Low inflation plus low unemployment is “puzzling” the Fed. It doesn’t need to puzzle us.

- Fed Chair Janet Yellen: “My colleagues and I may have misjudged the strength of the labor market”

- Inflation in healthcare, rent and education are headwinds for most Americans, not confirmation of a strong labor market

- Long-held assumptions about inflation’s impact on wages may be off the mark in an economy where technology leads to deflation

- There are limits to how high the 10-year treasury yield can rise without causing economic damage, so we should not be scared into shortest-term bond portfolios while waiting for a significant rate rise

For bond investors, it’s helpful to understand the link between inflation, short term interest rates, and longer term rates. Because inflation impacts the Fed’s rate increase schedule, a clear understanding of the Personal Consumption Expenditures (PCE) index may help investors develop a more accurate view of current and longer term interest rate trends.

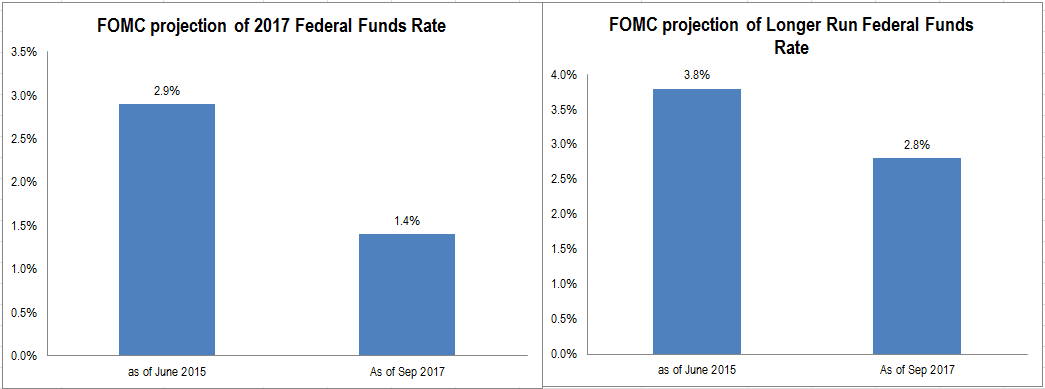

A top concern for the Fed as they contemplate their rate-increase trajectory is a 2% target for inflation. But the Fed’s expectations for both inflation and short term interest rates have been wrong for several years. So why is that? It is largely because they misjudged inflation, and they likely misjudged the health of the American economy by focusing too much attention on the low unemployment rate.

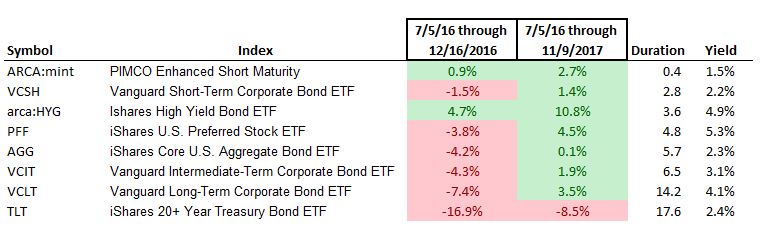

After bottoming near 2.05% recently, the 10-year treasury yield has marched steadily higher to 2.34% as this is written. For investors, the trend in interest rates has a large impact on how to position a fixed income portfolio.

Below is a look at how various bond funds fared during the five month period in 2016 when the 10-year yield jumped from 1.37% to 2.6%. Those who reached for yield in the longer-term funds suffered the worst returns during the period. However, all but the long term Treasury fund (average bond maturity of 26 years) are in positive territory over the period from 7/5/16- 11/3/17. A key question when determining how much duration** is acceptable in portfolios is where the 10-year is headed next; to 3%, 4% and beyond, or does it stay put in the mid 2% range or even drift lower? There are reasons to believe the latter case will be more likely, and thus an intermediate term duration rather than short term duration is appropriate.

(**Duration is an approximate measure of a bond’s price sensitivity to changes in interest rates. If a bond has a duration of 6 years, for example, its price will rise about 6% if interest rates drop by a percentage point, and its price will fall by about 6% if interest rates rise by a percentage point)

The Fed generally views inflation as an indicator of a healthy, growing economy that benefits most workers. Voting member of the Federal Open Market Committee (FOMC) Neel Kashkari said:

“I am inclined to believe in the logic of the Phillips curve: A tight labor market should lead to competition for workers, which should lead to higher wages. Eventually, firms will have to pass some of those costs on to their customers, which should lead to higher inflation.”

