Through 6/30/24, returns for the various indices are as follows:

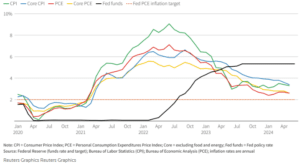

Q2 is in the books, and it was a good one for investors in stocks and bonds. Better than that, the forecast for more growth and economic stability has improved. Inflation continues to fall and our hope that the Federal Reserve doesn’t need to raise rates continued to be confirmed through the quarter. Oil and gas prices are stable to down despite the wars, consumer goods and raw material input prices are falling, auto prices are slowly retreating and overall, most inflation measures (see graph below) are now annualizing and trending below 3%. In fact, Fed cuts may be in the cards by year end as the Fed Funds rate is materially higher than inflation now. Consumers may get some relief if the Fed lowers, and investors may see even more gains the next 12-24 months as lower rates pave the way for higher valuations on securities. The resilient economy continues to confound most strategist and economists since Covid hit, but much of it is explained by the excessive spending (many would call it “irresponsible spending”) of the U.S. Government. For now, the government spending packages are a good thing, but of course the risks of too much debt becoming a problem rise.

I pointed out last quarter that the collapse in the 10-year bond interest rates last November of over 100 basis points, when the CPI came in lower than expected, that that was likely a good indicator of what’s to come in terms of economic growth. That seems to be continuing to play out in q2 and be confirmed each month during q2. A new negative that is worth pointing out is that while the overall economy is chugging along, there seems to be a bifurcation developing, in terms of who’s improving and who’s lagging. The wealthy, who own assets like stocks, companies and real estate are doing better and better while the other half is struggling. To a large extent we are seeing the same bifurcation play out within the equity markets, where the largest companies that have tremendous size and scale and play in global markets are doing very well…but the average midcap and small cap companies are just treading water. It’s not an ideal scenario whereby some do well and others struggle. We aren’t sure if that’s a sign of the times as companies grow more globally than ever before or a signal that predicts a problem ahead. Better breadth across ALL income cohorts for consumers and participation across ALL sized companies strikes us as a better more durable economy long term. For now we have to play the cards we are dealt and our positioning that tends to lean large cap has been paying off in spades the past 1, 3, 5, and 10 years. While we have the option and ability to invest in companies of all sizes and in all markets around the globe, our large cap and highly domestic tilts have been both significant, correct and rewarding. We’re always looking and willing to diversify more, but for now the firm continues to lean into large cap U.S. based companies across most accounts.

Last quarter I laid out some ground work on artificial intelligence (AI) and this quarter there’s little change to report except to say that that theme and industry is still on track, still growing and still showing many reasons to believe that it’s here to stay for the long term. Technology companies are spending tremendous amounts of money to get in the game early and fast. Again, it took about 10 years before we started to see the real durable use cases of the internet in the ‘90’s and how it was going to change the world and every industry on the planet. AI continues to feel about the same as the early days of the internet. And for investors, we want to reiterate while returns have been great so far, it may create a lot more volatility soon. We may see early adopters and we may see new winners emerge, only to see them lose within 5 years. Early AI leaders like MSFT, NVDA, AMD, SMCI, TSM, MU and AMAT have made big moves the past 12 months and technology now constitutes over 45% of the S&P 500(a new sector high!) Expect to hear a lot more about AI in the coming quarters and years….investments here are probably showing up in your portfolio either directly or as major weights and contributors of common passive indexed ETFs.

One final note, take note of the difference in performance below. I’m highlighting again that in 2024, which is not too different than what occurred the last several years, mega-cap companies continue to get bigger and perform much better than the average. For advisors like us choosing to mostly use an equal weight strategy to ensure good diversification, it’s been a battle to perform well without holding 5-8% positions in a handful of securities. It won’t always be that way, but it has run for a long time now and isn’t too different than what occurred in the internet bubble. By March of 2000 when we finally saw the bubble burst, the mega-cap companies materially lagged for many years. We’re not calling for that now but we do want to draw some attention to this and continue to recommend full diversification strategies with mostly equal weighted position sizes regardless of the negative short (0-2 years) to intermediate (3-5 years) term performance impact.

The information provided is for illustration purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action to be taken. These analyses have been produced using data provided by third parties and/or public sources. While the information is believed to be reliable, its accuracy cannot be guaranteed. MONTAG employees do not provide legal or tax advice. For specific legal or tax matters, you should consult with your own legal and/or tax advisors. There are risks associated with investing in securities. Investing in stocks, bonds, exchange traded funds, mutual funds, and money market funds involve risk of loss. Loss of principal is possible.