Finance 101 teaches us that higher interest rates (borrowing costs) should result in lower stock prices. Loftier yields are viewed as a double headwind for stocks: first, higher financing costs hurt earnings by requiring companies to allocate a greater share of revenue to interest expense; second, the value of future earnings (“two birds in the bush”) becomes less attractive compared to bond investments when fixed-income securities offer an increasingly competitive, and certain, return sooner rather than later (“the bird in the hand”).

If that’s the case, then how can it be that in a blazing-fast span of less than 18 months, the Fed has raised short-term interest rates from zero to 5.25%, commercial banks have raised their prime lending rate from 3.25% to 8.50%, and stock prices are not far off their late 2021 highs?

Finance or economics students could reasonably expect that interest rates jumping this far, this fast, and from an unprecedentedly low starting point, should have sent stock prices into serious downdraft and kept them there. Yet, here we are.

| 2-Year Cumulative Return

as of Late-August 2023 |

|

| S&P 100 (largest 100 companies) | 4.7% |

| S&P 500 | 2.9% |

| S&P 400 (mid caps) | -1.1% |

| S&P 600 (small caps) | -7.1% |

| S&P 500 equal weight | -0.1% |

How can this be? Short answer: time.

How Higher Interest Rates Impact Corporate Earnings & Bond Yields

While a complete analysis is beyond the scope of this blog post, two elements stand out:

- The impacts of higher rates on corporate earnings are not instantaneous.

- Starting from such a low base, bond yields had a long runway before reaching a level enticing to stock investors.

Changes in interest rates impact earnings and profit margins via two channels – the pace and size of refinancing needs and whether the new interest rate is higher or lower.

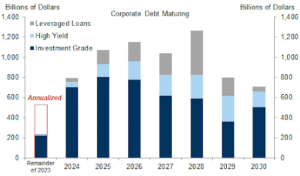

In recent years, corporations, homeowners, and governments alike took advantage of ultra-low yields to issue large quantities of debt and issue longer-maturity bonds. Companies termed-out their debt financing by lengthening maturities and locking in lower borrowing costs.

But what is deferred eventually comes due, and the pace accelerates next year.

Furthermore, when that low-coupon debt is renewed, corporate finance chiefs and profit margins will feel the pinch from financing costs that have not been this high on a sustained basis for well over a decade.

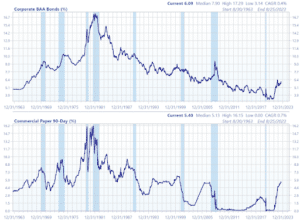

A Quick Glance at Interest Rates Over the Years

By locking in relatively cheap financing during the Fed’s “zero interest rate policy” (ZIRP) years (roughly 2009-2015 and again 2020-2022), many companies’ profit margins have been able to defer effects from the Fed’s tighter monetary policy.

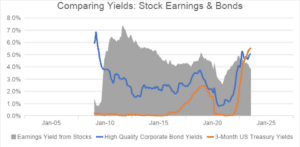

The second reason for stocks’ support in the face of higher interest rates is that when yields were at historically low levels, the returns offered by bonds were seen as insufficient relative to the potential returns from stock investments.

Such was stocks’ TINA era, “there is no alternative.” The only-half-joking acronym describes how record loose monetary policy during the ZIRP years factored into higher equity prices, despite legitimate apprehension regarding economic and earnings strength. Bonds at least offered a secure return, albeit minuscule or even negative interest!

To illustrate, consider the rudimentary “earnings yield,” observed when we invert the price-to-earnings ratio, a valuation metric, and compare it to yields available in the bond market.

Using this measure, for most of the past ~15 years, bond yields were too low to serve as a reasonable alternative to the uncertain, but possibly richer, “yield” of corporate earnings growth. Said another way: Bonds were relatively expensive and stocks were relatively cheap.

Now for the first time in over a decade, the bond market offers meaningful competition for a portion of investors’ portfolios. Thanks to the Fed’s aggressive interest rate hikes, TARA has supplanted TINA and “there are reasonable alternatives” to stocks. Cash flow and earnings yields must exceed higher thresholds now to be worth the additional uncertainty.

This relative shift between stock and bond yields bears watching and tells us risks have risen. My Portfolio Manager colleagues and I remain dedicated to our clients and will continue to evaluate the implications of this changing investment environment.

* * *

The information provided is for illustration purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action to be taken. These analyses have been produced using data provided by third parties and/or public sources. While the information is believed to be reliable, its accuracy cannot be guaranteed.

Any securities identified were selected for illustrative purposes only. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed were or will be profitable.