BY BEN HARRIS, CFA

Political noise emanating from Washington and geopolitical events has prompted fresh concerns that a US equity market correction may be looming. But have no fear: the market often takes a leg down, only to bounce back quickly.

US stocks have enjoyed a powerful rally since the November elections. The S&P 500 Index advanced by more than 20% from the election through September 30, on hopes that the new administration’s policies—including tax cuts, deregulation and repatriation of corporate cash held overseas—would boost economic growth and earnings. However, the President is facing political headwinds regarding his agenda, and investors seem less optimistic that his policies will come to fruition.

GAUGING THE WARNING SIGNS

One of the key components that nervous investors will point to is the valuation of the markets in general.

As of September 30, the S&P 500 is trading at a price/forward earnings ratio (P/E ratio) of 19.0x according to Thompson I/B/E/S. This ratio is high, in both an absolute and relative sense (the Great Recession notwithstanding).

While these valuations are partially supported by strong profitability, relatively low interest rates, low volatility and contained inflation, investors are questioning whether margins can continue to improve as they have over the last few years. As such, these conditions, and investor sentiment, suggest that the equity market could be vulnerable.

And finally, first-quarter real GDP growth in 2017 came in at 1.4%, which was driven by slowed consumer spending. This data point was viewed as a disappointment, for certain.

Yet many positive trends, including low unemployment and upbeat business surveys, were in place well before the election and pointed to solid growth ahead. Further, second-quarter real GDP growth was just recently revised upward from 2.7% to 3.0% and there are also encouraging growth signals in other parts of the world, in particular both Japan and Europe.

So with some indicators showing signs of strain, yet others showing signs of continued optimism, what do you do with all the data points?

DRAWDOWNS ARE COMMON IN STRONG YEARS FOR STOCKS

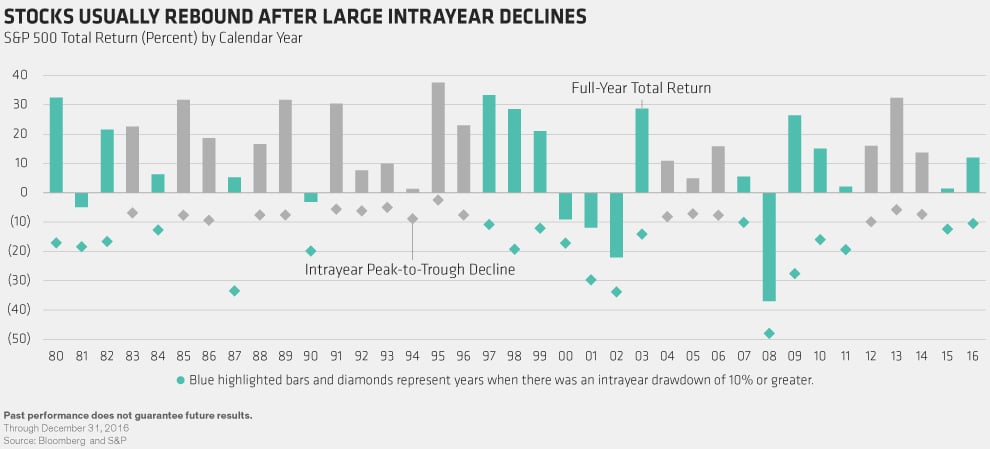

Market valuations might be high and due for a correction, but market trends also require context. In looking at the S&P 500 from a period of 1980 to present , US equities have been hit by a peak-to-trough decline of at least 10% in 20 of those 37 years (see Chart 1). These episodes always trigger anxiety and as a result, investors search for the exits. However, of those years that exhibited such a decline, a bounce back occurred in a majority of them.

As

Dumping stocks during a decline is usually a mistake. Since stocks have delivered positive annual returns in most years, getting out of the market during a sharp correction often means locking in losses and forfeiting returns in a rebound. And it’s almost impossible to time market inflection points.

Today’s extremely low volatility levels have reinforced investors’ complacency. It’s easy to forget how often equity corrections happen—and how quickly the market tends to rebound. That’s why it’s so important to keep the historical context in mind before the market takes a hit.

CORRECTIONS CREATE OPPORTUNITIES

As the term suggests, a “correction” isn’t necessarily all bad news. With the Fed reining in the supply of “free” money, companies will be forced to look more closely at how to allocate their capital and run their business, as the cost of borrowing will inevitably rise. This environment could foster a more traditional business cycle than we’ve seen over the past decade.

Further, higher rates could help investors distinguish companies whose margins are driven by solid business models, growth prospects and effective management teams from those who have relied too heavily on low interest rates to artificially buoy profitability. Active equity managers can exploit bouts of volatility to build positions in companies that have long-term staying power in the changing environment.

It might sound counterintuitive, but there’s really no reason to panic when stocks fall. Corrections are often the best time to add to an equity allocation. And over the long term, we believe that maintaining a long-term strategic position in equities is the best way for investors to preserve purchasing power by compounding gains. By bracing for a correction—and understanding that they’re usually fleeting—investors can gain the confidence to stick with an appropriate long term equity allocation, and are likely to be rewarded over time for their patience.

The information provided is for illustration purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action to be taken. These analyses have been produced using data provided by third parties and/or public sources. While the information is believed to be reliable, its accuracy cannot be guaranteed.