by: John Montag, President & Chief Investment Officer

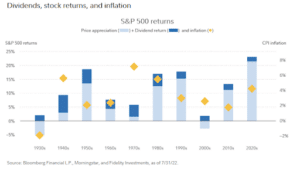

When I joined the firm back in 1995, cash provided a 5% yield. Think about that for one moment: if you did nothing except let cash sit in your portfolio, you satisfied the typical spending policy for an endowment, 5%. Concurrently, many clients looked towards their bond income (“interest”) as the primary source for spending. Stock income (“dividends”) was an additional benefit and the growth in stocks (“price appreciation”) provided that much more cushion. At the time, Dad often showed a chart to clients similar to the one below. It shows that dividends were a significant percentage of the stock market growth from the 1920s through the 1990s – Let’s take a look at how that differs for dividends, stock returns, and inflation in 2023.

When I joined the firm back in 1995, cash provided a 5% yield. Think about that for one moment: if you did nothing except let cash sit in your portfolio, you satisfied the typical spending policy for an endowment, 5%. Concurrently, many clients looked towards their bond income (“interest”) as the primary source for spending. Stock income (“dividends”) was an additional benefit and the growth in stocks (“price appreciation”) provided that much more cushion. At the time, Dad often showed a chart to clients similar to the one below. It shows that dividends were a significant percentage of the stock market growth from the 1920s through the 1990s – Let’s take a look at how that differs for dividends, stock returns, and inflation in 2023.

History At A Glance

The left side of this chart shows a dark blue line, meaning a large part of stock returns came from dividends. During the past two decades, however, this changed and the dark blue portion became that much smaller. For thought since 2013 interest rates fell below 4% and the stock market appreciated considerably, meaning the dividend yield declined as well. In other words, the aforementioned 5% (“just by doing nothing”) went closer to 1-2% depending upon the portfolio. Investors who make regular withdrawals from their portfolios needed to think differently.

Fast forward to 2022, a year in which it has been a mess across all returns (“mess” being a technical term here…). Currency and commodity investors have benefited, but everyone else has suffered. Concurrently, interest rates have risen back to above 4% – a seismic shift.

Dividends, Stock Returns, and Inflation in 2023

So, where does all of this leave investors with respect to opportunity? Oddly, that rise means that cash is finally doing something again. Remarkably, when we review portfolios now – as compared to the past decade – it appears that doing nothing once again could generate income while sidestepping market volatility and a potential long-term recovery.

The point here is that we must look towards 2023 with a different perspective than 2022. With that in mind, I encourage you to contact your portfolio manager to discuss whether the information above should be incorporated into your conversation.

The information provided is for illustration purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action to be taken. These analyses have been produced using data provided by third parties and/or public sources. While the information is believed to be reliable, its accuracy cannot be guaranteed.