BY KENT SHAW, CFA

Spreading investments across multiple types of assets can mute the benefit of any single asset but it can also increase the probability of owning something that is producing attractive returns in a particular period. In the last few months we have had several client questions about investing internationally so we would like to look at the benefits of including international equities in a portfolio. In the last few decades, the economies of different countries have become more connected which does cause some economies, and equity markets, to move in tandem at times but there are still enough factors exclusive to each country to cause equity returns to vary. As we discussed in our quarterly market commentary, the US equity market is more expensive than the majority of foreign markets. The relationship between valuation and long-term returns is a strong one.

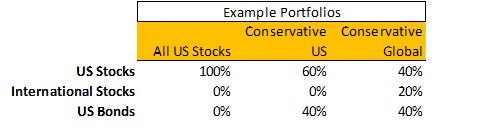

In order to look at the effect of owning international equities, we have collected data representing US large cap stocks, US high quality bonds, and international stocks. The data covers the 40 years from 1976 through 2016 and was combined to form two portfolios, Conservative US and Conservative Global. The Conservative US portfolio includes 40% US bonds and 60% US stocks. The Conservative Global portfolio includes 40% US bonds, 40% US stocks, and 20% international stocks. A portfolio of all US stocks was also included for reference. There are more asset allocation options than the three discussed here. However, we believe examining a small portion of these options can be instructive. An exhaustive analysis is beyond the scope of this article.

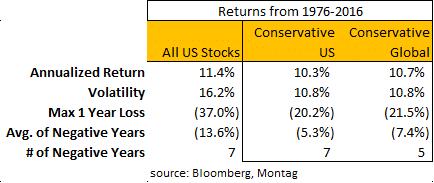

The test period included many different events including rising and falling inflation, rising and falling interest rates, and a large number of shocks to the capital markets. The table below contains estimated returns for our test portfolios based on each calendar year from 1976 to 2016. During that period, the Conservative Global portfolio outperformed the Conservative US portfolio by a small margin of 0.4% per year. The largest one year loss of the Conservative Global portfolio was similar but slightly larger. It experienced 5 years of negative returns while the Conservative US portfolio experienced 7 years of negative returns but the average of those losses in Global was higher than what was experienced in the Conservative US portfolio. Even though international equity markets have higher volatility than US equities the volatility for the two test portfolios was the same because the three different assets in the portfolio do not always move in the same direction at the same time; the benefit of diversification.

Striving for the best returns is a valiant goal but striving for success in a financial plan may not be the same thing. In many cases, higher returns carry greater risks of loss or, more practically speaking, less stability. If an investor is hoping to reach a specific value for their investable assets within a given time period, at your retirement date for example, taking steps that increase the odds of achieving that target value is prudent. One investment step may produce higher returns over time but also have a higher risk of loss. If that loss happens to coincide with your retirement date, for example, undesired changes in living expenses may be required.

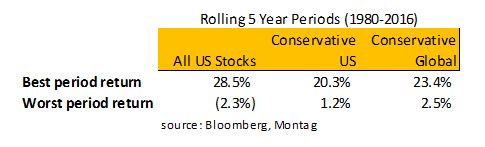

The table below shows the best and worst returns from all of the rolling 5-year periods in our test period. The first 5-year period ended in 1980. The prior table illustrated that the conservative portfolio that includes international equities had a slightly better return than the Conservative US portfolio. However, one additional benefit of adding international is that the worst 5-year period had a return of 2.5%, or 1.3% higher than the Conservative US portfolio. A one percent difference compounded over a 5-year period produces an additional $51,000 for a $1 million portfolio.

So what is the downside of including international equities in a portfolio? There will be years when the international assets add to the overall portfolio and other years when an investor may wish only US equities were owned if US equities are stronger. For example, in the 5-year period ending in 1999, the Conservative US portfolio produced returns that were 4% greater than the portfolio that included international equities. Some investors may feel left out by such occurrences. We believe these emotional difficulties are easier to navigate with a financial advisor that follows the capital markets closely. In many cases, investing is as much an emotional discipline as it is a financial one.

The hypothetical portfolios shown here require that the same weights in the same asset classes will always be used, to ensure an accurate comparison. This provides legitimacy to the model while also breaking down vast amounts of information into something illustrative and easy to use.

While the examples above are worth examining, it is important to note that at MONTAG, we consider the various asset types and their attractiveness relative to market conditions; in other words, our examination of asset classes and asset selection are not done statically, as is the case with these models. We use models like these to identify attractive areas of the market (be it international or domestic), but these models are often a starting point for the work we do to exploit market opportunities for our clients while protecting capital to achieve their long term goals. The prosperity of our clients drives everything we do.