by Chris Guinther, Senior Investment Strategist & Wealth Manager

The second quarter was a period of extremes. In early April, the equity markets briefly fell into bear market territory, having declined more than 20% from the highs on worries about the “Liberation Day” tariff announcements and risk of inflation. But, after the initial tariff plan was put on “pause”, stocks began to recover. By the end of the quarter, major equity indices finished up almost 11%, which equates to the best quarterly performance since 2020. The changes coming out of Washington appear to be encouraging investors to buy stocks in anticipation of higher earnings over the next several years. Risks to the U.S and the worldwide economy are, of course, still very high.

For the second quarter ending on 06/30/25:

| S&P 500 Index | 10.9% | Nasdaq Composite | 18% | |

| Russell 2000 Index | 8.5% | Bloomberg US Aggregate Bond | 1.2% | |

| DJIA | 5.5% |

To recap, the quarter began with President Trump announcing a surprisingly aggressive tariff plan on April 2. Between April 2 and April 8, the S&P 500 dropped by over 12%. That was the worst four trading-day drop since March of 2020. Then, on April 9, Trump announced a “pause” on the most severe of the tariffs, touching off a 9% rally in a single day. That rally was the largest one-day gain for the S&P 500 since October 2008 and the 8th largest percentage gain ever. The rally continued in May and June, and by the end of the quarter, global stocks were hitting new all-time highs.

Strong Earnings

Part of the continued rally came from strong earnings reports. During the quarter 78% of S&P 500 companies reported earnings that were above Wall Street forecasts. Traders had been bracing for a more negative earnings season and were especially worried that companies would forecast weaker profits in the back half of the year. So far this has not happened and there haven’t been any significant negative pre-announcements for second quarter earnings either.

No sign of inflation yet

Another major positive that helped boost stocks this quarter was a lack of inflation. The May Core PCE inflation figure came in at +0.18%, suggesting that tariffs haven’t had a meaningful impact on overall prices just yet. In fact, inflation over the last three months has been at just a 1.65% annualized pace(1), below the Fed’s 2% target. That may make it easier for the Federal Reserve to cut rates later this year. It seems likely that the Fed would already be considering cutting rates right now if not for concerns about tariffs causing future inflation. At the very least, these tame inflation reports tell us that there isn’t excess inflation pressure outside of tariffs. If inflation remains benign and the economy does slow later this year, the Fed has room to cut rates more aggressively to help forestall any potential recession.

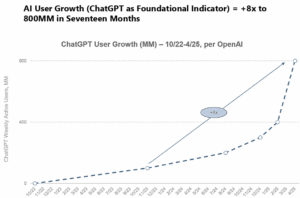

AI adoption accelerated

MONTAG RESEARCH recently put out a large piece highlighting the growth and recent acceleration of AI. You can read that report at:

https://montagwealthmanagement.com/AI-investing/

Today we have a large number of companies racing to create AI products. This ranges from the Large Language Models (OpenAI, xAI, Anthropic, Alphabet, Meta, etc.) to the myriad of companies trying to create AI-based tools. All of these companies need things like semiconductors, data center capacity, more speed and memory, and access to Large Language Models. It feels like 1995 all over again, but the pace and adoption is 10x faster and the significance is thought to be far greater. As mentioned for many quarters now, investments in this theme are important and growing.

OpenAI reports Weekly Active Users which are represented above. 4/25 estimate from OpenAI CEO Sam Altman’s 4/11/25 TED Talk Disclosure. Source: OpenAI disclosures

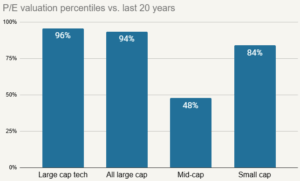

Valuations are very high

Source: Dow Jones S&P Indices, Russell Indices, Bloomberg

It seems the AI boom is just beginning, but investors will need to understand the risks given the already high valuations. To stay invested in this theme and to continue riding what could perhaps be a very rewarding growth trend, not too different than what occurred during the internet era, allocations and investments here will need to be closely watched and measured.

As we head into the summer months, we recognize that markets, the economy and politics will be action packed. As your trusted advisor, we at MONTAG Wealth will remain vigilant, assessing potential impacts on your investments and proactively managing your portfolio to provide you with peace of mind over the long term.

As always, we encourage you to reach out to your wealth management team with any questions along the way.

Sources:

- https://en.macromicro.me/collections/5/us-price-relative/93782/us-core-pce-annual-rate-change

Disclosure:

The information provided is for illustration purposes only. It is not, and should not, be regarded as “investment advice” or as a “recommendation” regarding a course of action to be taken. These analyses have been produced using data provided by third parties and/or public sources. While the information is believed to be reliable, its accuracy cannot be guaranteed. MONTAG employees do not provide legal or tax advice. For specific legal or tax matters, you should consult with your own legal and/or tax advisors. There are risks associated with investing in securities. Investing in stocks, bonds, exchange traded funds, mutual funds, and money market funds involve risk of loss. Loss of principal is possible.