By CHRISTINE QUILLIAN, CFA, CFP®

Like the monster under the bed, capital gains taxes loom large in investors’ minds. Many investors have a tendency to hold on to stocks with large embedded capital gains because to sell or trim shares and realize gains would mean paying capital gains taxes.

People are loath to pay taxes, especially if there is an option not to. Furthermore, paying that tax bill means dollars out the door and fewer in the portfolio, reducing the capital available for growth.

Why trim your sails if you don’t have to? Because realizing capital gains may be the least bad choice – and possibly the best one. Reasons to sell or trim holdings and realize capital gains include:

- Reduce a large concentrated holding, decreasing a portfolio’s dependency on the fortunes or failures of one particular company’s business.

- Pursue better growth and value elsewhere. Enron, Worldcom, AIG and Citigroup are prime examples of companies whose shareholders had ample opportunity to lock-in gains before their stocks vaporized (Citigroup is ~$69/share today…but recall management instituted a 1-for-10 “reverse split” in 2011). Former Kodak shareholders know that past performance is no guarantee of future results. Companies may not adapt and change, but portfolios can.

- Adjust asset allocation as financial market circumstances evolve.

- Use for living expenses; low interest rates may not provide enough interest income. Most investors who draw from their portfolios will consume some of their portfolio’s built-up growth.

The fact is that outside of IRAs and retirement plan accounts, capital gains taxes should be viewed as an existing liability on an investor’s personal balance sheet. Deferral is not the same as elimination. Barring material changes to the tax code, capital gains tax payments are a matter of when not if. Consider the following:

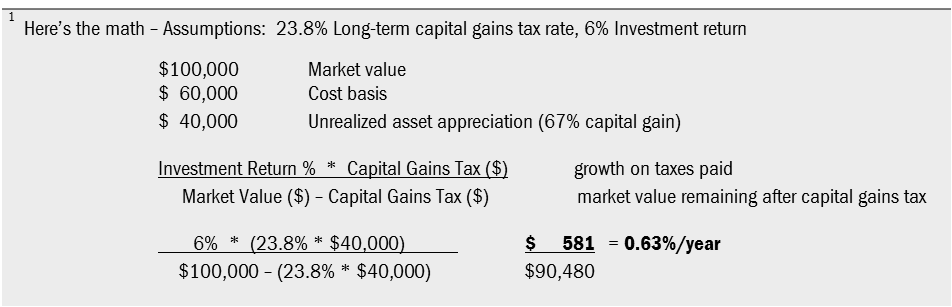

$100,000 market value ($60,000 cost basis and $40,000 unrealized gain, 67% appreciation)

23.8% capital gains tax rate ($9,520 capital gains tax liability [20% capital gains tax + 3.8% net investment tax])

$90,480 market value remaining after capital gains tax

Accepting that capital gains taxes may be postponed but not eradicated, then the objective value of this investment is $90,480, not $100,000.

Unless an investor expects to die holding a security (and by doing so secure a step-up in the stock’s cost basis), or donate the stock to a charity, then capital gains tax will be paid – sooner or later. Except for circumstances of death or donation, capital gains taxes cannot be eliminated – only deferred.

The key to remember is this: what needs replacing is not the tax payment itself. As noted above, the tax liability is already there, not eliminated, only postponed (see Example). What needs to be recouped is the growth on the tax dollars that leave a portfolio after a capital gains tax bill is paid.

Continuing the example above, an investor who postpones the payment of capital gains tax on this investment receives an economic benefit of $581, or only 0.63% – tiny in the context of a $90,480 net market value and the range of possible stock market returns.[1]

Size of the unrealized gain and investment returns do matter in this analysis. Larger gains and higher growth rates mean higher hurdle rates for replacement investments and more dollars to be saved by postponing capital gains taxes. That tax-deferral savings is very small in the context of the ongoing ebbs and flows of stock market returns. The Table below shows the estimated value of deferring capital gains taxes under various unrealized gain and investment return assumptions:

At MONTAG, we work with clients who have taxable (as well as tax deferred) portfolios, sometimes both. While we realize that paying capital gains taxes are inevitable and painful, we work diligently with our clients to harvest these taxes in a mindful manner, based on the investment objectives of the portfolio, income needs, and risk tolerance.

COMPLIANCE DISCLOSURE: The information provided is for illustration purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action to be taken. These analyses have been produced using data provided by third parties and/or public sources. While the information is believed to be reliable, it’s accuracy cannot be guaranteed.

Any securities identified were selected for illustrative purposes only. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed were or will be profitable.

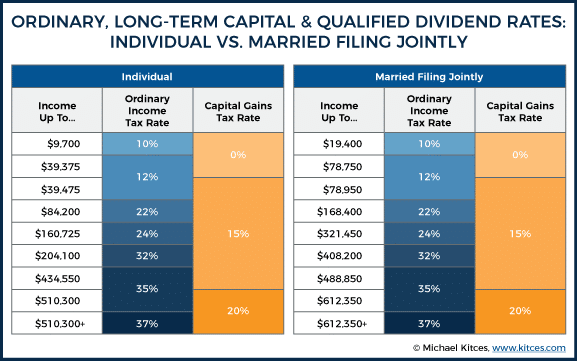

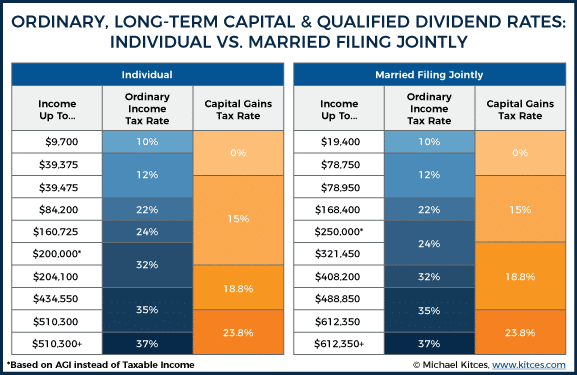

APPENDIX – For those desiring a “Deeper Dive”, here’s a quick primer on the intersection of income and long-term capital gains taxes for 2019, courtesy of Michael Kitces, www.kitces.com:

In theory, there are three brackets long-term capital gains: 0%, 15%, and 20%. However, long-term capital gains (and qualified dividends) are subject to the 3.8% Medicare surtax on net investment income, which has its own thresholds of $200,000 of Adjusted Gross Income (AGI) for individuals, and $250,000 for married couples (not adjusted for inflation).

In practice, this means there are not just three long-term capital gains tax brackets…there are actually four: 0%, 15%, 18.8% (the 15% bracket plus the 3.8% Medicare surtax), and 23.8% (which is the top 20% long-term capital gains tax rate with the 3.8% Medicare surtax stacked on top).