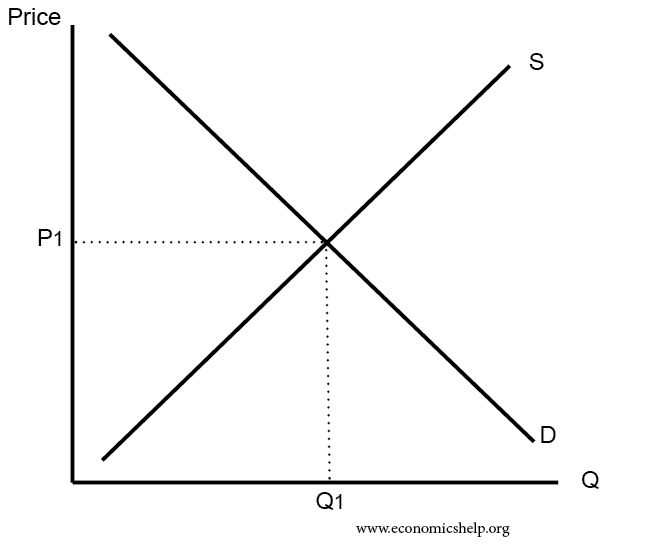

In a world that an Economist understands, and appreciates, is where “supply” meets “demand.” Where these two intersect, in said Economist’s world, is perfect harmony for a free market. Which happens to be what the United States is.

In a world that an Economist understands, and appreciates, is where “supply” meets “demand.” Where these two intersect, in said Economist’s world, is perfect harmony for a free market. Which happens to be what the United States is.

More specifically, where the supply and demand lines intersect is where PRICE paid and QUANTITY supplied result.

But sometimes, supply or demand is disrupted – causing their respective lines on the graph to move, flatten, or steepen. Most of the time, it’s supply. Oil, supply chain disruption, natural disasters, these all change what happens to the supply chain. But what happens when demand is disrupted? That’s what we’re coming out of now.

As the global economy begins to reopen [SEE THE REOPEN TRADE] you are seeing consumers clamoring for a return to normalcy. And that means consumption of goods and services. Whereas the “Big Short” of 2008 caused people to tighten their belts, collectively (and they succeeded), this is the reverse. People want to spend. I don’t want to delve into the psychology of the post-pandemic consumer, but there is a wave coming.

So that’s demand. But supply chains are strained. Not broken, but strained [SEE SUPPLY CHAINS]. Recently, MONTAG colleague Larry Mendel mentioned to me that he can’t walk into a restaurant anywhere where the line is not out the door. The demand is overflowing, and, most of the time, any restaurant would love that kind of business. But what if pasta is in short supply because the restaurants just can’t get it? Where is the production? Expect the PRICE for that pasta that can be found to increase, with both the restaurant and their customers paying more for it.

Supply for things from seafood to microchips has been hampered by the pandemic. Which led to labor shortages, because some folks unfortunately lost their jobs. Which led to people not coming back to work (in America) because the unemployment benefits passed by the Government were very accommodative. The demand for the economy to get jumpstarted is there. Is the supply (i.e., the labor force)? That remains to be seen. Workers may have to be “lured” back with higher paychecks, those PRICE and QUANTITY dynamics of the supply & demand graph once again at work.

We suspect that the “reopen” will work, as there are signs that Asia (which is a bellwether for autos and tech) seem to be ticking up. In real estate, you hear about a “buyer’s market” or a “seller’s market.” This is a LABOR MARKET, and companies will pay for labor, in the end.

In sum, consumers are ready to consume as they get back to “life as normal.” We will see what that means for the market as we go forward, and this speaks nothing of inflation, but everyone wants to get back on the road (during the summer especially), get back in to the office, and put this all behind us. The demand is there. At MONTAG, we are continually monitoring these market dynamics and will continue to protect our clients during this new era.