by: Benjamin Harris, CFA, Portfolio Manager

by: Benjamin Harris, CFA, Portfolio Manager

Last year, US stocks had their worst calendar year return since the Great Recession year of 2008 and the 7th worst year in the last 97 years. This follows 2021, when U.S. stocks had the 23rd best calendar year return over the same span of years. What a ride for the stock market!

After peaking on December 27, 2021 at 4,808, the S&P 500 hit its most recent low of 3,574 on October 12, 2022 for a decline of -25.6%. Along the way there have been 5 meaningful rallies ranging from 6.1% to 17.4% — with an average rally of 11.1%. Since the October low, the S&P has risen 17.4% to about 4,136. The math tells us we’re half way back. The question is whether this is another bear market rally, or have we seen the lows?

Let’s take a look at the stock market from several angles to see where its trajectory might go in the coming months.

Corporate Earnings

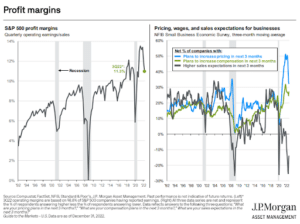

Perhaps the biggest question/concern looking ahead is what will overall corporate earnings be for 2023 and beyond. More than 70% of S&P 500 companies have reported their earnings for the last quarter of 2022. As it stands now, the aggregate earnings were almost 5% lower than the same quarter in 2021. This marks the first quarterly year-over-year earnings decline since the third quarter of 2020. One big issue is that corporate operating profit margins have started falling from unsustainably all-time highs reached at the end of 2021. Headwinds include lower global economic growth, cost pressures from still-elevated inflation, rising labor costs, ongoing supply chain issues, currency drag from a stronger U.S. dollar last quarter compared with the year-ago quarter, and geopolitical instability, particularly in Eastern Europe.

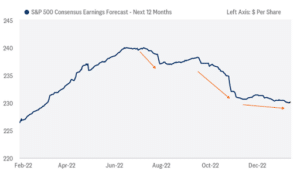

The Consensus for calendar year 2023 operating earnings per share is around $226. As seen below, these estimates have been coming down since last summer and are likely to fall further. Some Wall Street estimates are as low as $180/share. Conclusion: a head wind.

Source: LPL Financial Research, FactSet

The Fed/Inflation/Interest Rates

In the spring of 2022 the Federal Reserve finally realized that the inflationary pressures that started building during the economic reopening in 2021 were not “transitory” after all. Hence, they began the most aggressive interest rate hiking program in history that will continue probably into this summer with short term “Fed Funds” rates topping out at 5.25%. Some economists think they won’t go that high while others think even higher rates will be needed to tame inflation. What the Fed has made clear is that mission one is to tame inflation. While inflation, as measured by the CPI, has come down from its peak rolling twelve-month number of 9.1% last June to 6.4% as of January 31, it is still far higher than their target rate of 2%. On a positive note, at least so far, their tightening has not had a negative effect on employment numbers, though layoffs are the last round of belt tightening companies usually make to save costs. As to whether or not the economy goes into a recession, if it does, it will be one induced by the Fed rather than some economic bubble bursting (as with the housing bubble/mortgage crisis of 2008-2009, or the tech. bubble that burst in late 1999), or recessions that occurred as a result of some geopolitical event (’73-’75 recession caused by OPEC oil embargo, ’81-’82 recession caused by the Iranian revolution and energy crisis, 90’-’91 recession caused by the Persian Gulf War and Savings & Loan collapse). Almost without exception, Fed-induced recessions are shorter, milder and have a far less negative impact on the economy and stock markets. Conclusion: a head wind that may be calming in a few months.

Equity Market Valuation

Whether valuing a market, sector, industry or company, it must be done relative to its own history, its peers and to competing investments. With respect to the S&P 500, it is currently trading at about 18 times the consensus operating earnings per share expected for 2023. The average over the last 10 years is about 16.9X. So, you could say it’s close to fair value if you believe earnings estimates for this year remain where they are; but as mentioned before, those estimates are likely to come down. Flipping the PE ratio on its head gives you the earnings yield. Therefore, 1/18 equals 5.6%. Until recently, comparing this yield to competing investments — say bonds and cash — the choice was “easy” from a relative standpoint. For most of the period between early 2009 until May of 2021 cash yielded close to zero and quality bonds not much more, which gave rise to the phrase “T.I.N.A.” – There Is No Alternative to stocks. It’s a different ballgame today. Money market funds are yielding over 4%, a one-month treasury bill pays 4.6%, and six and twelve-month treasuries are paying right at 5%. One could argue that a risk free one year return of 5% looks very good verses an unsure yield of 5.6% on stocks. Of course, we are discussing the S&P 500 as a whole and we are looking out only a few months. Although our near-term outlook for stock returns is tepid, it is important to remember that over the last 50 years stocks have provided significantly higher annual returns than intermediate term bonds almost 70% of the time. Conclusion: a slight headwind – earnings dependent.

As investment portfolio managers in Atlanta, we look at the weight of the evidence and monitor many different indicators to make investment decisions. These 3 measures are impactful and will help guide our portfolio decisions and holdings along with other key metrics. With the current headwinds, a conservative posture makes sense, but as the direction shifts, we will look to make appropriate adjustments to portfolios based on each client’s risk profile and needs.

About MONTAG

MONTAG has established itself as, and remains, a trusted Atlanta wealth management and investment company since 1982. As a multi-generational, family-run business, MONTAG understands that superior service requires treating clients like family to enable them to build and secure wealth for current and future generations. Because they understand each client has their unique story, MONTAG always takes the time to get to know you, your investment philosophy, and your priorities to tailor strategies to your perennially evolving needs. Ultimately, your financial security is at the forefront of every decision you make.

The information provided is for illustration purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action to be taken. These analyses have been produced using data provided by third parties and/or public sources. While the information is believed to be reliable, its accuracy cannot be guaranteed.

by:

by: