THE PIT (in your stomach) AND THE PENDULUM (of investment choices): ARE COMPLEX INVESTMENT SOLUTIONS FOR YOU?

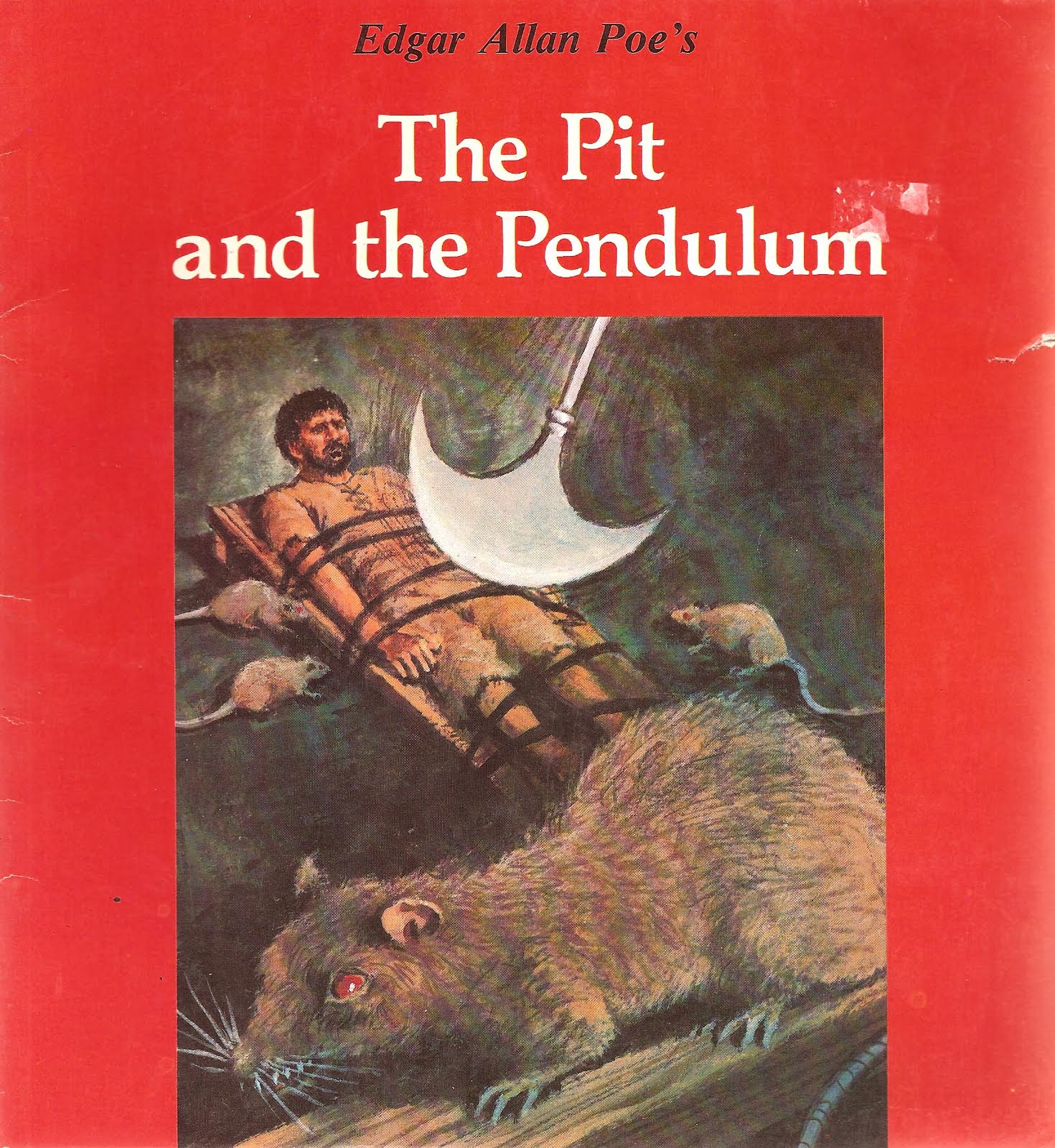

In the famous short story The Pit and the Pendulum, penned by perhaps the original “Gothic” author Edgar Allan Poe, a young man recounts the sudden trials and torture he must endure by a nameless and faceless judge. With ever increasing and elaborate torture devices around him, the man is slowly driven insane by his own fear. Indeed, one critic said at the time of the story’s release, “The story is especially effective at inspiring FEAR in the reader because of its heavy focus on the senses…”

