed the forecasted recession to be pushed into 2024. Unless, that is, the FED can somehow manage to slow spending just enough to cool inflation back to 2%, but not so much as to start a recession.

We continue to play it safe and are not at all pleased to see interest rates on the 10-year U.S. Treasury continue to rise to over 4.6% today as debt supply/issuance, appears to be outweighing demand. Additionally, as the U.S. and developed world shuns China, China in turn is shunning the U.S. and one area that’s showing itself now is in the U.S. Treasury market, a place where China had once been a big buyer.

As rising interest rates tend to slow the economy, they also pressure valuations on businesses and public equities. Equity valuations, unfortunately, are not low and we are concerned that the almost inevitable slowdown could be a double whammy to stock prices as their valuations fall and the prospects for growth fall too. The good news is, after 10-15 years of extremely low interest rates and almost no ability to generate any income or growth in fixed income portfolios, we can now invest in all sorts of bonds ranging from U.S. Treasuries to Corporates to Municipals, with higher than 5% yields. While that’s not the larger returns we prefer over the long term, it is a good start and good place to securely preserve and protect assets.

We continue to believe a world of “higher for longer” interest rates and slower growth than the last four years is much more likely than a return to the abnormally low interest rate environment when high growth stocks dominated and high valuations were the norm.

In general, we continue to recommend positioning conservatively to account for a wide range of possible outcomes given the unprecedented inflation and eventual withdrawal of stimulus that is beginning to occur worldwide.

Thank you for your continued trust in MONTAG Wealth Management.

The information provided is for illustration purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action to be taken. These analyses have been produced using data provided by third parties and/or public sources. While the information is believed to be reliable, its accuracy cannot be guaranteed. MONTAG employees do not provide legal or tax advice. For specific legal or tax matters, you should consult with your own legal and/or tax advisors.

Author

-

Chris is a Senior Investment Strategist and Portfolio Manager who leads equity research and market strategy efforts at MONTAG. His expertise includes stocks and bonds, with a particular focus on technology stocks and growth investing.

View all posts