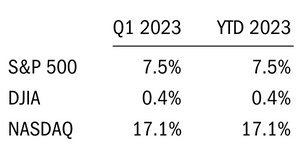

Let’s begin by noting the 2023 first quarter’s market numbers, as of the quarter’s close of March 31st:

Equity Investors — A Focus on Earnings Growth

The stock market displayed resilience in the first quarter of 2023 even as earnings forecasts for this year modestly declined. For the quarter, the S&P 500 Index was up 7.5%. At the beginning of 2023, earnings were expected to grow by low single digits for the year. As of today though, 2023 earnings are expected to be down slightly from 2022. Yet, the growth sectors of the economy are dominating like it’s 1999! Through 3/31/23, Information Technology was up 22%, Communication Services +21%, and Consumer Discretionary +16%. Mega-cap growth companies are heavily weighted in these sectors and have led the way with outperformance in the first quarter. Investors used the same old playbook, when interest rates fall, high growth securities are bid up. Meanwhile, defensive and cyclical sectors were only slightly up or modestly lower. Financials were the worst sector, down 6%, reflecting the current banking tumult. In general, investors have been solely focused on interest rates as the dominant factor in equity positioning.

Expectations are high for an end to the interest rate hiking cycle in the next quarter. Since the Silicon Valley Bank failure led to a banking crisis in early March, expectations have risen for rate CUTS toward the end of the year. However, let’s remember that almost everyone has gotten the rate hike cycle wrong so far. Going into 2022, the Federal Reserve was expected to move the fed funds rate higher by just .75% from zero. Instead, the FED started increasing rates in March, sooner than expected, and ultimately raised interest rates 4.25%. So far in 2023, the FED has increased rates by another .50% to 4.75%. It’s been a Shock and Awe campaign to beat down inflation. ALL forecasts from early 2022 were significantly wrong. We’ve got to be careful thinking that forecasting future interest rates with any precision is possible.

Just like last year, interest rates may well play out very differently from the consensus forecast. Our concern is that some market participants may be missing the forest for the trees. Let’s say the Fed does cut rates later this year as inflation subsides and the economy softens. If investors expect that we are back in a 2019 environment where the Fed cuts rates and the market soars, we would disagree and note the numerous differences today. The Fed cut interest rates in 2019 from 2.25% to 1.50% and stocks returned 31.5%, the second-best return since 1997. However, valuations were much lower than today and earnings growth was finally accelerating after the listless growth in the mid 2010’s. If the Fed doesn’t raise again and then lowers rates .75% in the second half of this year, the fed funds rate would be at 4.00%, not 1.50%. The market currently trades at 19 times this year’s estimated earnings. In January 2019, it was closer to 15 times. Earnings growth is slowing, not accelerating. Revenue growth may prove more challenging in an environment where price increases are tougher to pass on. Margins have already been getting hit based on higher wages and other increased costs. Most likely none of this will impact the stock market too negatively, but the data doesn’t speak to stronger earnings expectations or an increase in multiples any time soon.

In our view, investors should focus on the windshield and not the rearview mirror. We believe a world of “higher for longer” rates and slower growth than the last four years is much more likely than a return to the abnormally low interest rate environment when long duration growth stocks dominate and high valuations were the norm.

Conclusion

We continue to recommend positioning conservatively to account for a wide range of possible outcomes given the unprecedented inflation and withdrawal of stimulus.

We recognize that uncertainty is elevated and that there is a wide range of potential outcomes for the economy and financial markets. That said, we note that bonds, at today’s higher yields, offer more ballast in a balanced portfolio should the economy enter a downturn. We believe a cautious approach to risk taking remains appropriate in this environment.

At MONTAG, we do things differently. We‘ve been a family-run business for nearly 40 years, and we still believe that our clients are best served by treating them as part of that family. We take the time to get to know you – what you’ve done to build your net worth, your investment philosophy, your financial questions and fears, and above all, your financial hopes.

Every single client has their own unique story – a story that deserves more than a conversation with an anonymous voice. Contact our Business Development team today by calling 404.522.5774 or emailing info@montagwealth.com to get in touch.

The information provided is for illustration purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action to be taken. These analyses have been produced using data provided by third parties and/or public sources. While the information is believed to be reliable, its accuracy cannot be guaranteed.

Any securities identified were selected for illustrative purposes only. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed were or will be profitable.

Author

-

At MONTAG, we do things differently. We‘ve been a family-run business for nearly 40 years, and we still believe that our clients are best served by treating them as part of that family. We take the time to get to know you – what you’ve done to build your net worth, your investment philosophy, your financial questions and fears, and above all, your financial hopes.

Every single client has their own unique story — a story that deserves more than a conversation with an anonymous voice. Contact our Business Development team today by calling 404.522.5774 or emailing info@montagwealth.com to get in touch.

View all posts