It was actually in Early January that the Coronavirus became a worry for the market. It started out in December 2019 in the city of Wuhan, the capital of China’s Hubei province, and seemingly the big market worries were about the slowdown in China. Not only the impact from China’s quarantines and business disruption as the world’s supplier of goods and components, but also the slowdown in end user demand. News ebbed and flowed for over a month, as US companies and investors fretted mainly about the impact to their supply chains and Chinese customers. Apple was among the first US companies to warn of the negative impact to operating results, but after initially falling on February 18th, shares rebounded the next day, as the market viewed the virus’ impact as a fairly quick “one and done” hit to demand. Some analysts in fact moved all of the lost revenue in Apple’s current quarter into the next quarter, leaving full year numbers intact. The market hit an all-time high February 19th.

Thursday and Friday February 20th and 21st saw the S&P500 give up .4% and 1% respectively, due to a combination of a bit more queasiness about the Coronavirus as well as some possible overbought and overenthusiastic market conditions.

Monday February 24th saw the S&P500 fall 3.3% after weekend news came in about rapidly deteriorating situations in Iran and Italy indicating a growing possibility that this virus would go global.

Selling continued Tuesday the 25th, with the S&P500 dropping another 3%, likely impacted by the CDC’s frank (and helpful in my opinion) warnings that Americans should be ready for this virus to come stateside and not in small numbers. The CDC spokesperson suggested there could be significant impacts to daily life in the USA as kids are asked to stay home from school and workers are asked to work remotely rather than commute to offices. My hope/expectation is that Americans handle this pretty well and even “come together” a bit which would be a welcome side effect in such angry times. That said, hope is of course not part of the investment process.

Yesterday (2/26) the market seemed to strongly rebound in morning trading, only to give that up and reverse lower, in part due to an announcement in Nassau County New York of 40-80 people being tested for Coronavirus. A 5:30pm White House Press conference was held in an attempt to reassure Americans that the risks to Americans are low, while cautioning that things could get worse. This morning (2/27) the market is down after an earnings warning from Microsoft due to Coronavirus’ impact on software demand. To put it lightly, it’s a fast moving and fluid situation.

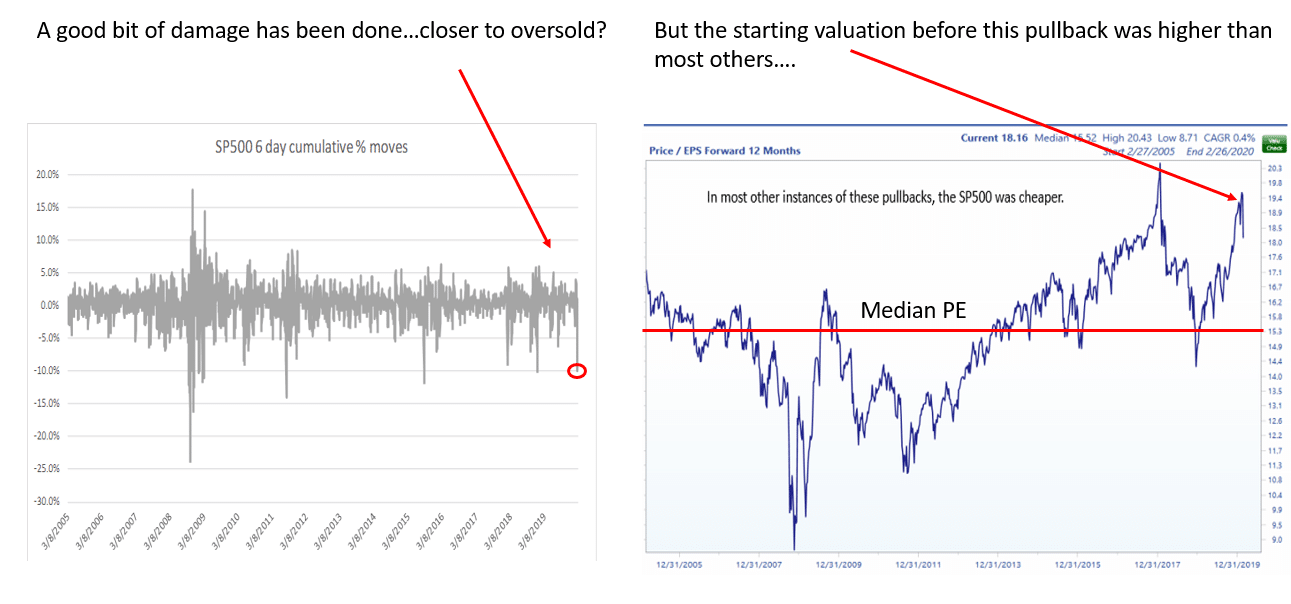

Market comparisons to other events like SARS are flawed for multiple reasons but among the most important is that coming into this event, unlike others, the largest US stocks (particularly technology) were pricing in near-perfection. Despite being cheaper and unloved, value areas like energy and financials have fallen as much or more than the hottest areas of the market. The oil and gas situation is precarious as it is marginal demand growth that heavily impacts the commodity price, and China has been and continues to be a huge share of the growth in energy demand. As for financials, the recent plunge of the 10-year yield to new lows is bad news for net interest margin.

Having been up 5.1% for the year on February 19th, the S&P500 has fallen 9.5% since then (as of pre-market trading 2/27) and is now down about 4.8% for the year. But those figures only relate to an arbitrary calendar year-end. Over 12 months the market and portfolios are still up substantially, thus anchoring to 12/31/2019 as a date from which we’ve “lost money” may not make the most sense as a reason to act.

There are few areas of the market left untouched by this situation, and the defensive sectors have been priced high enough to offer little defense. This Coronavirus situation is evolving and a headwind for our economy, our country and portfolio positions, but high quality companies and managements have dealt with troubles in the past and will handle them in the future. Market timing (wholesale reductions or increases in the portfolio’s equity percentage) adds less value over time than finding and sticking with high quality companies. In the current environment we try not to over-react, while also digging deep to make sure we are not ignoring deeper or more dangerous issues. With so much volatility, we may be able to trim positions that have outperformed and add to others that have been previously reduced or are on a watch list.

Vigilant about protecting downside, but cautiously optimistic seems like the way to go. While there are risks and real chances of making decisions that result in temporary or permanent loss of capital, ugly and uncomfortable periods also can provide the weak investor sentiment that allows for deploying cash opportunistically.