by Olga Lee, MONTAG Portfolio Manager

by Olga Lee, MONTAG Portfolio Manager

At MONTAG Wealth Management, an investment policy statement is the foundation for a portfolio manager to construct a customized portfolio. To begin an engagement, MONTAG Portfolio Managers have in-depth conversations to identify the unique needs and risk tolerance of each client. Some of the questions include:

- Does the client need income or are they looking for growth?

- Is capital preservation top of mind or are they wanting to maximize growth despite potential for significant short-term volatility?

- Are there any specific tax circumstances or liquidity needs that need to be considered?

Understanding the right asset allocation targets and risk tolerance for each client is the most important task investment managers face. Once a client’s needs and objectives are confirmed, we can utilize different asset classes as building blocks in constructing portfolios.

When building a portfolio there are multiple strategies which investors utilize to implement and maintain the appropriate holdings. This article will focus on the differences in Strategic Asset Allocation and Tactical Asset Allocation. In doing so, we will focus on the three main asset classes which are:

- Cash

- Fixed income (Bonds)

- Equities (Stocks)

Within these asset classes, we will also use broad definitions and not get into sub-components of fixed income (taxable or tax-free, corporate or government, etc.) or equities (domestic vs. foreign, small vs. large, etc.).

What is Strategic Asset Allocation in Wealth Management?

Strategic asset allocation sets a target mix between the three main asset classes (cash, stocks, and bonds) depending on a client’s needs and risk tolerance.

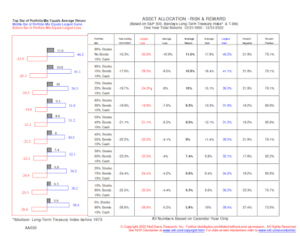

For example, the exhibit below from Ned Davis research outlines the potential returns for portfolios based on various asset allocation targets going back 70 years. The higher the stock allocation, the higher the potential for average gain in the long-term, but also the higher potential for a loss on a one-year basis. The 50% stocks and 50% bonds and cash portfolio offer slightly lower average returns, but also offer less volatility and potential for loss.

You can review the chart below to see the various historical outcomes based on the different asset mixes in a portfolio.

Once the asset allocation is established, the portfolio that follows is rebalanced on some regular interval basis. It could be monthly, quarterly, or annually depending on how the portfolio performed and how far the portfolio drifted from the actual portfolio targets. Some say strategic asset allocation is comparable to a buy-and-hold strategy. With this strategy, changes to asset allocation targets are not based on market conditions, (i.e. stocks are expensive relative to history, so we should own less of them), but only based on changes in client needs in terms of cash flows, liquidity, retirement, etc. In the long-term, the assumption is that returns of the portfolios will gravitate to their averages, and short to intermediate- term fluctuations should be ignored.

If a client truly has a long-term horizon, there is a lot of value to this process as it forces certain discipline on investors by removing personal opinion and emotion from the conversation. If stocks experienced a decline and dropped below the target allocation, it forces one to buy them to bring the allocation back up to target, even if it does not feel good at that point. If stocks performed well over a period, it forces one to sell stock and allocate it to cash and bonds to come back within targets, even if it creates taxes and feels uncomfortable. Human nature tends to not want to sell what is working, but with strategic asset allocation, the disciplined reallocation forces you back into the target range.

What is Tactical Asset Allocation?

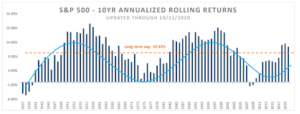

Tactical asset allocation is an active portfolio management portfolio strategy that makes deliberate moves between various asset classes based on the expected risk reward over the intermediate-term basis. Effectively, it means taking an active stance on the strategic asset allocation or targets that have been established for the portfolio. As highlighted in the Ned Davis table, over the long-term, equities remain the best investment vehicle to build wealth. However, they can be volatile on a year-to-year basis, and periodically go through an extended secular bear market. For example, the exhibit below highlights that the average total return for stocks going back to 1925 was 10%. However, there have been three extended periods in history previously that produced mediocre returns (1929 -1945, 1970s, and 2000-2010). We call these periods secular bear markets, and the starting asset allocation at those periods mattered a lot for long-term portfolio returns. Making tactical allocation changes to portfolios during those periods by having less in equities and more in other asset classes likely created solid long-term portfolio returns.

Source: Credent Wealth Management

Professional investment managers tend to follow macro factors in trying to identify the right risk reward and mix of asset classes when constructing client portfolios and implementing tactical asset allocation changes. Some of the factors include fiscal and monetary policy, overall valuation levels across various asset classes, earnings and economic growth expectations, investor sentiment, and many others.

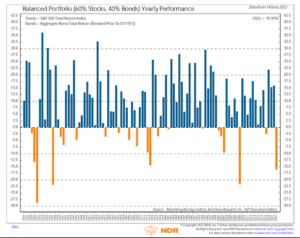

2022 is a prime example of the value of tactical asset allocation. As illustrated in the chart below, the typical 60/40 bond stock portfolio through December 31, 2022 produced a negative 15.79% return. After three years of above average returns, the starting point early in 2022 for most asset classes from a macro and valuation stand point was not favorable. While it is impossible to time the market on a short-term basis, focusing on big intermediate-term trends and making appropriate asset allocation changes in accordance with changes in trends can add value when tactical allocation is implemented.

In conclusion, both strategic and tactical asset allocation strategies have a place in portfolio construction and it is up to the individual client and the investment managers to determine the best course of action.

At MONTAG Wealth Management, Portfolio Managers are encouraged to customize solutions to their personal investment philosophy in relation to the needs of each client. My personal outlook tends to focus more on tactical allocation as it allows me to tune my clients’ portfolios for the short to intermediate-term market environment. It takes more effort and time to implement, but I feel my ability to customize portfolios tactically gives more of an opportunity for long-term wealth management success.

The information provided is for illustration purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action to be taken. These analyses have been produced using data provided by third parties and/or public sources. While the information is believed to be reliable, its accuracy cannot be guaranteed.

by

by