By CHRISTINE R. QUILLIAN, CFA, CFP®

At MONTAG, our clients count on us to research and monitor a wide range of investments to steer their portfolio toward the goals they seek. The list of available securities is endless, as is the range of factors and frameworks we could use in our decision making. In today’s blog post, we consider the US dollar. While we do not invest in stand alone currencies on behalf of clients (too much risk for not enough return), the US dollar can provide useful information.

For the last five decades, the US dollar’s value on the global stage has been set by a mish mash of economic and political forces, ranging from trade and interest rate policies, to manufacturing levels, inflation expectations and central bank decisions on interest rates.

The fact that the US has the deepest and most liquid currency market brings a heap of privilege. US dollars and the debt securities backed by them (such as US Treasury bills, bonds and notes) are so valued by the world that other countries park their savings in buying US-backed debt.

The fact that the US has the deepest and most liquid currency market brings a heap of privilege. US dollars and the debt securities backed by them (such as US Treasury bills, bonds and notes) are so valued by the world that other countries park their savings in buying US-backed debt.

University of Chicago economist Greg Kaplan says, “if another country really, really wants to hold your debt, that means it’s very easy for you to issue debt.” Unlike you and me, the US government can choose to live beyond its means by issuing debt to fill the gap when expenses (spending) exceed income (taxes and fees).

There is a downside to this high degree popularity, however. Meg Lundsager, former US executive director at the International Monetary Fund highlights, “when there’s a big international role for your currency, you lose control over it.” During periods of extreme market stress investors rush toward US dollar-backed securities and away from assets farther out on the risk spectrum; international and emerging market investments perform worse than US-based ones. As this demand for US dollars rises, the currency becomes stronger than it otherwise would be. A stronger dollar means imports are cheaper to US consumers and US exports are more expensive to foreign consumers, all of which is not good for American manufacturing and US trade.

2020 has been a year of uncertainty like no other. From a US dollar perspective, virus induced ambiguity and everlasting election fears have been driving safe-haven demand for US assets and boosted the value of the dollar. However, as I write today, two long-anticipated events are finally in the rear-view mirror: the US presidential election week has concluded and we have very positive preliminary results from two vaccine trials.

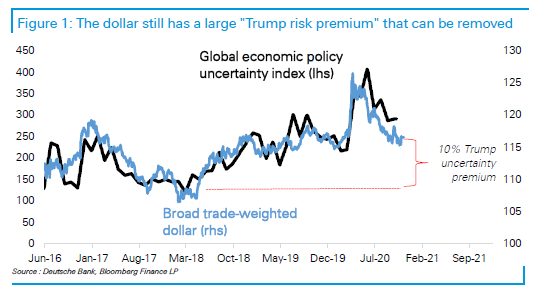

Having crossed these hurdles, we appear to be entering a period ripe for further diminishing uncertainty (see Figure 1).

Investors, frozen with indecision, had piled into US dollar denominated money market funds now are expressing a willingness to take on new risks. In currency language, this translates to incremental selling of US dollars, reduced demand for “risk-off” investments such as US Treasuries and increased demand for “risk-on” investments.

In portfolios, we express expectations for a weaker US dollar in two ways – (1) by owning stocks of companies that are passive beneficiaries of US dollar headwinds (such as US-based exporters), and (2) by owning investments that are active beneficiary destinations for money flowing out of US dollar safe-haven.

