by Chris Guinther, Senior Investment Strategist & Wealth Manager

U.S. equity indices declined slightly in the first quarter of 2025, pulled lower by the same mega-cap companies that led the market higher in 2023 and 2024. Investors rotated into large-cap value stocks, which were up about 2% for the quarter, and into Europe, where enthusiasm for fiscal reform in Germany and low valuations prompted investors to buy.

For the first quarter ending on 03/31/25:

| S&P 500 Index | -4.3% | Nasdaq Composite | -10.3% | |

| Russell 2000 Index | -9.5% | Bloomberg US Aggregate Bond | +2.8% | |

| DJIA | -0.9% |

Typically, Viewpoints reviews the most recent quarter’s financial results because they are somewhat symbolic of current economic conditions, and they can be indicative of what one might expect over the next several quarters.

This time, however, the usual review is irrelevant as President Trump appears to be attempting to create a new world economic order. Markets are reacting sharply as investors adjust their expectations in light of the new tariff structure announced April 2 and the revisions that continue to be announced. The range of potential outcomes from all this change is broad, leading buyers and sellers to generate extreme volatility in the markets. Investors tend to de-risk when future revenue and earnings are so unknown.

The Trump Administration’s tariff plans, outlined on “Liberation Day,” are widely viewed as an assault on the Bretton Woods II era of globalization, an important driver of corporate margin expansion and disinflation that benefited equity prices over the last two decades. This is not music to the ears of investors who had priced the market at more than 21 times forward earnings. The size and breadth of the announced tariffs means there are lots of numbers to crunch in order to estimate the effects on the economy, the consumer, and critically, profit and free cash flow margins. The situation is fluid and unpredictable, and the true duration of the protectionist plan is unknown and probably unknowable.

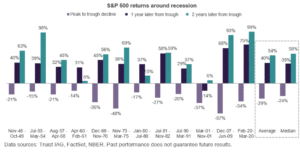

In our view, this is the stuff of investing opportunities. With hindsight, we recognize that some of the most promising moments are created when the unknowns are the greatest, fear is the highest, and investors capitulate en masse by selling. History shows that investors who stay disciplined through downturns, and keep investing when others are fearful, are almost always rewarded with strong returns in years to come, with few exceptions (see chart below).

It is also important to recognize that a long investment time horizon is itself a valuable asset. Most of the trading in these periods of extreme change and uncertainty is done by players in the equity market that do not have the luxury of time…traders who are focused on generating performance measured over mere days or weeks. In our view, wealth is created by long-term investing and not short-term speculation.

The market may not reward patience tomorrow or next month, but given time, we believe it will. We maintain our belief that, beyond the current tumult, large cap U.S. companies will retain their competitive advantages of size, scale, and profitability and continue to deliver solid investment returns for decades to come.

We remain focused and thoughtful about building and managing client portfolios to take advantage of positive themes while also protecting for the risks that present themselves.

Disclosure: The information provided is for illustration purposes only. It is not, and should not, be regarded as “investment advice” or as a “recommendation” regarding a course of action to be taken. These analyses have been produced using data provided by third parties and/or public sources. While the information is believed to be reliable, its accuracy cannot be guaranteed. MONTAG employees do not provide legal or tax advice. For specific legal or tax matters, you should consult with your own legal and/or tax advisors. There are risks associated with investing in securities. Investing in stocks, bonds, exchange traded funds, mutual funds, and money market funds involve risk of loss. Loss of principal is possible.