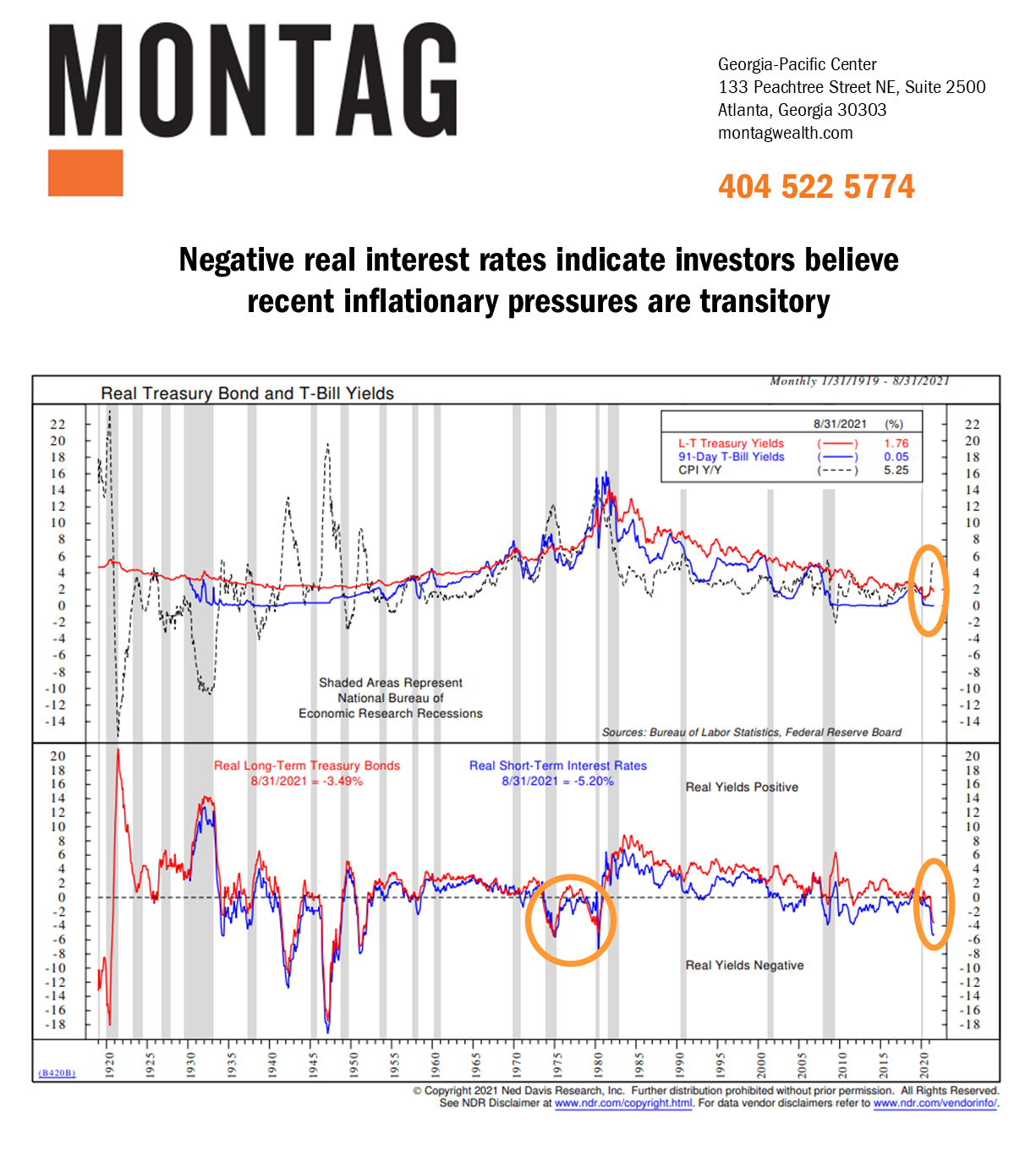

In another of our “A Minute With MONTAG” series, we look at the phenomenon of negative real interest rates – not seen since the 1970’s – and what this might say about investors’ inflation expectations:

A real interest rate is an interest rate that has been adjusted to remove the effects of inflation to reflect the real cost of funds to the borrower and the real yield to the lender or to an investor. Fixed Income investors remain complacent regarding recent inflation pressures assuming that they are transitory. As the chart reflects, real long-term rates have not been this low since 1970s. If inflation proves a bit more sticky due to supply and demand imbalances and labor shortages, bond investors may face an unwelcome adjustment in inflation expectations.