EDTIOR’S NOTE:

MONTAG has followed the troubling events in Europe of recent weeks with concern. As an investment firm, it is MONTAG’s responsibility to focus on securities markets, prices, changes in valuation, and other factors during uncertain times. However, that’s not to minimize the humanitarian tragedy we see unfolding before our eyes in Ukraine.

MONTAG’s portfolio managers keep track of these developments regularly, always watchful for potential effects on clients’ portfolio holdings. We will offer several different perspectives in the days and weeks ahead. The following is an update from RANDY LOVING, CFA

* * *

As the virus recedes we now are dealing with global central banks removing stimulus that saved the global economy. Just as the market was getting its head around the pace and level of interest rate increases coming from the Federal Reserve, Russia invaded the Ukraine. Today, investor sentiment is about as negative as it gets when we are in recession.

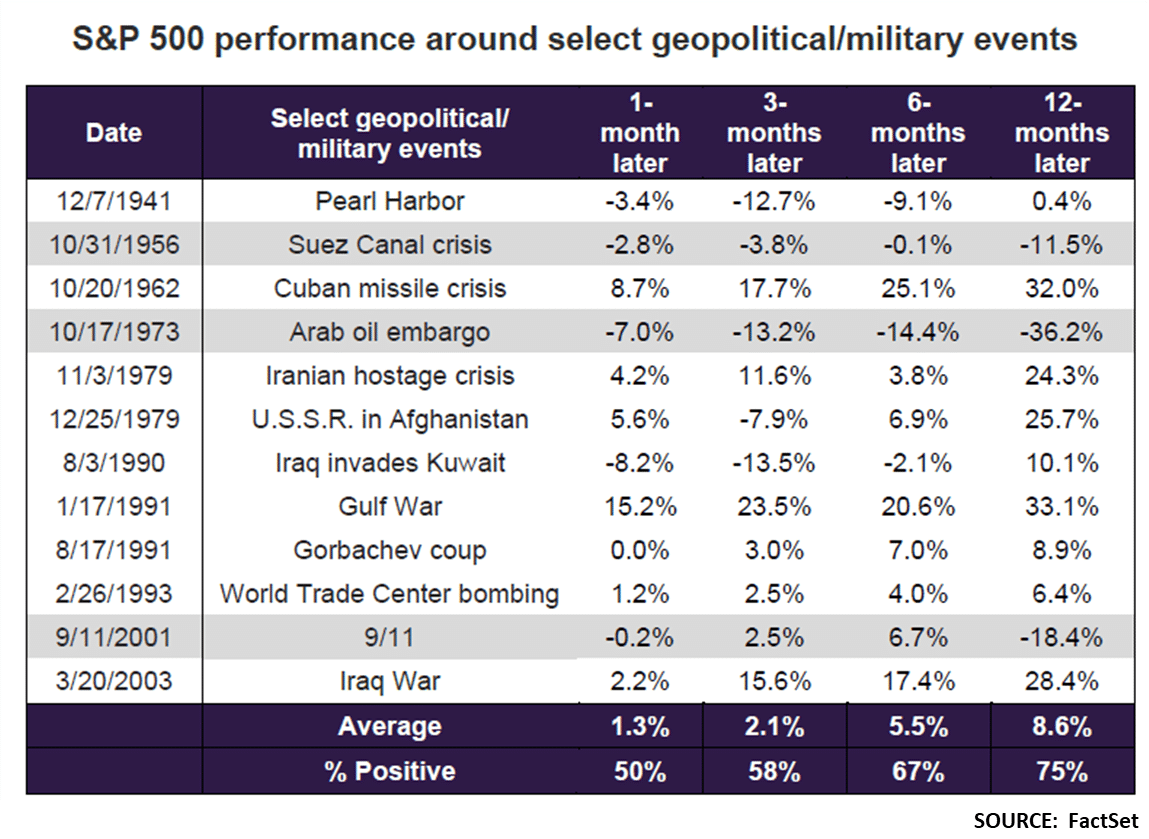

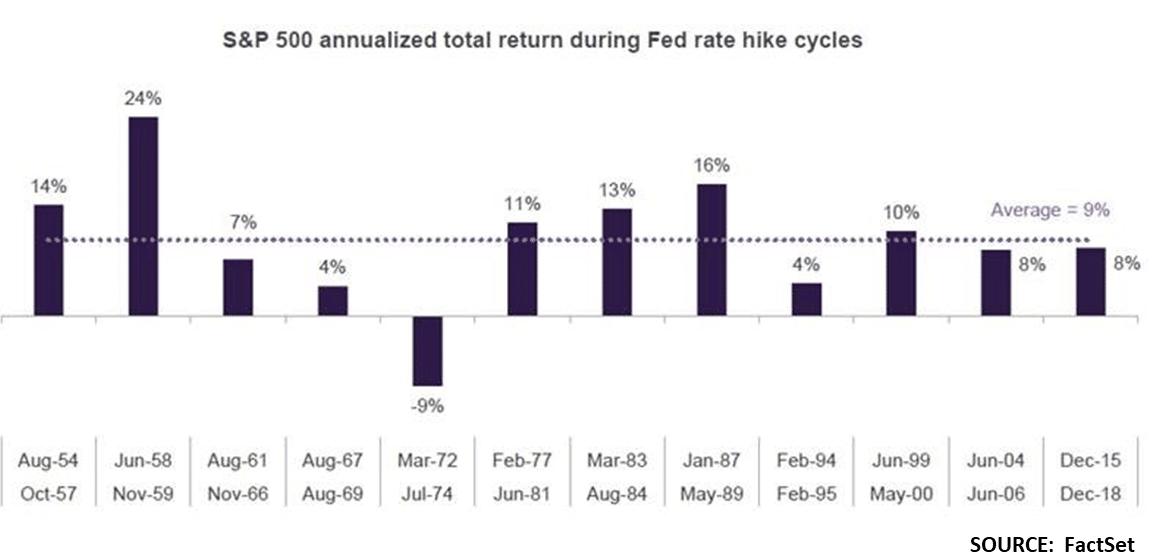

Some perspective provided below on how markets have reacted post wars (first chart) AND during FED interest rate hikes (second chart) are illustrated below. We do not assume the current situation will react as historically documented events have, but the odds are that it will. -10% pullbacks in the market have occurred 11 times in the past 20 years, with the caveat that this situation today is a little different and could worsen.

Currently though, we are simply forewarned of a heightened risk for a recession. As a result, we are not looking to make too many alterations until we understand a little more about how the current situation evolves. We will continue to monitor the situation, but at this time, we do not see the war changing much for U.S. earnings. We will, however, continue to be watchful for buys in equities where the price has been marked down and earnings continue to grow at a stable level.

Other factors to consider:

1. Oil supplies are already low, so higher oil prices cause inflation which is already a problem… but only to a point, then the higher prices actually depress demand and the economy.

2. Oil prices impact all sorts of other commodity prices, agriculture, metals, gas, etc.

3. Does this really impact the direction of earnings in the U.S. the next 12-24 months… maybe, but I suspect not.

4. Possible escalation of conflict spreads across Europe beyond what is currently expected in just Ukraine/Russia.

5. FED may now NOT lean towards hiking interest rates so much or fast… which investors will like on the margin.

6. Overall stock valuations are improving with every tick down.

7. Long term equity investors – pull backs like this have typically been an opportunity out 3-5 years. May add to tech positions.

The information provided is for illustration purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action to be taken. These analyses have been produced using data provided by third parties and/or public sources. While the information is believed to be reliable, its accuracy cannot be guaranteed.