by JACKSON KEENAN, CFP®, DIRECTOR OF FINANCIAL PLANNING

by JACKSON KEENAN, CFP®, DIRECTOR OF FINANCIAL PLANNING

As we enter the season of charitable giving, it is important to match your desire for making a difference while also being thoughtful with your tax planning.

Many of our clients have family foundations or, for a simpler solution, they utilize Donor-Advised Funds. Whichever strategy you choose, there are general planning decisions which can work to your benefit.

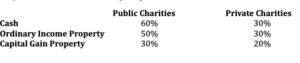

First, consider what asset you want to utilize for your giving and how each asset class has unique tax advantages. For example:

Itemized Deduction Limits for Charitable Gifts: Percentage of Adjusted Gross Income (AGI) Limitation

To implement the above strategy, you will need to itemize your taxes. This will be used to show that your itemized deductions are higher than the standard deduction. (The 2023 standard deduction is $13,850 for single filers and $27,700 for married couples filing jointly.

Donation Bunching

If your total itemized deductions are below these amounts you may try “donation bunching.” This is a tax strategy which consolidates your donations for two years into a single year to maximize itemized deductions for the current year. This approach may produce a larger total deduction over two years than two years of standard deductions. This has been one of the reasons Donor Advised Funds have grown so much. You can bunch your donation but then distribute it in a manner that is timely for your needs. The good news is you get the entire deduction immediately and can pace your contributions annually.

Other Benefits of Charitable Giving

Charitable giving is also a great opportunity to donate highly appreciated assets. Certain assets may have significantly appreciated over time and would incur a large capital gains tax upon their sale. By using these stocks for donation, you will get more bang for the buck by not paying the capital gains tax. You can also utilize this strategy as a beneficial way to rebalance your portfolio.

If you have not completed your Required Minimum Distribution (RMD) and are at least age 70 ½, you should consider a Qualified Charitable Distribution (QCD). A QCD allows you to donate up to $100,000 to one or more charities directly from a taxable IRA instead of taking an RMD. This may help donors avoid being pushed into higher income tax brackets and prevent phaseouts of other tax deductions.

Donation Deadline for 2023

The 2023 donation deadline is December 31st, so the sooner you start planning the better. You can give yourself a double win: improving the world and a potential tax break too.

The information provided is accurate to the best of our knowledge as of the date of publication. The information provided is for illustration purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action to be taken. MONTAG employees do not provide legal or tax advice. For specific legal or tax matters, you should consult with your own legal and/or tax advisors.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER™ certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Citation: IRS Publication 526 Charitable Contributions and Publication 590-B (2022), Distributions from Individual Retirement Arrangements (IRAs).