By AMY CARCIONE, CFA

Do you recycle? Do you compost at home? Do you worry about global warming? Do you drive a hybrid car? Do you use reusable bags when you go to the grocery store? Do you buy only high-efficiency appliances? Do you have solar panels on your roof? Have you stopped drinking bottled water? Does deforestation trouble you? Are you concerned about natural resource depletion?

Does your investment philosophy follow suit?

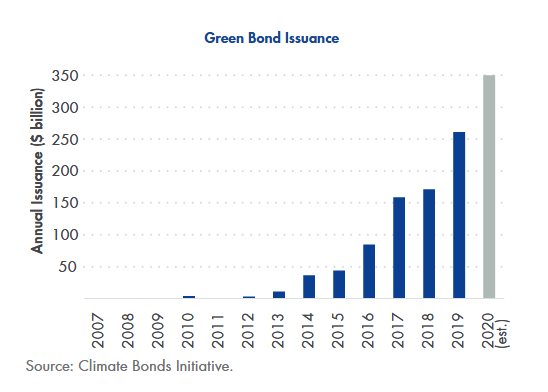

In 2020, $305.3 billion green bonds were issued, up 13% from 2019. This increase drove the total issuance of green bonds to over $1 trillion, since 2007, data from Bloomberg showed. However, despite this increase in issuance, they still make up a small fraction of the $100 trillion bond market.

In 2020, $305.3 billion green bonds were issued, up 13% from 2019. This increase drove the total issuance of green bonds to over $1 trillion, since 2007, data from Bloomberg showed. However, despite this increase in issuance, they still make up a small fraction of the $100 trillion bond market.

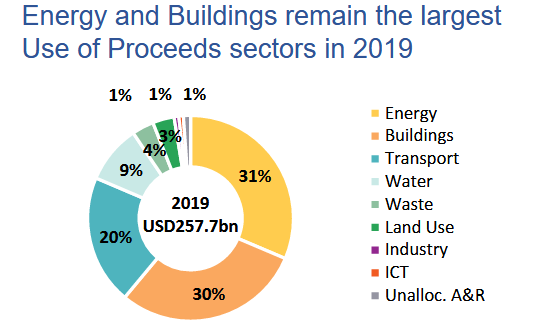

The growing interest in green bonds signals a gradual shift towards impact-based investing, or investments with intended social or environmental benefits. Green bonds are debt instruments, with the same characteristics of other bonds that pay coupon interest payments and return your principal at a stated maturity. The difference is that the funds generated from selling green bonds are specifically earmarked for climate change and environmental projects, such as pollution prevention, clean transportation, sustainable water managements, energy efficiency, sustainable agriculture, and the development of environmentally friendly technologies to name a few. They provide a unique opportunity to invest, not just for financial returns but for social values.

source: Climatebonds.net

Green bonds are just one form of ESG (Environmental, Social, and Corporate Governance) investing and face many of the same issues as the larger impact investing market. Critics will argue that the parameters of what constitutes a green bond is too broad in scope and it is difficult to quantify the extent to which the use of proceeds are actually doing to promote sustainability. While there are currently no governing agencies overseeing the practices of these issuers, recommended guidelines for disclosure and voluntary standards of practice have been created, such as the Green Bond Principles from the International Capital Markets Association (ICMA) and the Climate Bonds Initiative. Creating clear metrics for standardizing and quantifying the impact achieved will be an important step in validating green bonds to investors globally.

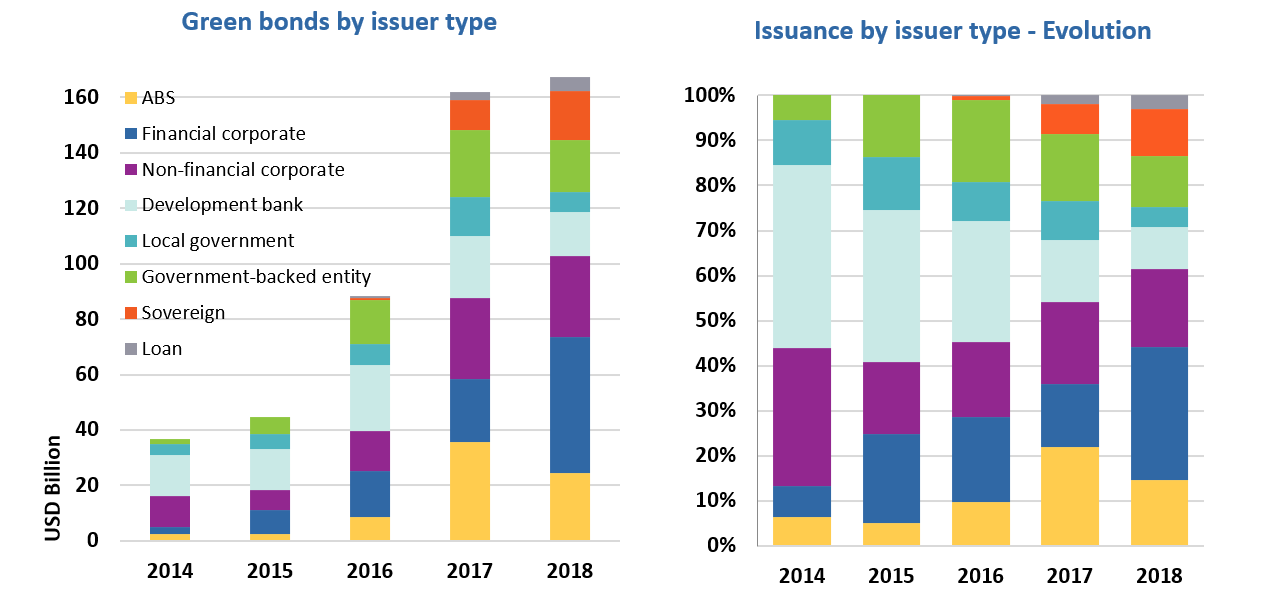

As a Municipal Fixed Income Manager for most of my career, I have seen municipalities fund environmentally responsible projects long before the concept of “green investing” became a thing. Most municipal bonds are issued with the intended purpose of supporting or updating roads, transportation, buildings, schools, hospitals and utility systems. Despite the inherent theme of sustainability and efficiency in these improvements, most projects do not qualify as “green” because there is not a measurable environmental benefit. However, that has changed since the first municipal green bond was issued in the US in 2013. In 2015 alone, $4.2 billion of municipal green bonds were issued and by mid- 2020 total issuance outstanding has reached $39 billion. While this is still a small fraction of the $3.7 trillion US municipal market, it reflects an evolution of investor focus and demand.

In addition to municipalities, other asset classes are taking advantage of this young, but accelerating demand for socially-responsible investing. There are now many ESG-themed mutual funds and ETFs, as well as individual countries and corporations offering ethical investment options. Some ratings agencies are beginning to assign an ESG impact ratings for bonds as well, along with a credit rating. Having access to global fixed income markets to fund projects, sustainability, and innovation could drive significant environmental change in upcoming years as ethical investing becomes more mainstream and investor interest grows.

Source: Climate Bonds Initiative, Climatebonds.net

So, if “going green” is an important part of your core values, is it worth your investment? Is it time to align your social goals with your investment objectives? As the world around us evolves, the green bond market will, and your investment portfolio could too.

The information provided is for illustration purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action to be taken. These analyses have been produced using data provided by third parties and/or public sources. While the information is believed to be reliable, its accuracy cannot be guaranteed.