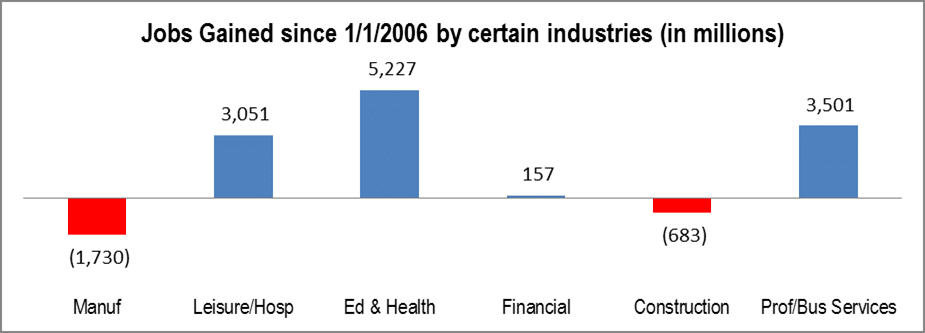

It does make intuitive sense, if we were operating in an unchanging “tennis ball factory” economy like the ones dominating economic textbooks. In a tennis ball factory economy, workers toil away in factories churning out tennis balls. As the unemployment rate drops, according to Kashkari’s assumption, then the competition for workers will drive up wages, and so the price of tennis balls will be increased, passing along this cost of higher wages to customers in the form of higher prices, i.e. inflation. But we have reached a point where a large percentage of inflation sub-components can be rising, without much of an economic benefit for workers in the form of higher wages. That lack of upward wage pressure and inflation is part of the reason the 10-year treasury yield has not climbed higher as had been expected.

So what are the main components of inflation, and as they rise are they benefiting workers, and thus the economy?

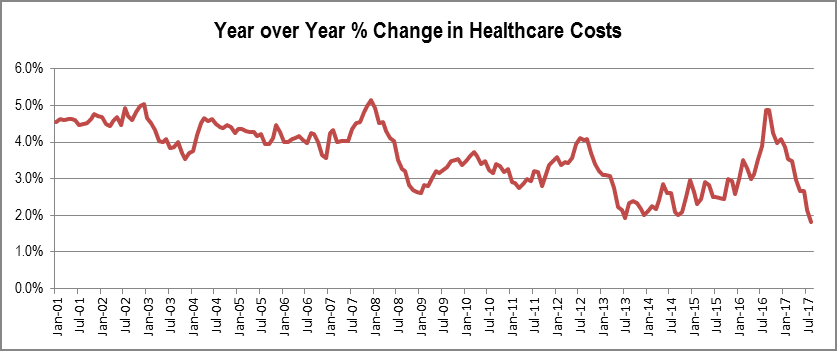

One of the largest contributors to inflation in the past 15 years has been medical costs, which comprise 20% of the PCE. This spending category is something many would suggest is closer to a tax for American workers rather than a tailwind to their wages.

More recently, healthcare costs have been much less of a boost to inflation. Whether it is generic drug price deflation, political class outrage over the costs of prescription drugs, this significant tailwind to inflation has slowed dramatically. Having said that, does the Fed wish for healthcare cost increases to re-accelerate, boosting inflation and thus the justification for higher rates?

The housing component, at 23% of the PCE, also has puts and takes. Homeowners are generally benefiting from the increase in value in their residence, in some cases taking out home equity loans which further increases overall economic activity. But a record number of people are “renters not by choice,” as the education component of inflation has risen so much that their student loans prevent them from building up enough cash for a down payment to own a home of their own. The significant increases in rents at multifamily apartment complexes are another component of inflation that does not lead to higher wages. Further increases in this inflation component will add more pressure to the 20% of renters who were unable to pay their rent in full within the past three months, according to a study done by apartmentlist.com.

Food and beverage spending, at 14% of the PCE, is largely comprised of restaurant sales and groceries consumed in the home. Even before Amazon entered the grocery fray with its purchase of Whole Foods Market, Kroger and Walmart had been systematically cutting prices for both grocery items and consumer packaged goods in an effort to retain or gain traffic in a mature industry. And this is before deep discount grocery brands like Aldi and Lidl add several thousand stores to the US landscape in the coming three to four years. These are deflationary forces, outside the Fed’s control.

Deflationary factors continue to crop up in the communications area, which is lumped together with education to comprise a smaller 5% of the PCE. Earlier this year Verizon re-introduced unlimited data plans, and AT&T had no choice but to match it. Janet Yellen called this a temporary rather than an ongoing deflationary development, but in months since we now hear that AT&T will give away HBO service (they’re acquiring HBO parent Time Warner) to unlimited wireless subscribers. Comcast has introduced a “skinny” streaming cable bundle at a cost to their internet subscribers for just $18, another deflationary type of event. Expect to see more from this sector, where price cutting actions like these are taken to reduce subscriber losses.

