The second quarter 2018 season is coming to a close, and so far the overall results have been pretty strong. The S&P 500 companies are set to deliver 8% revenue growth and 25% earnings growth. While the recently enacted tax changes are contributing approximately 8% to this quarter’s earnings growth, excluding the tax benefit, earnings growth is still set to be a strong 16%. With 80% of the S&P 500 market cap having reported earnings so far, despite a few high profile misses, in general, companies are beating revenue expectations by 1.5% and earnings by 5% with approximately 75 % of companies exceeding bottom line estimates. In general, strength is broad based across industries with the best performance coming from the consumer discretionary, technology and healthcare sectors. While the results are good, the beats on both top and bottom line were rewarded by a 2% one day move on average, while the misses were punished more, and the stocks declined 8%. (source FactSet and CSFB research) reflecting the less forgiving nature of the market.

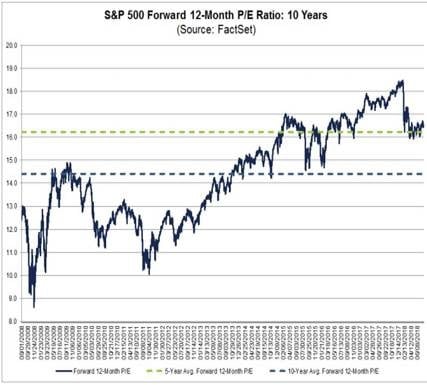

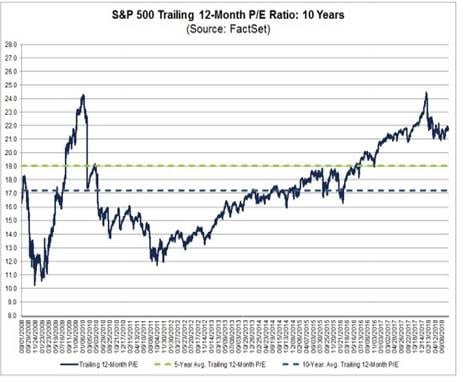

While earnings growth has been strong this year, the market multiple has actually declined from 18.5x forward looking earnings at the beginning of the year to 16x currently (24.5x to 22x if looking on the trailing basis), implying multiple compression for the broad market.

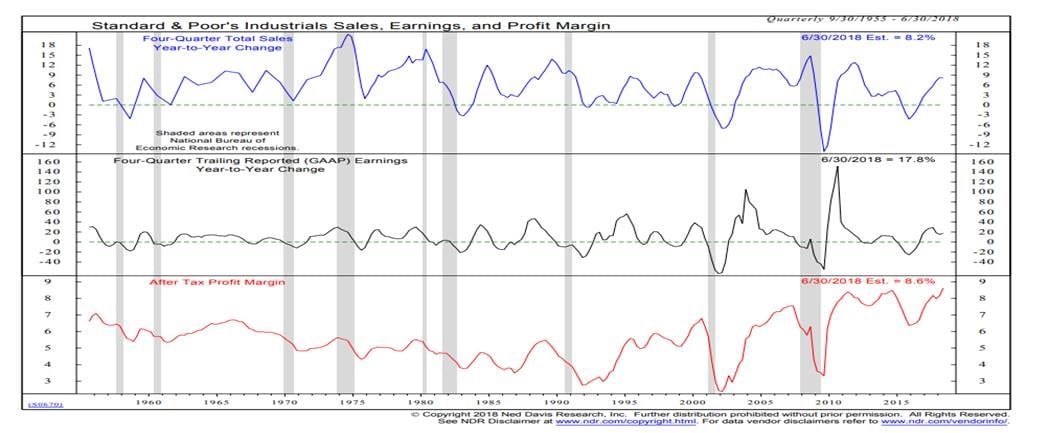

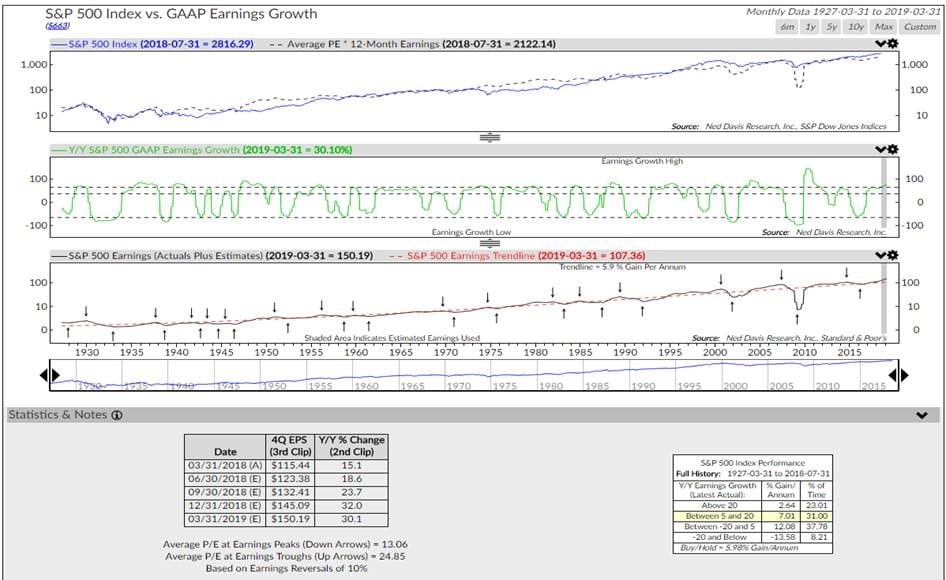

So, the natural question that many are asking, how much of this earnings growth is priced in. Are we looking at a pause in the market before the next leg up, or is it a sign of a peak. With profit margins for the broad market at high level (see above exhibit 1), it is hard to bet on any further significant expansion. If anything, the recent rise in labor, freight and commodity costs are starting to have a negative impact on some of the companies. As we anniversary the positive impact of tax cuts on this year’s earnings, 2019 earnings growth is likely to slowdown from the current level, leaving us with sales growth to carry the day. Historically, according to NDR research, when earnings growth is very rapid, the broad market returns historically have actually been more muted. Good news is already priced in and the market tends to anticipate a potential for future slowdown. The best times for the broad averages tends to occur when earnings growth starts to accelerate and improve from negative to positive (usually after a recession or an economic slowdown), which is not where we are now.

At this point, while the current economic backdrop in strong, we are watching closely for any changes in the sustainability of current sales growth and its impact on earnings and margins as we start to look towards the next year.

The information provided is for illustration purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action to be taken. These analyses have been produced using data provided by third parties and/or public sources. While the information is believed to be reliable, its accuracy cannot be guaranteed.