by Jackson Keenan, CFP® – MONTAG’s Director of Financial Planning

by Jackson Keenan, CFP® – MONTAG’s Director of Financial Planning

The Setting Every Community Up for Retirement Enhancement (SECURE) Act was passed in December 2019 and brought many changes impacting retirement planning. On December 23, 2022, the U.S. House of Representatives passed the SECURE Act 2.0 bill that provided additional updates to the original 2019 SECURE Act. In this post, I will focus on the changes from the new bill that are specifically related to retirement planning.

* * *

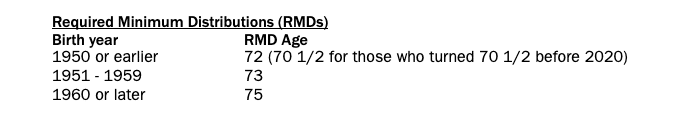

For starters, the age to start Required Minimum Distributions (RMDs) has been pushed out:

Prior to the Secure Act 2.0 passing, for taxpayers who had either been tempted not to take their RMDs or did not understand the distributions were mandatory, a penalty was imposed. That penalty was a steep one at 50%. Note that a 50% penalty is much higher than the highest income tax bracket – 37%! After the passage of the Secure Act 2.0, the RMD shortfall penalty has been lowered from 50% to 25%; 10% if corrected in a timely manner.

* * *

The Secure Act 2.0 has also brought a direct impact on ROTH accounts.

To clearly understand the consequences of the changes, below is a brief overview on ROTH IRAs verses ROTHs in employer plans (Roth 401(k)s, Roth 403(b)s, Roth 457(b)s).

A Roth IRA is funded with after-tax dollars and thus it grows tax free. When the funds are distributed, the money received is also tax free as taxes were paid prior to the money being invested in the Roth IRA. Roth IRAs are valuable if you think you will be in a higher tax bracket during retirement. Unfortunately, ROTH IRAs have income phase out limits that would block the investors who would benefit the most from these types of investments.

Roth 401(k)s, Roth 403(b)s, and Roth 457(b)s work just like ROTH IRAs except you can deposit more funds into them and there is no income phase out to be concerned about.

The SECURE Act 2.0 has new rules encouraging the use of ROTHs.

Those rules have a direct impact on employer provided plans:

- Starting in 2024, Roth 401(k)s, Roth 403(b)s, Roth 457(b)s, and Roth Federal Thrift Savings Plans do not have RMDs. The required minimum distributions are no longer mandated, even if you have taken them in the past.

- SIMPLE IRAs and SEP IRAs can now have a Roth component. (This is valuable to the self-employed or smaller employers.)

- Employer contributions, like matching and non-elective contributions, have previously only been added to pre-tax accounts. Now they can be ROTH and are included in employee income and do not require vesting.

- The maximum contribution to an employer plan is $22,500 and employees over 50 can save an additional $7,500. The new act provides that employees with income over $145,000 must use the Roth option for the over age 50 catch-up contributions for 401(k), 403(b), and governmental 457(b) plans.

Starting in 2024, 529s can be transferred to a ROTH IRA with these limitations.

As they say in late-night infomercials, “But WAIT – There’s MORE!” This new “Rothification” even stretches to 529 Education Savings Plans.

- The Roth IRA receiving the funds must be in the name of the beneficiary of the 529 plan.

- The 529 plan must have been maintained for 15 years or longer. Note that it is unclear if changing the beneficiary on a 529 restarts the 15-year wait.

- Any contributions to the 529 plan within the last 5 years (and the earnings on those contributions) are ineligible to be moved to a Roth IRA.

- The annual limit for how much can be moved from a 529 plan to a Roth IRA is the IRA contribution limit for the year ($6,500), less any ‘regular’ traditional IRA or Roth IRA contributions that are made for the year.

- Example: You contribute $4,000 to a Roth IRA. You can only transfer $2,500 from a 529.

- The maximum amount that can be moved from a 529 plan to a Roth IRA during an individual’s lifetime is $35,000.

- The child must still have earned income.

- Regular Roth IRA contributions are subject to income limitations, 529 transfers to a Roth are not.

Details on these and other SECURE Act 2.0 topics can be found at Senate.gov under the title “SECURE 2.0 Act of 2022.”

The information provided is accurate to the best of our knowledge as of the date of publication. The information provided is for illustration purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action to be taken. MONTAG employees do not provide legal or tax advice. For specific legal or tax matters, you should consult with your own legal and/or tax advisors.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER™ certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.