By Helen Donahue, Portfolio Manager

As we all know, the current landscape in the fixed income markets has drastically changed from the near zero-rate environment we have had for years. With the goal of slowing growth and getting inflation under control, the Federal Reserve’s interest rate hikes have opened the door for fixed income to again become an integral part of investment portfolios. Since rates have been so low for so long, bonds issued when rates were lower are now priced at a discount to par, or $100.

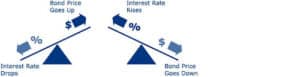

A brief review of bonds is helpful in explaining this phenomenon. Government entities or corporations issue bonds typically with a coupon, or rate of interest, and a maturity date that is fixed. The coupon is usually set at a yield that is close to the current interest rate available for a given maturity and therefore its price is close to par, or $100, which is the price received when a bond matures.

Rising Interest Rates in 2022

After the bond is issued and it starts trading in the secondary market, its price changes as interest rates change. Bond prices move inversely to interest rates. Thus, in a rising interest rate environment such as what we have experienced in 2022, bond prices decline and bonds issued when rates were lower fall below $100. This is to compensate an investor purchasing an older bond now for receiving a lower coupon than what would be received on a newly issued bond.

While clients may be dismayed to see the value of their bond holdings decline in value, they should keep in mind that bonds mature at a price of $100, so if the bonds are held to maturity, the principal value will not be lost and the client will earn the yield that was locked in at the time of purchase, assuming the issuing entity does not declare bankruptcy.

A bond that was purchased two years ago near $100 may be priced at $98 today, but when the bond matures, the price received will still be $100.

New purchases of bonds at a discount to par earn the same yield to maturity as bonds purchased at a premium price because the lower purchase price compensates the investor for the lower coupon (or interest rate) paid.

At Montag, we had been allocating most of our client portfolios to very short maturity bonds or ETFs during the low interest rate environment. Bond mutual funds and most bond ETFs are portfolios of individual bonds and are priced daily. As bonds mature, the fund or ETF portfolio reinvests in new bonds, but the price of the fund or ETF goes up or down with changes in interest rates. Thus, it is more likely that losses will be incurred in holding bond funds or ETFs than in owning individual bonds.

One advantage of owning individual bonds is that bonds mature at $100 and the yield to maturity is locked in at the time of purchase as described above. With the more attractive yields available now, we have been selling these short duration funds and ETFs and purchasing individual bonds where appropriate for our clients.

This strategy allows our clients to earn the higher yields available while minimizing risk of the loss of principal. Our full-time bond trader and insights from our portfolio management team allow us to customize our clients’ bond portfolios to meet their income and return objectives.

At MONTAG, we do things differently. We‘ve been a family-run business for nearly 40 years, and we still believe that our clients are best served by treating them as part of that family. We take the time to get to know you – what you’ve done to build your net worth, your investment philosophy, your financial questions and fears, and above all, your financial hopes.

Every single client has their own unique story – a story that deserves more than a conversation with an anonymous voice. Contact our Client Services team today by calling 404.522.5774 or emailing info@montagwealth.com to get in touch.

The information provided is for illustration purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action to be taken. These analyses have been produced using data provided by third parties and/or public sources. While the information is believed to be reliable, its accuracy cannot be guaranteed.