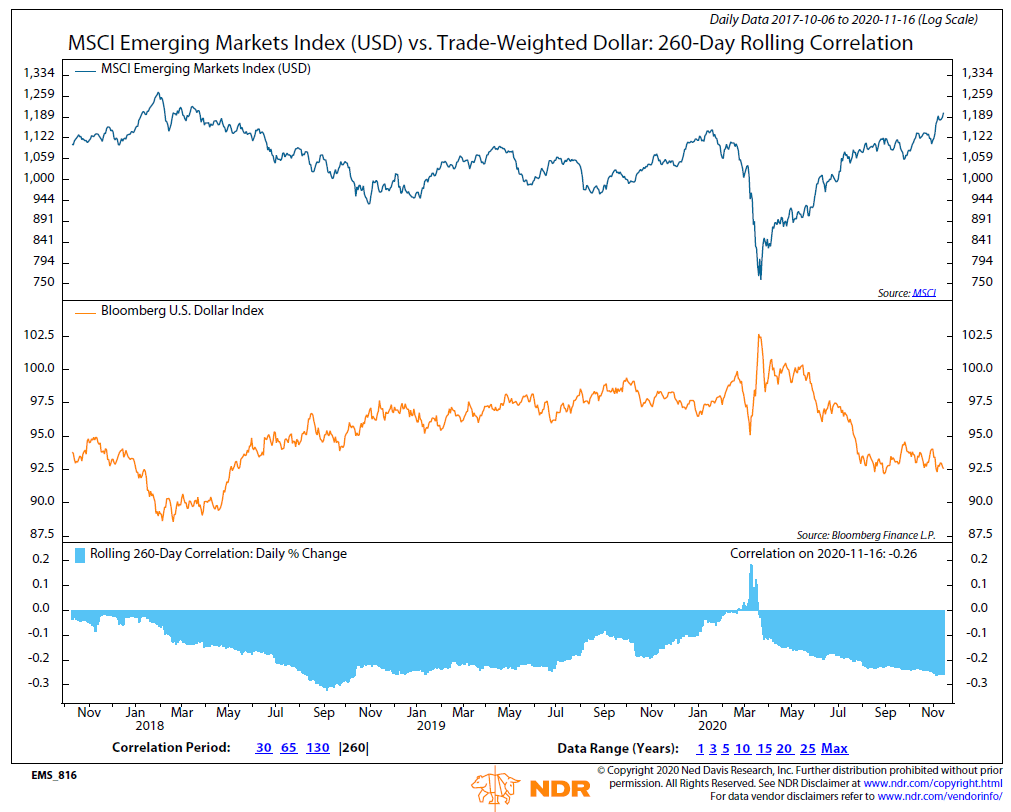

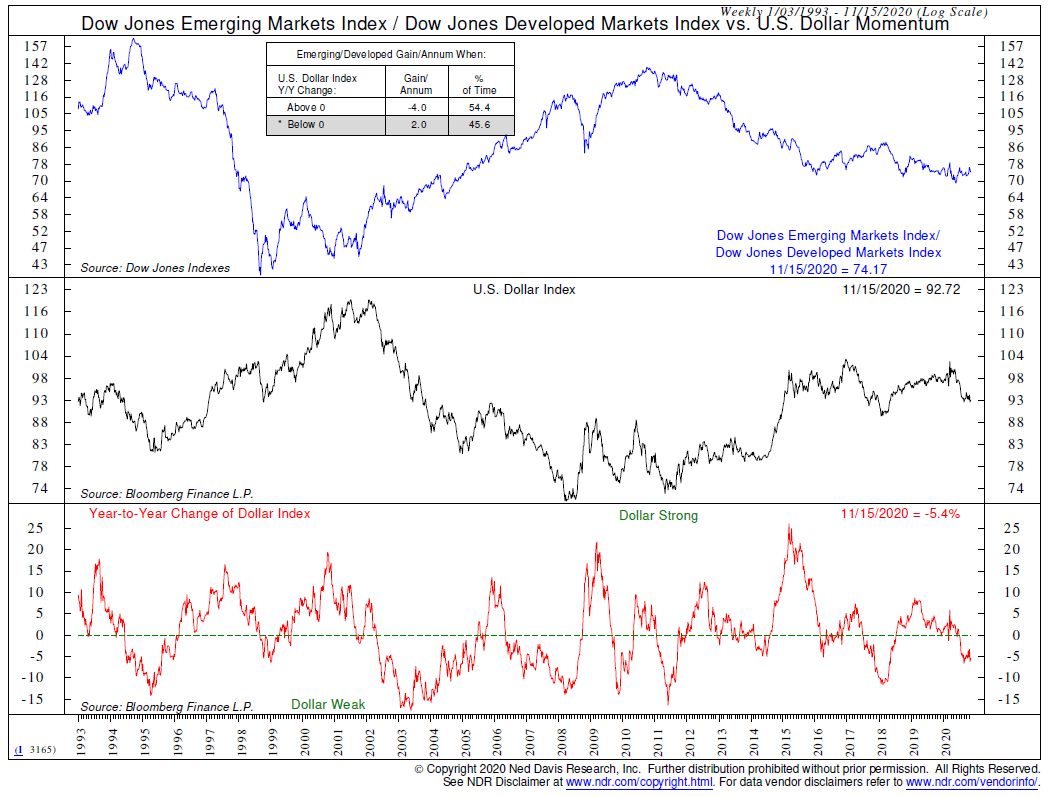

Exhibits 2 and 3 below illustrate how emerging markets, for example, stand to benefit from this weaker US dollar trend should it remain in place.

Exhibit 2 is a chart that compares the MSCI Emerging Markets Index (priced in US dollars, top clip) with the Bloomberg US Dollar Index (middle clip). The bottom clip shows how tightly these two indexes move together, albeit in opposite directions most of the time. We can also see that the (inverse) correlation between these two indexes has been strengthening throughout 2020.

Exhibit 3 is a chart that shows the ratio of the Dow Jones Emerging Markets Index to the Dow Jones Developed Markets Index in the top clip. The middle clip plots the U.S. Dollar Index, and the bottom clip shows the dollar’s year-to-year percent change. As shown in the chart’s statistics box, when US dollar momentum has been weak, emerging markets have historically outperformed developed markets.

The last decade has mostly been one long stretch of US large cap stocks trouncing virtually every other equity benchmark. While it is too soon to draw conclusions about the secular outlook, we will respect the evidence – and the adage says “the market will do whatever it can to prove the majority wrong.”