As the Moderna and Pfizer vaccines become more available and the adoption rate is on the rise, especially for targeted parties like those over 65 and those medically at risk, some of the pent-up demand for certain goods and services is starting to find its way into the economy. And for all intents and purposes, this means the stock market, where stock price reflects improved sentiment.

For those of you that follow the stock market, the term “reopen trade” may soon become just as common as some of the terms we learned at the beginning of this pandemic, like “social distancing.” But what does a reopen trade really mean?

When the pandemic hit, some companies that had a more traditional business platform saw a lot of their business go away because people couldn’t go outside. Conversely, some companies, like Zoom, saw their stock price rise 215% and went from about $190/share to almost $600 a share at its peak.

Well, the reopen trade is the opposite of the Zoom phenomenon: the trade is one where one buys cheap stocks that will benefit from an open economy, and perhaps rotating into cheaper areas of the global stock market overall. That sounds like good news, right? The economy is reopening, people are getting back to a pre-pandemic lifestyle a little bit, and therefore are spending more, from appliances to increased travel!

And yes, while the reopen trade does embody some good factors, in my last blog I mentioned that with an explosion in realized demand, because people are willing and able to spend again, comes inflation, as that competition for goods and services pushes prices higher. So the reopen trade does bring some potential baggage to the table.

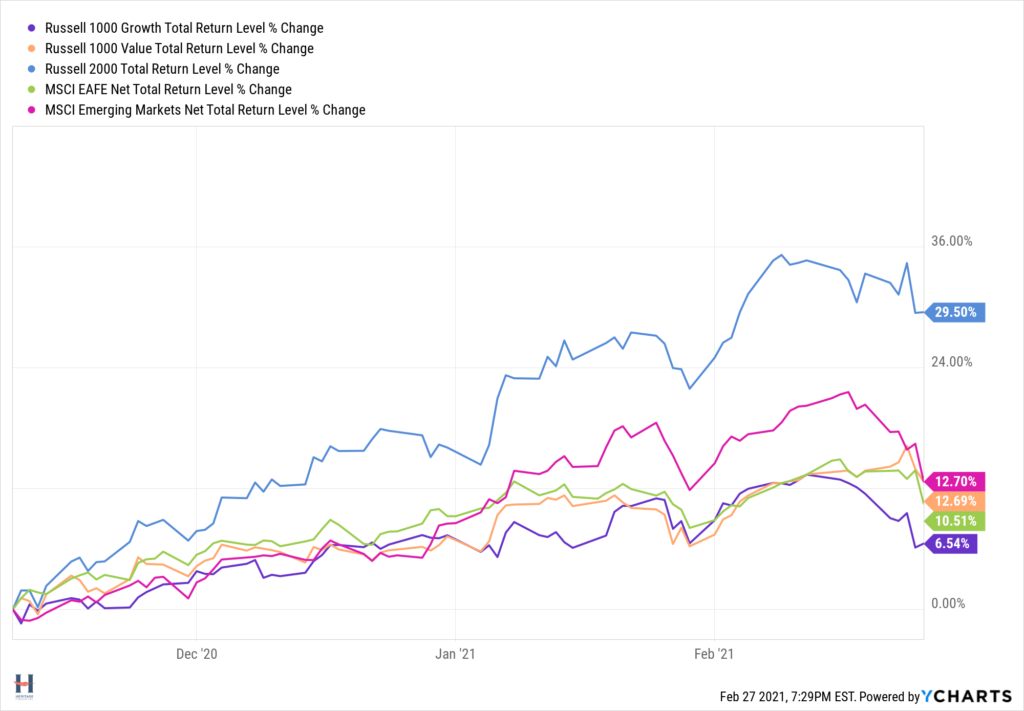

Finally, it should be noted that the terms “growth” and “value” are important to analyze in this environment. As you can see in this chart below, growth stocks, which had dominated this bull market of the last ten plus years, has actually underperformed value stocks as the economy started to open up. That’s because value stocks tend to be the unloved stocks (reflected in their cheaper stock price) and with an improved outlook now on the horizon, those unloved stocks…well they are getting some love now!

We are in the nascent stage of what the “reopen trade,” looks like, but at MONTAG we scrutinize these kinds of trends to fortify and protect your portfolios on a constant basis.