We are folding our sweaters and grabbing our allergy meds for the joyous pollen season (revenge of the flowers), also known as Spring. Our letter is presented in two sections, a brief overview of the markets and thoughts on a key news item. For a “Deeper Dive” that looks at opportunities in international investing, we invite you to visit the revised Resources page on our website montagwealthmanagement.com.

The first quarter of 2017 brought us positive returns, with all broad equity indexes rising. This quarter, the S&P 500 and Dow Jones Industrials increased 6.1% and 5.2%, respectively, while the NASDAQ Composite increased 10.1%.

As expected, the Federal Reserve voted to raise interest rates at the regular meeting in March, a move that was consistent with expectations. Two or three additional increases are expected during 2017 and, thankfully, the equity market appeared to digest this guidance from the Fed easily. Interest rates declined slightly for the quarter, with the yield on 10-year Treasuries ending at 2.40% compared to 2.45%.

Our view of the markets

The S&P 500 Index reached another all-time high in March 2017 after an explosive move that began in November of last year. The market has not experienced a 5% decline in almost 5 months as of this writing. Also volatility, the range of the up vs. down days, has begun to widen. Such a condition does not guarantee that a correction or slight pullback is ahead but it reminds us to expect the unexpected and be thoughtful of being in position to mitigate a selloff, while also being prepared to take advantage of potentially lower stock prices.

We believe that many companies will grow earnings by about 6% over the 2016 levels. This compares to a consensus of market participants that believe earnings growth will grow in excess of 12% over 2016. Because of this, we are being patient in purchasing some of the stocks we would like to own until we feel the price paid reflects an appropriate rate of growth.

Although we are concerned with the higher valuations and increasing volatility in the market, there are some positives which continue to provide us with a level of confidence:

- The number of stocks that are participating in the market’s advance is high, which suggests the current uptrend is likely to continue.

- Information from the bond market continues to show that bonds offered by riskier companies are performing well, which is often a good sign for equities.

- Recent economic data suggests that the US economy is strong.

- Sentiment from businesses are generally positive about their future and may spend more to expand.

It seems counterintuitive, but it is important to note that the stock market tends to move on the expectations of future economic data, so the market can sell off as economic reports sound promising.

Against the backdrop of generally more expensive US equities, we have begun paying more attention to international equity markets as a possibility for some portfolios. Since 2007, the majority of international markets have not experienced the same substantial returns that the US market has enjoyed. The EAFE Index, which represents 22 developed markets, now sits 22% below its high, while the US is 50% above its high from that same year. These lower valuations present potential opportunities to explore. We discuss this in-depth in our recent “Deeper Dive” blog on our website.

In The News – A major reckoning occurring in retailing in 2017

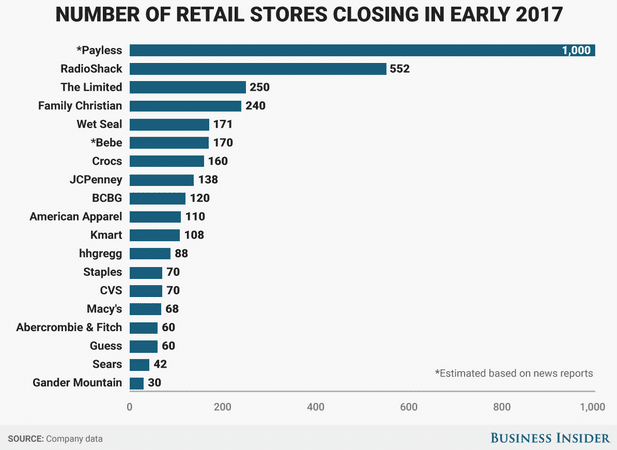

Business Insider reported earlier this month that more than 3500 retail stores are expected to close in 2017 according to company reports. These closures include RadioShack (552 stores), the once hot apparel retailer The Limited (250 stores), and electronics retailer HH Gregg (80 stores). Rumors about a possible bankruptcy at HH Gregg have been circulating for several months.

The rise of Amazon is certainly a factor but many of these companies brought the problems on themselves by growing their number of stores far too quickly. Barry Ritholtz, a New York investment advisor and writer for Bloomberg, reported in 2010 that there was 40 square feet of retail space for every person in the country. Online shopping through Amazon and other companies is certainly impacting the less efficient operators but there will likely be some survivors.

Amazon recently announced they will open two grocery stores, as a test, in Seattle where Amazon Prime members can order groceries online and pick up their order at the store in about 15 minutes. Customers drive up to the store and the groceries are loaded into their cars, certainly a plus for busy parents that are often forced to roam the aisles with multiple small children.

The practice of online ordering with in-store pickup is known as click-and-collect. Kroger is currently testing the same method in stores around the country including several in the Atlanta area. Wal-Mart also now offers online ordering and pickup of groceries with service being offered in 600 stores. Shipping for individual grocery orders to a customer’s home is extremely expensive and the new online order models that have in-store pickup can help reduce this cost and potentially make grocery stores a hub for other frequent transactions such as dry cleaning and package shipping services.

Wal-Mart recently acquired an online competitor Jet.com for $3 billion and has turned over their entire online strategy to Marc Lore, the CEO of Jet.com. His first move was to offer two-day free shipping on millions of items with a minimum order size of $35. Unlike Amazon Prime, however, no membership fee is required. The battle in retail will benefit the consumer but likely bring more pain for the competitors.

We welcome your thoughts and comments. It is a great privilege to manage your investments. Thank you for the opportunity to be of service.