By Chris Guinther, Senior Investment Strategist & Portfolio Manager

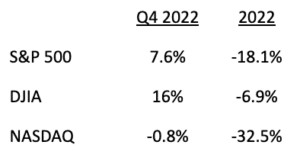

Let’s begin by noting the 2022 fourth quarter’s market numbers, and those for the year in full, as of December 31:

As these numbers make plain, 2022 saw poor performance in most sectors with the exception of energy and some industries within the materials sector. The good news is the 2022 bear market in both fixed income (bonds down 13%) and equities (S&P 500 down 18%) has meaningfully improved return expectations going forward. We still see a variety of challenges ahead for 2023, including rising interest rates, high inflation, falling earnings expectations, and a generally struggling global economy.

The FED and Economic Growth

Economic growth continues to slow and a recession is still likely. A year ago, the FED influenced recovery following the pandemic-induced recession, pushed the economy into a position of excess demand, and generally made for a good economy. But now the backdrop is changing as headwinds have intensified as a result of tighter monetary policy with higher interest rates to battle inflation and reduced fiscal stimulus by the government. We continue to look for more deceleration in economic growth in 2023, with all developed economies likely slipping into recession around the world. Our forecast anticipates that global GDP will expand by around 2% in 2023, which is less than a third of 2021’s GDP growth rate, and about half of the 2022 rate. That said, a few economic indicators have shown more resilience in the past few months, suggesting that the probability and expected depth of a recession might be lower than we initially feared. Should a recession materialize, we expect it to be of just middling depth at this time, as we don’t see the significant bubbles which proceeded other major economic peaks like in 2000 and 2008. A moderate recovery could take hold toward the end of 2023 if inventory levels continue to improve, supply chains normalize, labor costs cool and inflation stabilizes or even falls.

Inflation

Inflation continues to fall from extremely high levels in August, which will likely cap interest rates. The four main drivers that pushed inflation to multi-decade highs are all reversing course. Supply-chain problems have faded, commodity prices have declined, monetary stimulus has turned to tightening and fiscal stimulus has been reduced. For these reasons, we expect inflation to continue to drift down from the August high of 9.1%. We recognize, however, that other factors may slow its descent. Labor markets remain especially tight, the breadth of the inflation shock may make high prices stickier, and the shelter component of CPI only changes/improves slowly. It could take even longer for inflation in the Eurozone and U.K. to come down given the region’s unique challenges, mainly weaker currencies, and energy shortages.

Central Banks

Central banks are approaching the tightening/raising finish line which will cap interest rates. The quantity of monetary tightening delivered to tame extremely high inflation has been massive across the world. U.S. policy rates are already around 4 percentage points higher after less than a year of increases. But the rate-hiking cycle is starting to slow outside North America and Europe as inflation begins to ease. Some emerging-market countries have ended their rate hikes and the pace of tightening is mostly decelerating elsewhere. The U.S. fed funds rate is expected to peak near 5%, compared with a starting point of about 0% at the start of this year. This is double the “neutral policy rate” – that which neither stimulates nor restricts growth. But most of the hard work has been done and there is a possibility that policy rates in developed markets start to decline over the second half of 2023 if inflation cooperates and growth slows.

Stock Valuation

Exceedingly high asset and stock valuation risks are diminished but earnings remain vulnerable to falling. Equity markets stabilized in the past quarter but, even with the recent bounce, still finished the year with significant losses. The good news for investors is that stocks are now much more reasonably priced than they were at the start of 2022. The recent bear market pulled most equity market valuations back towards long-term average price/earnings ratio for the first time since March 2020 and could temper some of the downside risk. Should we enter a recession, and have earnings decline, stock prices could also resume their decline. Many analysts have already begun downgrading their profit forecasts for S&P 500 Index companies ahead of a potential recession, but the downward revisions have been small so far. We think these estimates are vulnerable to further downside given that earnings are still above their long-term trend and companies are facing headwinds from rising costs and slowing demand. In this environment, stock gains could be limited in the near term absent evidence that the economy is headed for a soft landing.

Conclusion

We continue to position relatively conservatively for a wide range of possible outcomes. Given the unprecedented inflation and withdrawal of stimulus, we recognize that uncertainty is elevated and that there is a wide range of potential outcomes for the economy and financial markets. That said, we note that bonds, at today’s higher yields, offer more ballast in a balanced portfolio should the economy enter a downturn. We believe a cautious approach to risk-taking remains appropriate in this environment. We know there is a lot of uncertainty in the world and in the markets, but your team at MONTAG will continue to monitor the ever-changing dynamics and actively adjust client portfolios to reflect the market conditions relative to each client’s investment objectives.

At MONTAG, we do things differently. We‘ve been a family-run business for nearly 40 years, and we still believe that our clients are best served by treating them as part of that family. We take the time to get to know you – what you’ve done to build your net worth, your investment philosophy, your financial questions and fears, and above all, your financial hopes.

Every single client has their own unique story – a story that deserves more than a conversation with an anonymous voice. Contact our Business Development team today by calling 404.522.5774 or emailing [email protected] to get in touch.

The information provided is for illustration purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action to be taken. These analyses have been produced using data provided by third parties and/or public sources. While the information is believed to be reliable, its accuracy cannot be guaranteed.