In the famous short story The Pit and the Pendulum, penned by perhaps the original “Gothic” author Edgar Allan Poe, a young man recounts the sudden trials and torture he must endure by a nameless and faceless judge. With ever increasing and elaborate torture devices around him, the man is slowly driven insane by his own fear. Indeed, one critic said at the time of the story’s release, “The story is especially effective at inspiring FEAR in the reader because of its heavy focus on the senses…”

In today’s investing world, there seems to be an increasing pendulum of investment solutions du jour, swinging back and forth between incredibly complex investment products on one end and something like passive indexing on the other. It’s the former that I wish to touch on, because that end of the pendulum produces the most anxiety due to the fact that the products are so hard to explain. I mean, you know what a stock is. “I own one share of Coca Cola stock” is much easier to explain than “I own a global long/short fund with a managed futures overlay”…right?

Maybe these complex products are appropriate for you; there is certainly a market for them and they don’t seem to be going away any time soon. But the pendulum may be doing something to the pit…the pit in your stomach. After all, if you feel uncomfortable with what you own, you might fear what you own. And that’s not a good thing.

Therefore, when thinking about these products, I ask you to consider these three things.

First, these products are complex because they have a LOT of underlying securities in them. Sure, you may be buying ONE fund, but that fund will own a lot of stuff in turn. The thing that is not getting said is that you are increasingly likely to own EVERYTHING in the market, especially if you own several of these funds. This phenomenon, known as hyperdiversification, means you have so many positions, and they are so small, that any good work by any one (or even several) positions doesn’t move the needle in terms of your performance. As we noted in “A Numbers Game” in the Q1 2019 edition of our newsletter Viewpoints here, there are now more investment products (think mutual funds) than there are actual stocks in the stock market! That means you are getting a lot of assorted assets and asset classes, some of which may unduly counteract each other due to their characteristics, and all of them are small.

Two, these complex investments are…complex. Returning to the ONE fund example, you may be buying one fund, but it may have stocks, bonds, sector funds, fund of funds, derivative products like options and futures, currencies, hedging strategies…you get my point. You’ll want to do your homework here and read the prospectus. What does it say you are getting if you buy this product? And further, it costs money to put something like this together. Are the fees explained clearly? Because you are probably paying a fee to your investment manager…and a fee for the management of the product he/she’s chosen. Ouch!

Finally, consider your own client experience. Wouldn’t it be nice to call up your investment manager and get a straight answer because the manager KNOWS WHAT YOU OWN? What a novel concept. Conversely, these complex investment products are, most likely, being remotely managed. That is, if you called up the investment manager who sold you one of these products, that person is most likely going to have to get back to you about any questions on the composition of the product, because those decisions are being based out of New York, London, Chicago…or maybe all three. Can an investment adviser even explain what’s in the product, or keep up with all the moving parts? The answer to that question should make you wary, and that’s the kind of nameless/faceless stuff that our poor narrator is up against in Poe’s story.

Investment styles are just like any other style; they come in and out of vogue. In today’s investment environment, the rise of technology has forged new, unbelievably complex (some proponents would call “elegant”) products that have a place, but definitely aren’t for everyone. If you fear the unknown, you should probably stay away from this area of the investment world and stick with a management style, with investments, that is explainable. Leave that book of short stories by Poe on the shelf and get out of that pit with your investment wits intact!