AMY CARCIONE, CFA

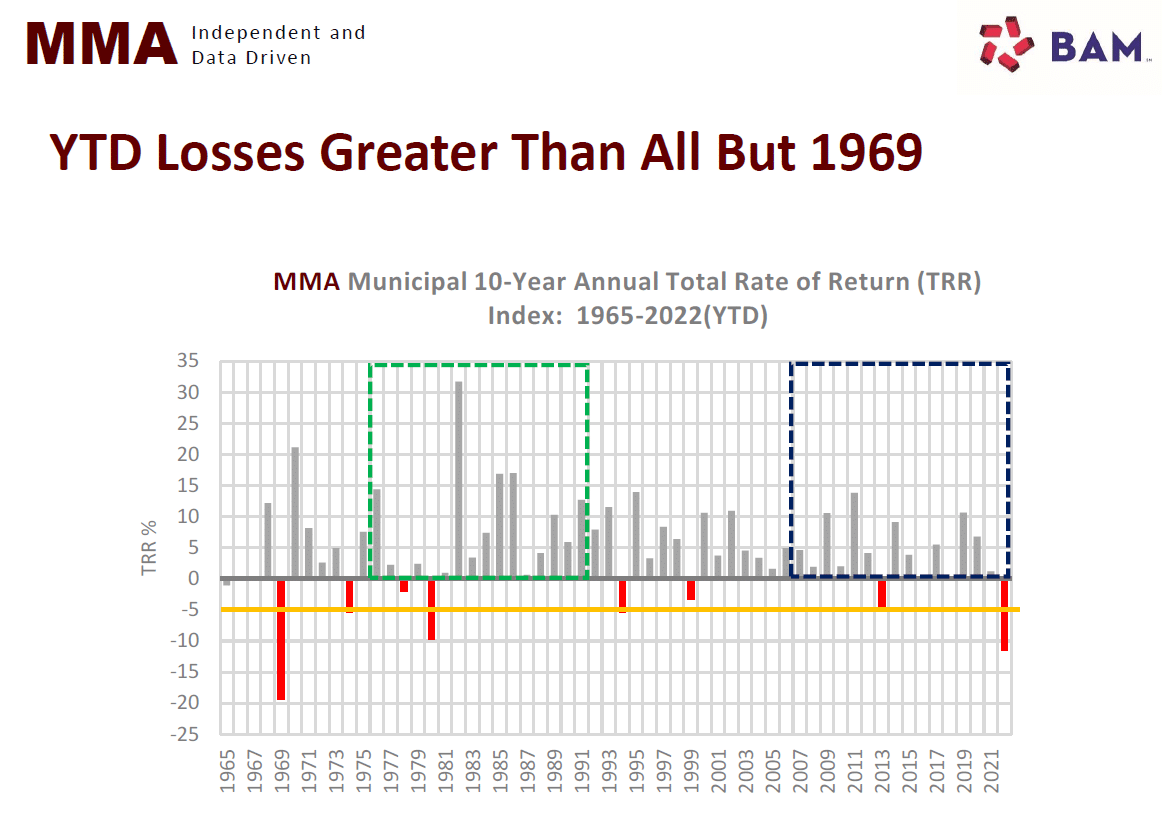

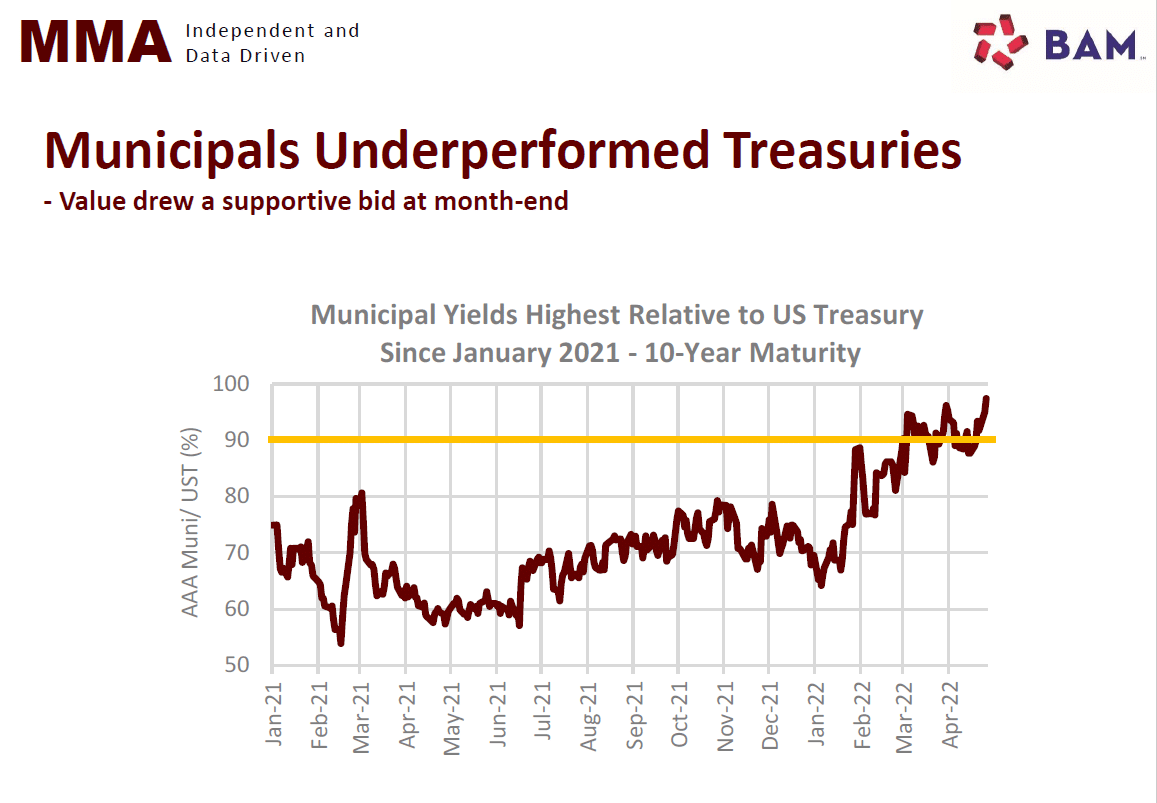

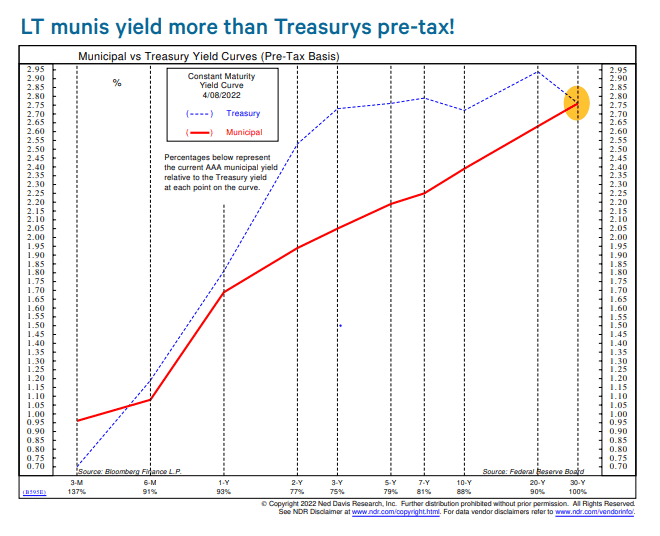

Since the start of 2022, we have witnessed a significant surge in municipal bond yields. This spike in yields has lured investors looking for tax-exempt income back into the municipal market. Most recently, an average 10-year municipal bond can yield 2.86%. This is up from 2.45% just a month ago and up from 1.27% since the start of the year. This has improved the Muni/Treasury Yield ratio from 72% to 95%, now making high grade municipal bonds a very attractive investment option on a comparative after-tax basis. Similar meaningful increases were seen across all areas of the yield curve, not just in 10 years. A number of factors contributed to this lag in municipal underperformance including mutual fund outflows, expected Fed Funds rate hikes, and improving fiscal stability for State & Local governments due to anticipated growth in income, sales, and property tax collections.

Looking Backwards

Since early 2020, when Covid sent the markets into a wave of uncertainty, bondholders saw the value of their portfolios increase as yields plummeted to historic lows. As yields on bonds go down, the price of the bond goes up. The 10-year municipal bond at this time was yielding 0.68%. However, bond issuers used this time as an opportunity to refinance their outstanding debt and pay bondholders lower interest rates on borrowed funds. Investors were then forced to search for income alternatives or reinvest their money at yields close to zero. Those who chose to redeploy their fixed income allocation into other asset classes or stay in cash did so, at times, possibly sacrificing income, diversification, or peace of mind with few viable replacements.

Looking Forward

While the rapid yield rebound this year has given back most of all the gains from the past two years, I would like to think the worst is behind us. The municipal market has been exposed to the volatility of an unstable rate environment as of late. The more clarity we have on the continued direction of rates over the next year or two, the more stable the municipal market will be. How much more can rates continue to rise? Will yields begin to trend lower for the remainder of the year? While I do not have a crystal ball to answer these pointed questions, municipal bonds can offer diversification, safety, income, and now finally again, some yield to your portfolio. With the municipal market up and hopefully stabilizing, this may be a good entry point. And “munis” are no longer just for the wealthy! With yields and ratios where they are, the right choice of municipal bonds may make sense for a portfolio regardless of your tax bracket.

The information provided is for illustration purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action to be taken. These analyses have been produced using data provided by third parties and/or public sources. While the information is believed to be reliable, its accuracy cannot be guaranteed.