by Olga Lee, CFA, Portfolio Manager

by Olga Lee, CFA, Portfolio Manager

The 2023 stock market started strong with most equity markets up as investors cheered that the end to the Fed tightening cycle was in sight. January and February were up across most indices. However, the narrative changed dramatically when the news of trouble at a few regional banks hit the wires in mid-March.

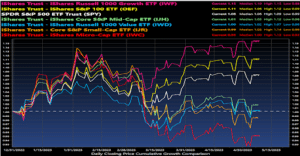

Through the end of April, the S&P 500 (which is mostly large cap and dominated by a few individual holdings, like Apple and Microsoft) is up 9%. At the same time, the equal weight S&P 500 is only +3.2%. Mid cap and small cap stocks fared even worse, with Russell 2000 only up 1% on the year and S&P 600 small cap index actually down 0.3%. The divergence is even larger between Russell 1000 Growth and Value Indices. The value index which has a large weighting in financial, industrials, energy and other cyclical sectors is only up 2.5% while the growth index, which is almost 50% technology, is +15%.

The chart below highlights this phenomenon by showing the relative performance of mega caps vs small and mid-cap indices.

Common Questions Regarding the 2023 Stock Market

What caused this divergence in returns and is it likely to continue?

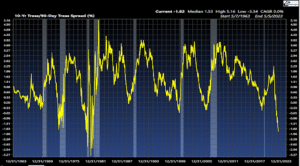

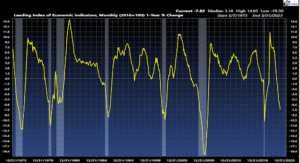

Investors quickly anticipated that the recent banking crisis would accelerate the economic slowdown. Leading economic indicators continue to point to further economic weakness. Also, bank willingness to lend made a new low after their recent balance sheet issues. In the wake of the regional banking crisis, investors have avoided any stocks that may need to access the capital markets in the next few years. Small-caps are more likely than large-caps to need capital, and many of the most vulnerable banks are classified as small-caps. Also, industrial and energy stocks tend to not do well during economic slowdowns. At the same time, after rising for most of 2022, the 10-yr Treasury yield fell from 4.06% to 3.5% and the yield curve remains in deep inversion. All these factors tend to reward safety and stability for the time being.

The following two charts highlight the deep inversion of the US Treasury yield curve and the deterioration in the Leading Index of Economic Indicators.

When can we expect change in recent trends away from narrow leadership of a few large caps stock?

Currently, the Federal Reserve is still tightening monetary policy in the fight against inflation. We just saw another 25 basis points hike in the Fed Funds rate to 5% despite the continued troubles with some regional banks. We do not believe we are in the early stages of an economic cycle like when smaller and cyclical names tend to outperform. Growth is decelerating and earnings estimates are likely to get cut as we approach the second half of 2023. Large cap companies with good balance sheets and high free cash flow margin are likely to continue their leadership until there is more clarity on whether the Fed can engineer a soft landing in the economy as they complete this tightening cycle, or after the Fed is forced to start an easing campaign in response to significant economic weakness.

MONTAG Wealth Management

MONTAG has established itself as, and remains, a trusted wealth management and investment company since 1982. As a multi-generational, family-run business, MONTAG understands that superior service requires treating clients like family to enable them to build and secure wealth for current and future generations. Because they understand each client has their unique story, MONTAG always takes the time to get to know you, your investment philosophy, and your priorities to tailor strategies to your perennially evolving needs. Ultimately, your financial security is at the forefront of every decision you make.

The information provided is for illustration purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action to be taken. These analyses have been produced using data provided by third parties and/or public sources. While the information is believed to be reliable, its accuracy cannot be guaranteed.

Any securities identified were selected for illustrative purposes only. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed were or will be profitable.