BY BRENDAN WAGNER, Portfolio Manager

“When you learn how to play the game, they change the rules” – legendary investment strategist Ned Davis

“Everybody has a plan until they get punched in the face” – legendary boxer Mike Tyson

No offense to Ned Davis, but Mike Tyson has the better investment quote and it will be relevant for generations. The fourth quarter of 2018 tested many an investment process. December was the worst month for the S&P500 since 1931.

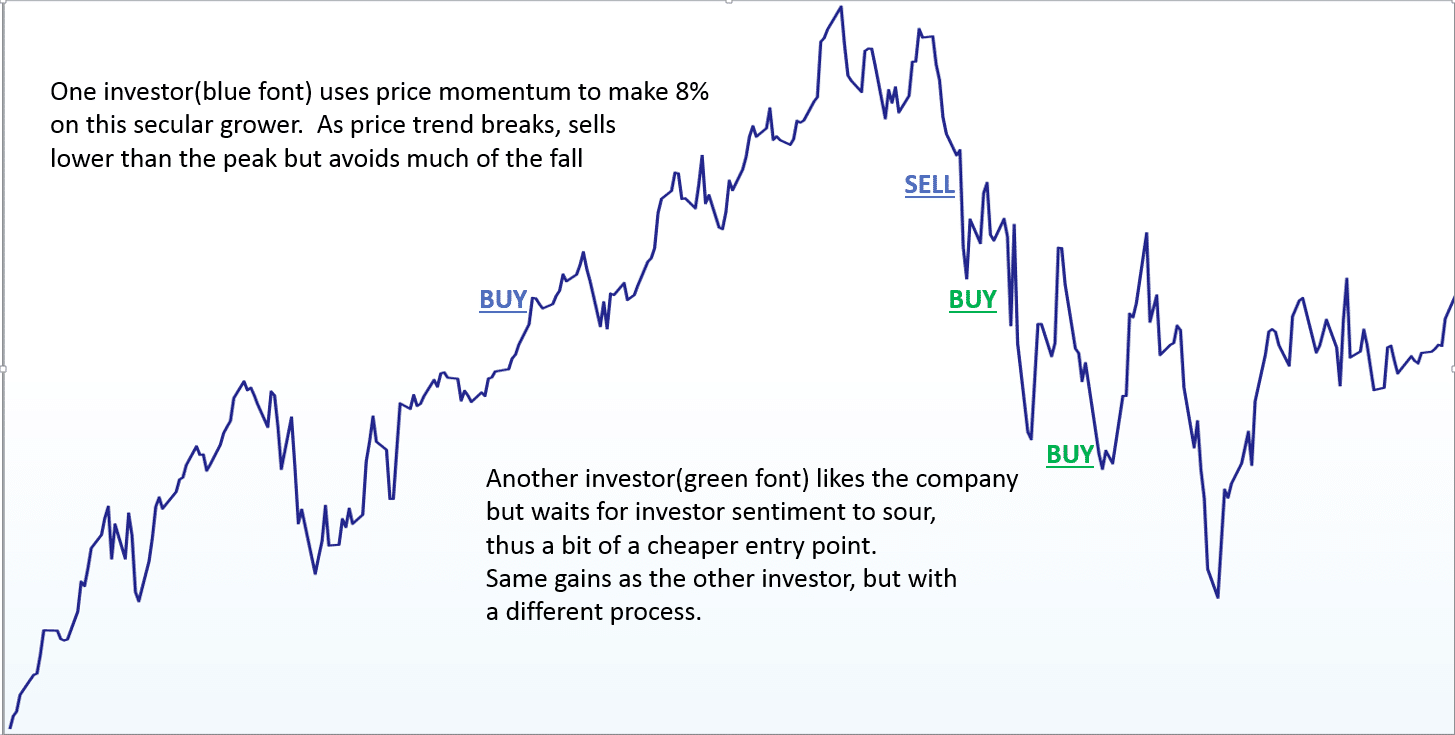

It is a good reminder of how important it is to know your process. Because two investors with completely different risk tolerance or conservatism levels can make the same profit, on the same stock (or ETF or index), with very different but still appropriate strategies.

Note the following section in the 2018 letter to investors from the management of Sequoia Fund:

“we sold our last shares of XXXXXX for over thirty times our estimate of near-future earnings…..the stock subsequently rose to a head-scratching level of more than fifty times at one point, but from our perspective, that’s someone else’s money to make.”

Those last six words are immensely important in investing and they are not said enough. Knowing what part of a company’s life cycle or growth cycle or valuation cycle you want to participate in, and why, is important for an investment process.

Using a high growth company as an example, compare two different – but successful – investors’ approaches to owning the shares. I won’t insult experts of each strategy by claiming the following is the exact science to the method, but it’s close.

In order to own very high growth companies, some investors employ “the trend,” using strong price momentum to capture multiyear gains that others might not. Owning companies during their highest growth period can often mean you own them at very high valuation levels– selling must be done quickly when sentiment turns, because these companies do not have much of a “floor” under them in terms of valuation.

Other investors (GARP, or Growth at a Reasonable Price) might admire this excellent high growth company, but it might not align with their valuation discipline – doesn’t mean they are looking for deep value no-growth companies, but rather they must have a little bit more margin of safety in terms of valuation downside. This investor might watch for the opportunity to buy into weakness, focusing more on fundamentals and absolute valuation. This can be a successful strategy as well, but for this investor the big challenge is making sure you’re not too late to the party. You can be a little bit late to a great party if this is a long term opportunity, but this investor does run the risk of buying into a company as its growth rate declines for multiple years, along with the valuation multiple. Not an easy situation to navigate, but those saying investing is easy should be ignored.

