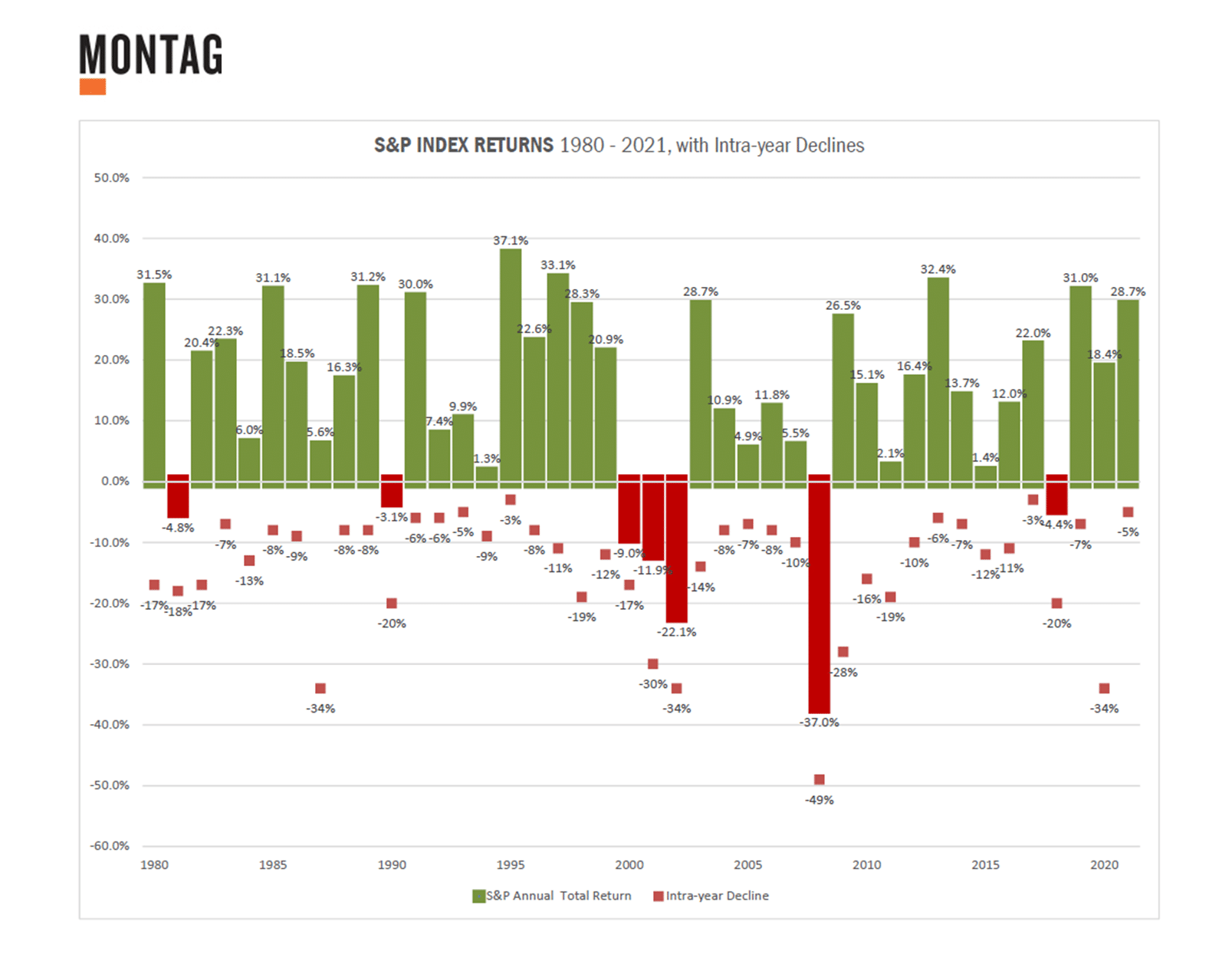

In light of the recent market volatility, we thought it would be worthwhile to remind investors that it is important to focus on the long-term when investing in the equity markets. No one likes to see their portfolio values decline. However, it is important to differentiate between a temporary pullback and a permanent loss of capital. As the chart below highlights, since the 1980s, the S&P 500 has experienced a correction every single year, from as little as -3% to -49%, with an average intra-year pullback of around 14%. Despite these pullbacks, annual returns were still positive in 32 out of 42 years or 75% of the time which is why we encourage investors to have a long-term perspective when investing in the stock market.

In the near-term we expect more volatility and more muted overall returns. After three very strong years for the market (2019-2021), despite the large intra-year decline in 2020 when the initial news of the COVID-19 hit the world, we find ourselves in a different environment today. Valuations are higher, inflationary pressures are here, and the Federal Reserve Bank is starting a tightening campaign. This reduced liquidity will be a headwind to stock and real estate valuations. At the same time, inflation has resulted in negative real interest rates across the yield curve, making investment into bonds even less attractive. On the other hand, the US economy is still in an expansionary phase, with low unemployment and consumers in strong financial shape. In the long run we believe that equity market declines present us with opportunities to invest in quality businesses within growing industries which are led by strong management teams.

NOTE: The information provided is for illustration purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action to be taken. These analyses have been produced using data provided by third parties and/or public sources. While the information is believed to be reliable, it’s accuracy cannot be guaranteed.