To their credit, some Fed economists are asking whether the assumptions upon which they rely might be faulty. My hunch is that the US economy is not as healthy as a 4.4% unemployment rate would have you think. Manufacturing and construction jobs still number about 2.4 million lower than in 2006 while lower paid leisure and hospitality (restaurant servers, bartenders) have increased by over 3 million:

Fed Chair Yellen has raised eyebrows as I write this. From the LA Times:

“My colleagues and I may have misjudged the strength of the labor market,” she said at a conference of the National Assn. for Business Economics in Cleveland. She said the same about “the degree to which longer-run inflation expectations are consistent with our inflation objective, or even the fundamental forces driving inflation.”

Her admission is a step in the right direction for an institution that for years feared showing any doubt in their models and predictions, lest that affect their ability to impact markets.

Will Americans be better off if their cellphone and cable plans reverse course and trend higher? Will increases in medical costs, rent, and education expenses lead to wage increases for Americans? The Fed has arrived at a point where the metrics they hope turn higher to justify rate hikes are generally headwinds for the average American family.

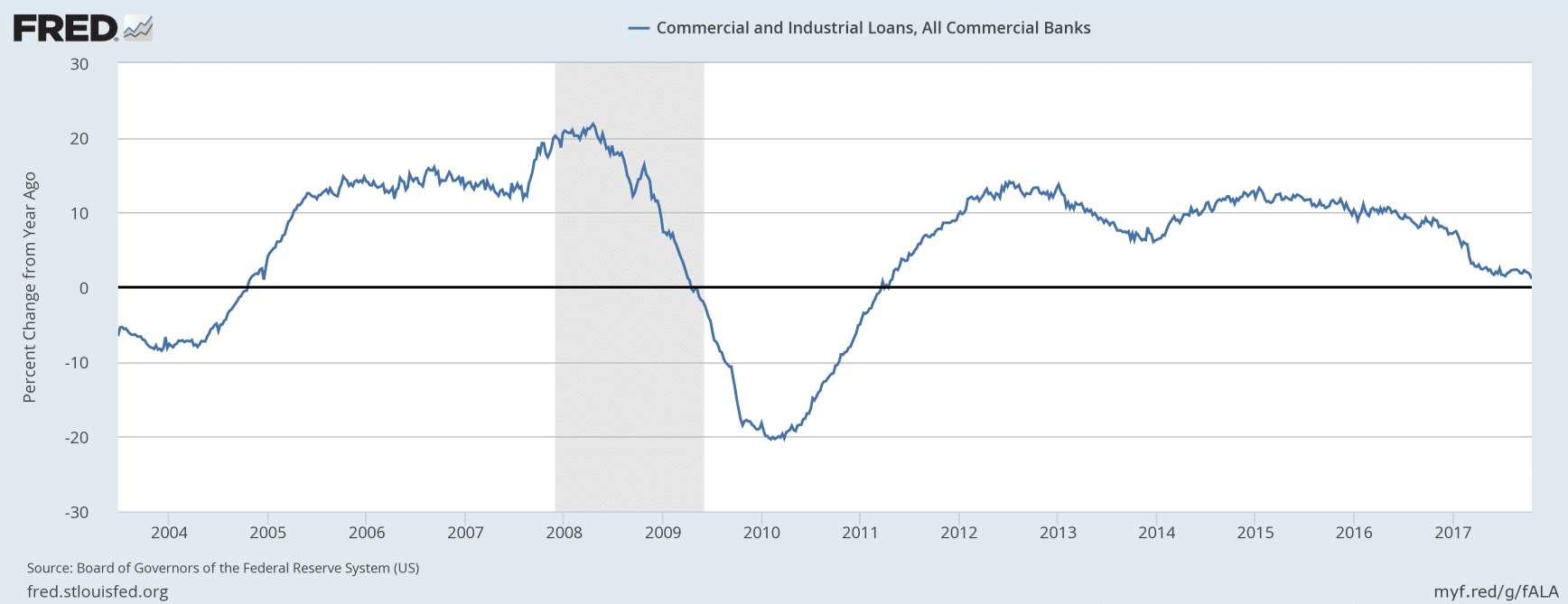

A better understanding of inflation inputs, how the Fed will react to them, and the corresponding impact on longer term rates can help us optimize our bond portfolios. Do we assemble bonds with an average 3% yield in our portfolios with a 6 year duration, knowing that a 1% rise in the 10-year yield could nullify a full two years’ interest payments? Or stay with a 2 year duration because we believe the Fed’s predictions about the upward direction of short and longer term interest rates? By questioning the validity of long held beliefs about inflation and its relation to the health of the consumer, we’re a step ahead of economists who have little career choice but to stay steadfast in their beliefs. The 10 year yield is at 2.33%, and our levered economy is already decelerating in terms of loan growth. The impact of the 10-year treasury rising 100 basis points or more is significant, and we should not assume that it will happen because economic models suggest it be so.

The information provided is for illustration purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action to be taken. These analyses have been produced using data provided by third parties and/or public sources. While the information is believed to be reliable, its accuracy cannot be guaranteed.