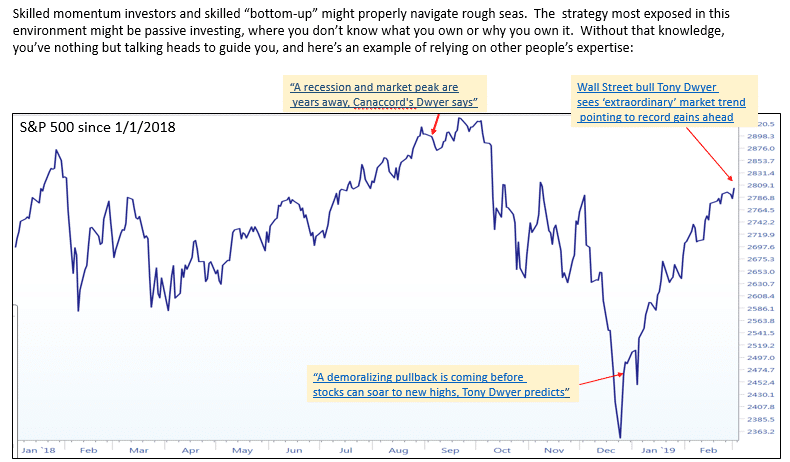

Thoughtfully-deployed Momentum and GARP strategies can perform well in up markets while “managing” brutal selloffs – how about passive strategies?

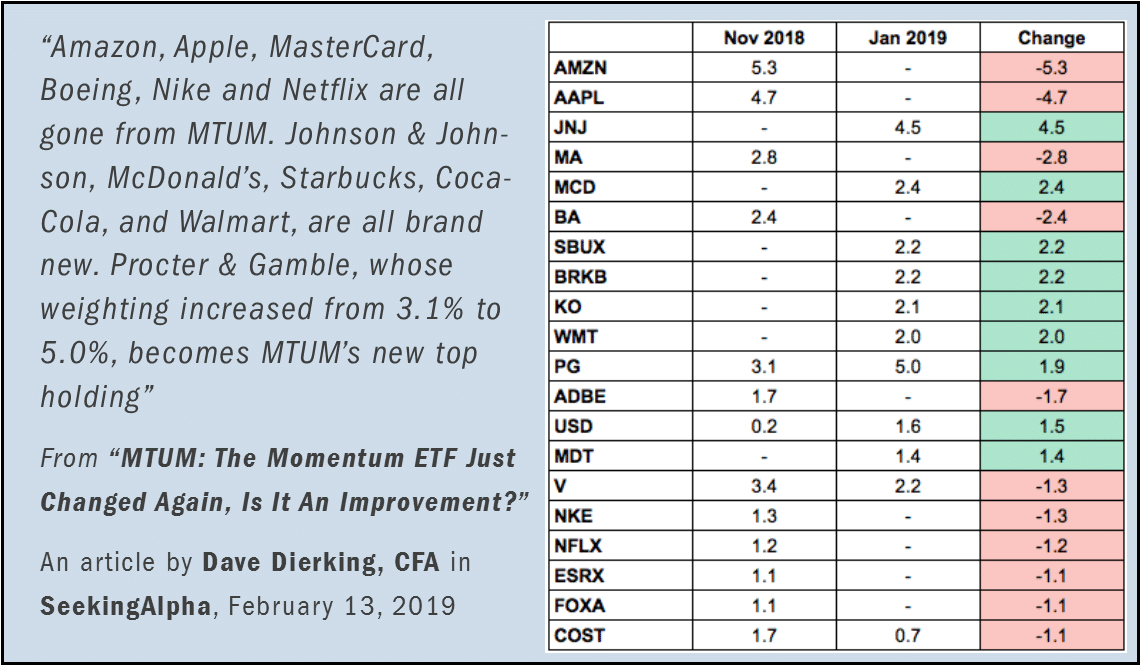

There’s a place and an argument for using exchange traded funds in portfolios, especially considering the benefits of much lower expenses. But there should be a distinction between “active passive” and “unmanaged passive.” Active passive would involve using these vehicles for specific reasons, and after thoroughly vetting the underlying holdings (whether that’s having a good grasp on the top 50 weights in the S&P500 index fund, or the US SmallCap Index, Emerging Markets, etc). Particularly useful are well-constructed sector or geographic ETF’s, but only when coupled with a firm understanding of the companies making up the top weights in the ETF. It’s also important to stay aware of rebalancings that completely change the makeup of the fund. For instance the Momentum ETF (symbol MTUM) widely used by investors recently made an enormous rebalance, and it is well-described below in an excerpt from an article in SeekingAlpha:

Passive investing, if one does not know the bulk of the companies in the underlying ETF’s, is not “passively” managed but unmanaged. What many investors gain from lower expenses and the certainty of not underperforming “the market” can be completely offset by the headwind that you don’t know what you own. Actually, and by design, you don’t CARE what you own. In that context, the only guide one has when navigating crazy market swings is the internet and experts on television – other peoples’ opinions. Unmanaged investing plus market timing advice from “experts” is in fact the way many people are guiding their investment portfolios. As can be seen below, it’s a dangerous mix when the market is no longer in a blissful drift higher but instead a late stage of a bull market with constantly changing leadership.

The information provided is for illustration purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action to be taken. These analyses have been produced using data provided by third parties and/or public sources. While the information is believed to be reliable, its accuracy cannot be guaranteed.

Any securities identified were selected for illustrative purposes only. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed were or will be profitable.