Getting to the point, and being clear, matters when relaying information to clients. Sure, you want your portfolio manager to be able to explain their investments, market movement, and other “difficult math” when asked, but you have entrusted them with the management of your assets…so you implicitly trust them to know that stuff. Sometimes you just need a straight answer.

In William Shakespeare’s famous play Hamlet, Lord Polonius utters the phrase “brevity is the soul of wit” when relaying a message to his king, and basically this is the 1602 version of “let me get to the point.” Brevity, or the manner of being brief, leads to a concise answer, and being concise shows conviction and develops credibility of your portfolio manager.

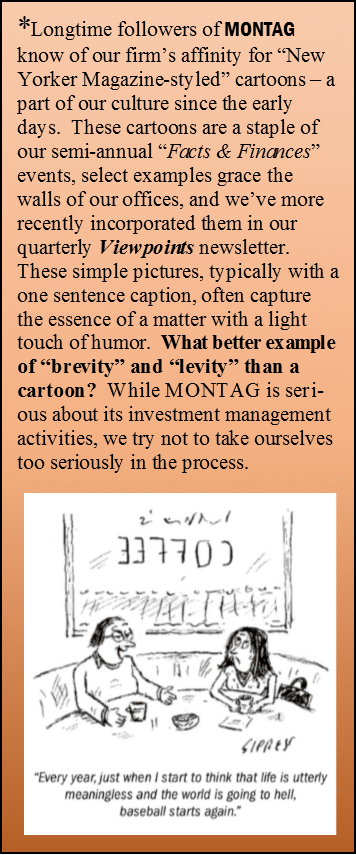

Further, in our experience at MONTAG, being relatable in what we say, and how we say it, is just as important. Having  a concise answer can easily seem too antiseptic to some clients who are looking for a little comfort, especially in a more turbulent market. We pride ourselves in client service, and that means knowing more about you than just the dollars we manage. A personal touch in your message, or even humor* if the situation dictates, can go a long way towards helping our clients and reinforce their trust.

a concise answer can easily seem too antiseptic to some clients who are looking for a little comfort, especially in a more turbulent market. We pride ourselves in client service, and that means knowing more about you than just the dollars we manage. A personal touch in your message, or even humor* if the situation dictates, can go a long way towards helping our clients and reinforce their trust.

All this to say, the one-two combo of “brevity and levity” is a very effective stance to take when talking with our clients. This is really what client service means to us, and for folks who value this kind of touch, we tend to be a good fit. Beyond the frequency and timeliness, giving answers that are digestible, and relatable, matters.

On a final note, this concept of brevity and levity seems ubiquitous across several generations, including Millennials. In a recent study by J.D. Power and Associates, one of their key takeaways is that advisor relationships keep them engaged. Their attrition rate may be higher than older generations, and they are more prone to gravitating towards a tech-rich investment platform, but according to the study, Millennials likelihood of switching advisors drops to 17% from 44%, if they feel their communicatory needs are being met by their advisor. This makes sense, as Millennials simultaneously look for an answer they can understand quickly (in the fast paced, 24/7 internet age we live in) but also with a hint of comfort because their attempts at wealth building are in its nascent stage.

At MONTAG, our portfolio managers communicate with their clients with one part message, one part tone (brevity), and one part experiential (levity), and this seems to be a valued service across many generations. If this is something you value, we’d love to have a conversation with you. Dare I say it can be as brief as you’d like!