By Amy Carcione, CFA

By Amy Carcione, CFA

Fixed income investors have been on quite a roller coaster ride over the last two years as interest rates have catapulted at record pace. This type of unprecedented movement in the bond market has generated some unwanted volatility in what was normally considered “safe” investments. With continued uncertainty over inflation, Fed policy, recession, and geo-political affairs, fixed income investors may be wondering “where did the stability go?”

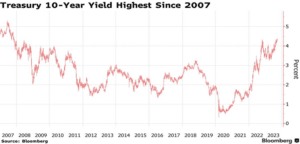

Many people thought interest rates may have peaked in late-2022 when the 10 year US Treasury yield exceeded 4% and then decreased steadily over the months that followed. Recently, in Fall of 2023, we saw the US Treasury yield top 5%. Clearly that must have been the peak, right? The answer is “we don’t know” and many things can impact where interest rates go from here. Timing the bond market is a futile task and not for the faint of heart. Here at MONTAG Wealth Management, we understand that clients want a reliable income stream and security in the foundation of their fixed income portfolios, regardless of the direction of interest rates. A bond ladder is one approach investors can use to lock in these historically attractive yields while still maintaining preservation of capital.

What is a bond ladder?

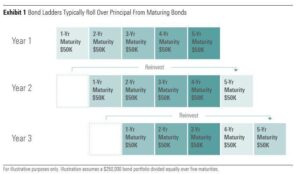

A bond ladder is a portfolio of individual bonds whose maturity dates are spread out evenly among a client’s specific time horizon. The intent of a bond ladder is to hold each bond to maturity. Then, as the bond matures, the goal is to replace it with a bond at the end of the maturity range to preserve the structure of the ladder. See example below.

Potential advantages to a laddered bond portfolio:

- Generate a predictable, dependable income stream – income payments, or coupon interest, is usually paid semiannually and we can structure the bonds in your portfolio so income payments are scheduled each month or quarter.

- Ongoing liquidity – Having bonds mature at regular intervals along your ladder allows for cash to be available on a consistent, scheduled basis.

- Reduce reinvestment risk and interest rate risk – If interest rates rise, we are able to purchase bonds on your behalf with higher yields as the ladder rolls off. If interest rates fall, your bonds with longer maturity dates would be locked into the initial higher yields. As a bond matures the decision can be made to continue the ladder structure or reinvest the proceeds in a more suitable investment allocation.

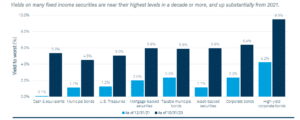

- Diversification – For a long time, yields were close to zero, but now bonds can deliver reliable income and return with potentially less risk than stocks. As a result, bonds may be a viable alternative to a new pool of investors or they can serve as a justifiable allocation for the balanced investor.

Why not just buy a Bond Fund or a Bond ETF?

- Variable monthly income distributions make it difficult to plan for income needs.

- Expense ratios paid to the fund managers can vary and sometimes be high.

- If you do not know exactly what the fund is invested in or the underlying quality of what you are owning there could be increased credit risk and volatility.

- There is increased liquidity risk because there is no set maturity date. Investors can usually sell at any time; however, the market value may be higher or lower than their initial investment.

Why should you choose MONTAG to help construct your bond ladder?

- We employ a seasoned, dedicated fixed income investment professional to follow and maintain the integrity of each bond portfolio.

- We have access to inventory and balance sheets of over 20 regional and national broker-dealers as well as top-tier electronic trading platforms.

- Institutional pricing power is attained when the needs of multiple clients can be grouped together to receive better pricing, whether buying or selling bonds.

- We oversee credit research on each credit, reviewed internally, with the access to rating agencies and credit analysts within the top fixed income firms.

- Personal customization and construction – Our Fixed Income Manager will build you a ladder that reflects your need for income, tolerance for risk, and investment time horizon.

As you will see in the charts below, whether you are in need of tax-exempt Municipal bonds, taxable Corporate, Treasury, or Agency bonds, fixed income yields are some of the highest we have seen in decades. It is likely that they will not stay this high forever but hopefully will normalize at levels that can still be useful to investors. Here at MONTAG, we are poised to help clients take advantage of this higher interest rate environment by enhancing their fixed income portfolio. Please reach out to your Portfolio Manager if you would like to discuss the possible options which may work best for you.

The information provided is for illustration purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action to be taken. These analyses have been produced using data provided by third parties and/or public sources. While the information is believed to be reliable, its accuracy cannot be guaranteed. MONTAG employees do not provide legal or tax advice. For specific legal or tax matters, you should consult with your own legal and/or tax advisors. There are risks associated with investing in securities. Investing in stocks, bonds, exchange traded funds, mutual funds, and money market funds involve risk of loss. Loss of principal is possible.